By Michael Langemeier and Joana Colussi

After increasing by 9.1% in 2024, current U.S. farm debt is expected to increase 3.8% in 2025 (USDA-ERS, 2026). Current debt includes operating loans and principal payments related to machinery, buildings, and farmland that are due within one year. This article examines trends in the size of a farm’s operating loans, reasons why operating loans may be larger, financial stress, and balance sheet strength using data from the Purdue University-CME Group Ag Economy Barometer (AEB) surveys over the last seven years.

The AEB survey is conducted each month to gauge producer sentiment among a group of approximately 400 U.S. agricultural producers (Langemeier and Colussi, 2026). In addition to questions pertaining to sentiment, monthly AEB surveys periodically include questions pertaining to operating loans and balance sheet strength.

Projected Changes to Operating Loans

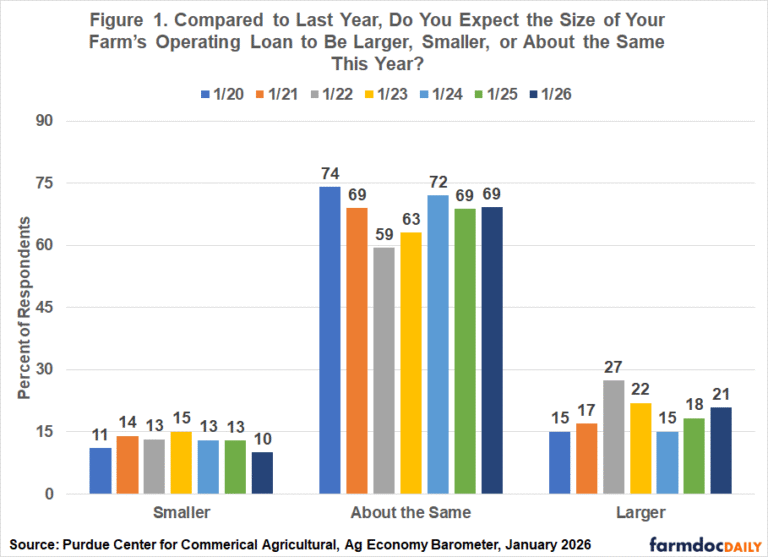

In January of the last seven years, the AEB surveys have included operating loan questions. The first operating loan question was as follows: Compared to last year, do you expect the size of your farm’s operating loan to be larger, smaller, or about the same? Over the last seven years, the percentage of respondents who indicated that they expected to have larger operating loans ranged from 15% in 2020 and 2024 to 27% in 2022. The survey respondents that answered “larger” increased from 18% in 2025 to 21% in 2026 (see Figure 1).

A follow-up question asked about the reason for their farm’s larger operating loan. Response choices included: increase in input costs, increase in operating size, and unpaid operating debt from prior years. Figure 2 summarizes the results from 2020 to 2026. An increase in input costs was the most common response in each of the years. However, there was a large range in the percentage of respondents who chose this response over time. From 2021 to 2024, over 60% of the respondents chose “increase in input costs” as the reason for higher operating loans. In 2020, 2025, and 2026, from 45 to 56% of the respondents chose this response. On average, approximately 18% of the respondents indicated that an “increase in operation size” was the reason for their larger operating loan. Respondents choosing the “unpaid operating debt from prior years” response averaged 21% and ranged from a low of 5% in 2023 to a high of 35% in 2020. In 2026, 31% of the respondents indicated that this was the reason for their higher operating loan, up sharply from the previous year.

Source : illinois.edu