By Ryan McGeeney

An escalating tariff battle between the United States and several of its largest trading partners may affect U.S. growers in Arkansas and elsewhere.

Over the first six weeks of his new administration, U.S. President Donald J. Trump has threatened, imposed and walked back a variety of tariffs on Canadian, Mexican and Chinese goods, ranging from 10 to 25 percent. Those trading partners have responded with retaliatory tariffs on U.S. goods, many of which are agricultural.

Ryan Loy, an agricultural economist for the University of Arkansas System Division of Agriculture, has done extensive research on tariffs and their effects on agricultural markets. He said that while some markets can shift purchases or sales from one trading nation to another, some agricultural markets are not so flexible.

“With tariffs, one of the fundamental ideas is to protect domestic production that would hypothetically improve the domestic economy for that commodity,” Loy said. “But what’s important here is that we don’t necessarily have the domestic production to fill demand gaps left from imposing a tariff, or domestic consumption for others.”

For example, Canada supplies about 80 percent of the potash, a key fertilizer that U.S. farmers use in their production, and is the only major potash producer in the Americas. While Trump did sign an exclusion for Canadian potash on March 7, reducing the duty from 25 percent to 10 percent, the possibility of reinstatement adds to the overall sense of uncertainty.

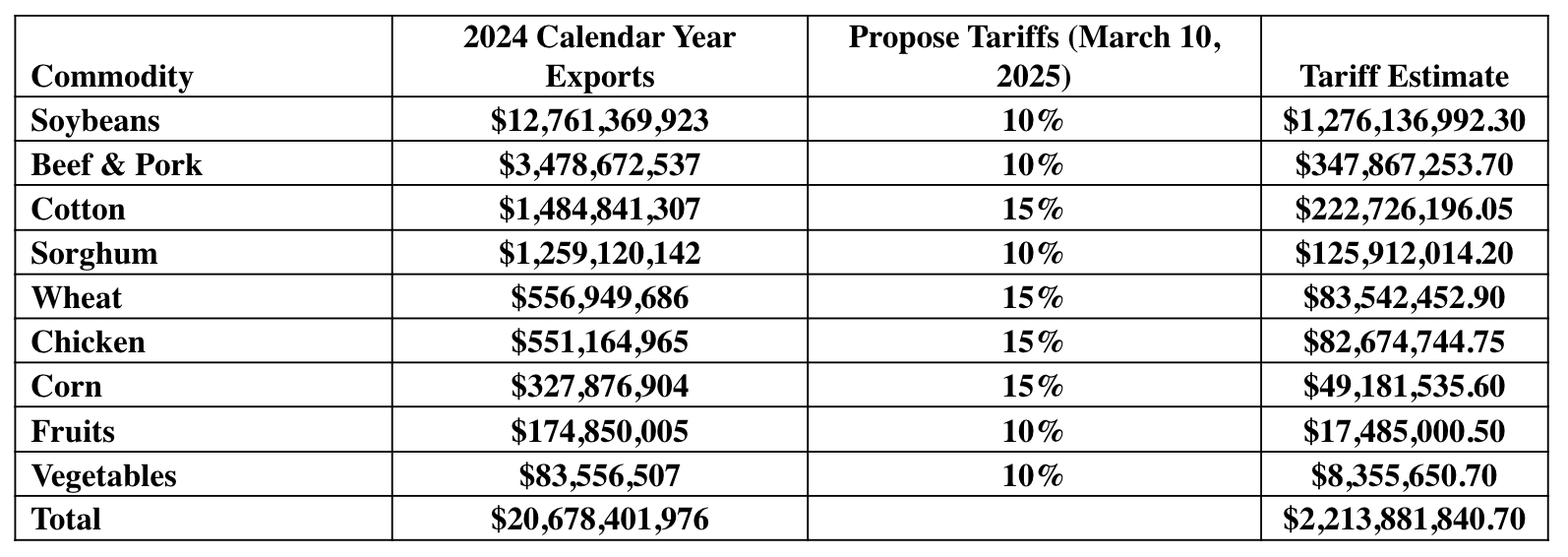

Similarly, China is the world’s largest purchaser of soybeans and has historically purchased more soybeans from the United States than any other buyer. The country primarily uses soybeans as livestock feed. In 2017, China purchased about 32 million metric tons $12.2 billion in U.S. soybeans, but when President Trump, then in his first term, initiated a trade war with China in 2018, purchases fell to about $3.1 billion that year.

While the trade relationship between the two countries improved during the intervening six years China purchased about 27 million metric tons, or $12.7 billion, worth of U.S. soybeans in 2024 the country also shifted a degree of its purchasing power away from the United States and toward South American countries such as Brazil and Argentina. In 2024, Brazil exported 19.2 million metric tons more than $31 billion of soybeans to China. So while the United States has regained much of its original market share for agricultural commodities in China, Brazil has taken the lion’s share of China’s expanding market.

“China doesn’t rely on us for commodities like they did back in 2018, so, in theory, they can easily just continue to buy as much as they can from South American countries, assuming those countries have the supply,” Loy said.

If China significantly reduces U.S. soybean purchases, Loy said, American producers will be hard-pressed to find equivalent demand elsewhere in the global market.

“We would feel this in Arkansas with an excess supply of soybeans due to limited export markets,” he said. “While there are other markets, there’s nothing that’s going to make up for the share that we’re not able to sell to China. And we don’t have the domestic consumption to compensate for that lack of exports.”

U.S. growers have already been operating in an environment of elevated input costs and depressed commodity prices. Loy said that agricultural tariffs have may squeeze growers further, increasing the likelihood of foreclosures for growers already in the red.

“Some farms may be forced to exit the market,” he said. “But the agricultural sector is resilient, and it’s necessary.”

Source : uada.edu