By Rob Hatchett

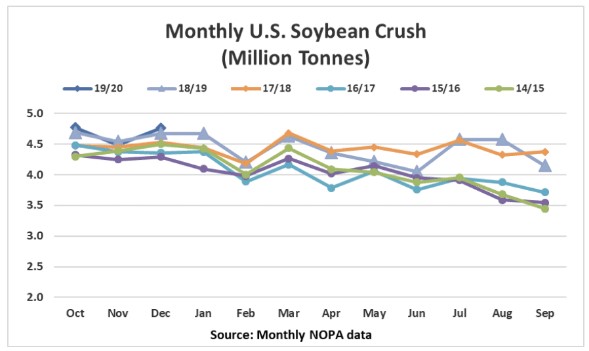

The National Oilseed Processor Association (NOPA) issued December soybean crush and stocks data on Wednesday, January 15. According to the data, NOPA member soybean processing in the third month of the 2019/20 product (October-September) marketing year totaled 4.758 million tonnes. December crushings were up 0.27 million tonnes from November and were the largest crushing for the month and also came in at the second-largest monthly total. Cumulative crushings of 14.109 million tonnes are up slightly from 13.909 million the same period last year.

According to analysts’ expectations published by Reuters, the trade was looking for crush to come in near 4.671 million tonnes with the highest published guess coming in slightly below the actual crushings at 4.736 million tonnes. The solid rebound in processing came after November crushings fell short of the trade’s expectations, which was attributed to limited farmer selling. The rebound in December suggests that improving crush margins, along with greater movement of new-crop soybeans were likely features that pushed processing rates.

Click here to see more...