By Joana Colussi and Michael Langemeier

The U.S. soybean harvest began in September without any orders from the world’s largest buyer: China. American producers are harvesting a crop the U.S. Department of Agriculture (USDA) estimates at 4.3 billion bushels, and there is no indication of when shipments to China will resume. In a typical year, China buys more than half of all U.S. soybean exports. Meanwhile, Brazil set a record for shipments to China from January through August 2025. In this article, we present U.S. and Brazilian soybean trade flows to China during the last two years, analyze the trade relationship between these countries dating back to before the first round of the 2018 trade war, and consider the possible consequences if a trade deal is not reached this fall.

U.S. Soybean Shipments Frozen Over Tariffs

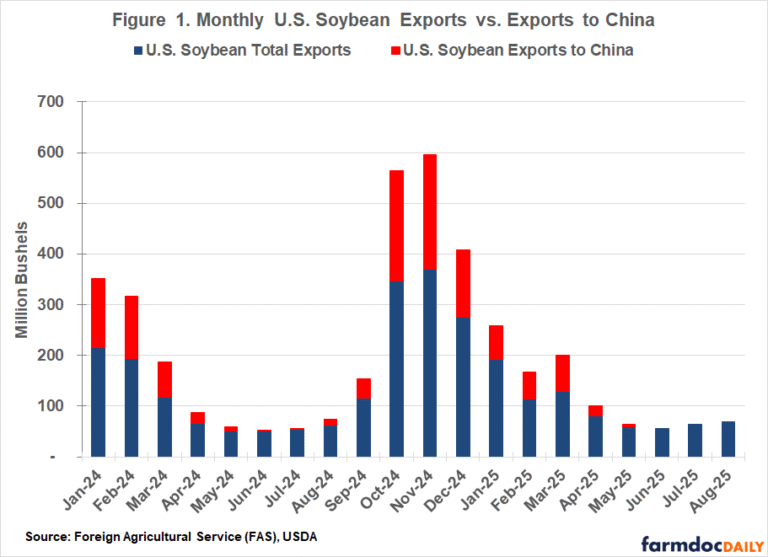

China is the top buyer of U.S. soybeans by a large margin. In 2024, the United States shipped nearly 985 million bushels to China, accounting for 51% of the nation’s total soybean exports that year. In 2025, U.S. soybean exports to China from January through August totaled only 218 million bushels – 29% of total exports for the period. In June, July, and August, shipments to China were effectively zero (see Figure 1).

The combination of a 20% retaliatory tariff and China’s Value-Added Tax (VAT) and Most-Favored-Nation (MFN) duties has pushed the overall duty rate on U.S. soybeans to 34% in 2025. Although this new retaliatory rate is 5% lower than during the 2018 trade war, the added duties should keep U.S. soybean prices higher than South American supplies ahead of the U.S. harvest this fall, stated the American Soybean Association in a letter sent to the White House in August.

Source : illinois.edu