By Doug Mayo

USDA’s National Agriculture Statistics Service (NASS) released the annual

January 1 Cattle Inventory Report on January 29, 2021. From 2013 through 2018 the US cattle herd increased. For the second straight year, the total number of cattle in the US dropped again slightly from the peak of 94.8 million at the end of 2018. In 2020, the all cattle inventory dropped by 199,000 head from 93.8 million on January 1, 2020 to 93.6 million on January 1, 2021. These snap-shot inventory estimates give you a total at the end of the previous year, so it is a little confusing, but the January 1, 2021 inventory is a summary of 2020 production.

When you break it down by class of animals, you can see that there was very limited fluctuation from the previous year. There were 181,100 fewer beef cows at the end of 2020 (down 1%), but 97,800 more dairy cows (up 1%). The 2020 calf crop was also down 456,100 head from 2019, but this was only a 1% decrease.

When you break the beef cow inventory down by state in the Southeast, you can also see some fluctuation, but for the seven state region there was only a drop of 3,000 head. Florida had the largest increase of 25,000 head, while South Carolina had a decrease of 11,000 head, and Georgia dropped 10,000 head.

So what does this mean?

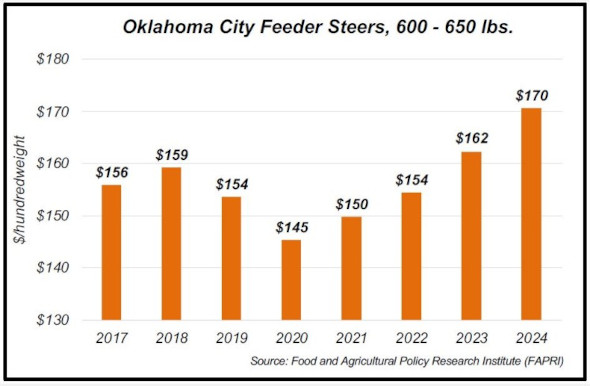

There are a number of factors that affect cattle markets. Supply and demand are key economic factors that influence fluctuation of market prices. The supply (inventory) has dropped 2% over the past two years. so If you are selling cattle, that is a good thing. If not for the economic chaos caused by the pandemic, you would have expected the price of feeder calves to increase last year, and again this year. But the pandemic has affected demand. With restaurants either closed, or operating with reduced patronage, their demand for high quality beef has declined. Many people are are not traveling, have reduced incomes, or have been laid off, so they are not eating at restaurants as before. People are cooking more food at home, but will they buy protein as beef, chicken, pork or peanut butter at the grocery store? All of these factors affect the demand for beef. Plus, the meat packers have still not caught up with the backlog of cattle from shutdowns in 2020, so the feedyards are still slowly working through their current inventory. Feed costs are also rising, so the feedyards will be forced to adjust the price offered for feeder calves. All of these factors point to a slow rebound for the cattle market. USDA’s Food and Agriculture Policy Research Institute (FAPRI) provides agricultural market price forecasts. FAPRI estimates a $5/cwt increase in the price of feeder calves in 2021, with another $4/cwt increase in 2022. There is hope for the the future of the cattle industry, but market improvements are moving slower than expected.

Credit: Chris Prevatt, UF/IFAS

Buy Low/Sell High

There is a silver lining to low cattle prices. When cattle are cheap, this is the time to invest not sell. 2021 should be an excellent year to add to your herd by keeping additional heifers or by purchasing young breeding stock. So if you have the capitol to invest, this is a good year to build or expand a cow herd. Cows and heifers will likely gain in value over the next four years, so if you are thinking of starting or adding to a herd, this is a good year to consider that investment.

Source : ufl.edu