By Mark White

Department of Agricultural and

Consumer Economics University of Illinois

Labor shortages present persistent challenges for regional economies, but they can also create opportunities for young workers (i.e., high school students and/or recent high school graduates) who may be called upon to help fill these workforce gaps. Youth employment opportunities allow young people to generate income, learn about the world of work, and in some instances explore potential career options. Youth employment can also help employers fill the part-time, low-wage, and often seasonal positions that are often less attractive to older workers, especially during tight labor markets.

This article explores youth employment trends. Connecting young people to local employers and work opportunities can support efforts that keep young people in their community. Consequently, these trends are particularly relevant to the Midwest because many of its urban and rural midwestern communities are losing population and have aging workforces (White 2023). Therefore, building this pool of future workers is critical to some of the key industries that support the Midwest economy (e.g., manufacturing, agriculture, healthcare, etc.). This article will first highlight several broad national trends in youth employment. It will then examine three aspects of youth employment in the Midwest—labor force participation trends, the industry composition of youth employment, and the relative scale of youth employment across the region.

There are fewer young people in the labor force, in part because there are fewer young people.

According to the U.S. Current Population Survey, there are now substantially fewer young people in the labor market than two decades ago (Figure 1). In July 2000, almost 7 million jobs were held by workers aged 16 to 19, but by 2023 that number had fallen to under 5.5 million—a decline of more than 20 percent Demographic shifts explain much of this decline. Generation Z is relatively smaller than the millennial generation. As a result, there are currently fewer young people working because there are simply fewer young people.

![According to the U.S. Current Population Survey, there are now substantially fewer young people in the labor market than two decades ago (Figure 1). In July 2000, almost 7 million jobs were held by workers aged 16 to 19, but by 2023 that number had fallen to under 5.5 million—a decline of more than 20 percent.[2] Demographic shifts explain much of this decline. Generation Z is relatively smaller than the millennial generation. As a result, there are currently fewer young people working because there are simply fewer young people.](https://images1.farms.com/farms-production-images/Portals/0/Images/img3.png)

More recently, younger workers were more disproportionately impacted by the pandemic because the industries most affected by pandemic-related shutdowns (e.g., food service, retail) tend to employ significant numbers of young people. At the immediate outset of the pandemic, the number of jobs held by workers aged 16 to 19 fell by roughly 37 percent. Nevertheless, youth employment recovered faster than the labor force as a whole. It took until April 2021 for the number of jobs held by workers aged 16 to 19 to return to pre-pandemic levels, but it took until August 2022 for total employment to get back to its pre-pandemic levels. Nationwide, youth employment has slowed over the past several months, but its growth since January 2020 continues to outpace total employment growth.

Relative to the nation, Midwestern teenagers are more apt to participate in the labor force

National trends mask regional variations which can arise in measures such as the labor force participation rate (i.e., the share of the population active in the labor force). Based on data provided by the U.S. Census Bureau’s American Community Survey, every Midwestern state had a higher labor force participation rate among workers aged 16 to 19 than the nation (Figure 2). Roughly 38% of people aged 16 to 19 nationwide participated in the labor force between 2016 and 2021, but this figure was over 50 percent in states like North and South Dakota, Nebraska, Minnesota, Wisconsin and Iowa. Following national trends, however, most Midwestern states saw declines in Age 16 to 19 labor force participation. Only three states—Indiana, Wisconsin, and Michigan—had higher youth labor force participation rates during the 2016 to 2021 period than during the 2006 to 2011 period.

Increased labor force participation rates do not necessarily translate into more young people working. As noted above there are fewer young people today than there was 10 to 15 years ago. Other demographic challenges—like persistent outmigration—further reduce the number of young people available to work. For instance, Michigan’s labor force participation amongst workers aged 16 to 19 rose over the past decade, but due to population loss there was roughly 27,000 fewer 16 to 19 year old workers available in the 2016-21 period than during the 2006-11 period. Sizable drops also occurred in other large midwestern states (e.g., Illinois, Ohio) that have experienced significant outmigration.

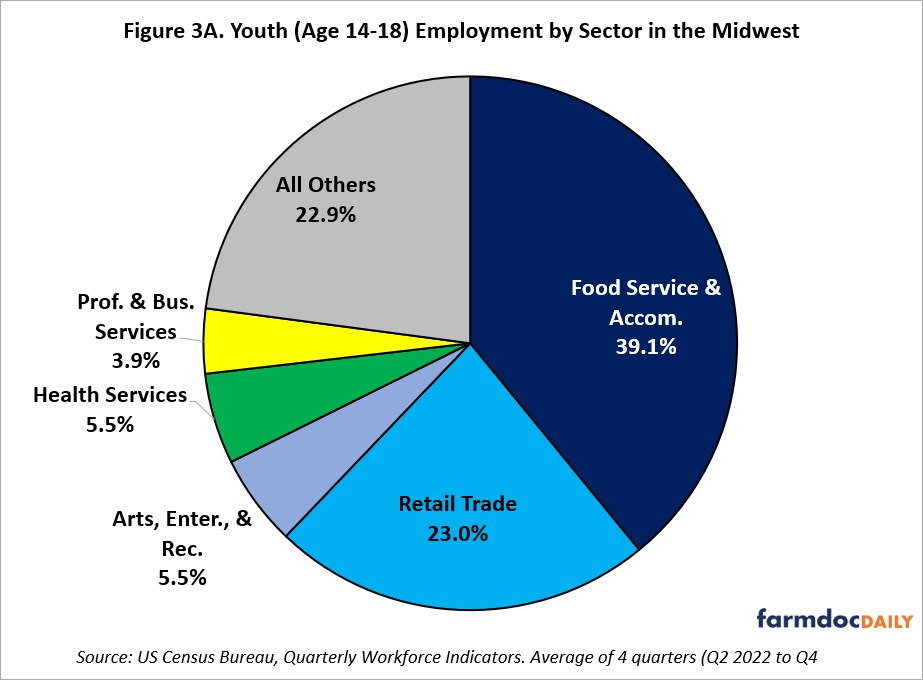

Employers in food service and retail hire many young workers, but employment opportunities diversify as they age

The data described above highlight youth participation in the labor force, but they lack detail about what these workers actually do. The U.S. Census Bureau’s Quarterly Workforce Indicators (QWI) answer some of these questions by showing employment by industry for different age cohorts. Figure 3A shows that almost 40% of Midwestern workers aged 14 to 18 worked in food service and accommodation; another 23% worked in retail trade. These industries often involve many part-time, relatively low-wage jobs, with irregular schedules. Many of these jobs may not always prepare young people for specific careers, but they do provide a useful introduction to the world of work by, for instance, teaching them soft skills like how to work with different types of people that they do not know. They also allow young people to interact with adults and potentially develop references for other, more career-oriented, jobs.

Figure 3B shows how this industry mix shifts as workers get older. The share of retail jobs remains largely the same for 19- to 21-year old workers. However, workers aged 19 to 21 are roughly half as likely to work in food service and accommodation than workers aged 14 to 18. Rather, these workers—often high school graduates—increasingly find work in industries like health services, professional and business services, manufacturing and construction, among others. In some instances, these industries provide opportunities for careers rather than just work. This is particularly true for workers that pursue post-secondary education, training, and/or industry recognized certifications or credentials. These new workers are critical for growing and strengthening the regional labor force.

Local opportunities shape youth employment

Figure 4 shows the share of youth employment (jobs filled by workers aged 14 to 18) by county throughout the Midwest Just as the Midwest has relatively higher labor force participation rates, so too does the region’s young people represent a relatively greater share of total employment than the nation. Again the Quarterly Workforce Indicators show that, in aggregate, workers aged 14 to 18 filled 3.5% of the region’s total jobs in 2022. By contrast, these workers accounted for 3.0% of total jobs nationally.

The highest levels of youth employment occurred in relatively small, rural counties. For instance, the counties with the greatest share of young workers included Lucas County, IA (10%); Aurora County, SD (8.7%); Hamlin County, SD (8.6%); and Wright County, MN (8.1%). Conversely, youth employment was lower in more urban counties that simply have more jobs and more workers. Overall, younger workers represent a larger share of employment in the Midwest’s nonmetropolitan counties (4.4%) than in the region’s metropolitan counties (3.3%). Youth employment was also relatively lower in some more historically impoverished areas, such as Appalachian Ohio, the Mississippi Delta area (e.g., Missouri’s Bootheel and Southern Illinois) and the Lead Belt region of the Ozarks. In these regions, younger workers likely face greater competition for employment with older workers.

The highlight boxes in Figure 4 also contain information about each county’s greatest source of youth employment. Of the 972 Midwestern counties (not including Michigan), the food service and accommodation industry employed the most young workers in roughly 700 counties; retail trade was the leading employer for young workers in almost 200 counties. Other industries were less prominent. Health services was the leading employing industry in 22 counties, and agriculture employed the most 14- to 18-year old workers in 15 counties (7 of these counties were in southwestern Kansas). Overall, agriculture employed about 1 percent of midwestern workers aged 14 to 18, a figure generally consistent with total farm employment nationwide.

Conclusion

Connecting young people to beneficial (rather than exploitative) work opportunities is a critical step in building and sustaining the local labor force. This is especially true for states and regions facing the challenge of out-migration and population loss. Private sector and educational leaders can facilitate these opportunities through a wide range of efforts around career exploration, work-based learning, career and technical education, internships and/or apprenticeships (Ross, Kazis, Bateman and Stateler, 2020). These types of efforts do more than prepare students youth for the world of work, but also direct them toward opportunities that might lead to a career rather than just a job. Youth groups can also play an important supporting role in these career exploration and preparation efforts. This is particularly true in fields like agriculture where groups like 4-H and FFA can introduce and even prepare young people for careers in agriculture. As a result, the places where local leaders—from education, non-profits, and the private sector—can connect with their current youth around meaningful career exploration and employment opportunities will likely have a stronger workforce in the future.

Source : illinois.edu