The merger would create the first Canada-U.S.-Mexico rail network

By Diego Flammini

Staff Writer

Farms.com

At least one Canadian ag organization has voiced support for a proposed railway merger.

Canadian Pacific Railway (CP) is in talks with Kansas City Southern (KCS) to purchase the U.S. railway for about US$29 billion (CAD$22.96 billion).

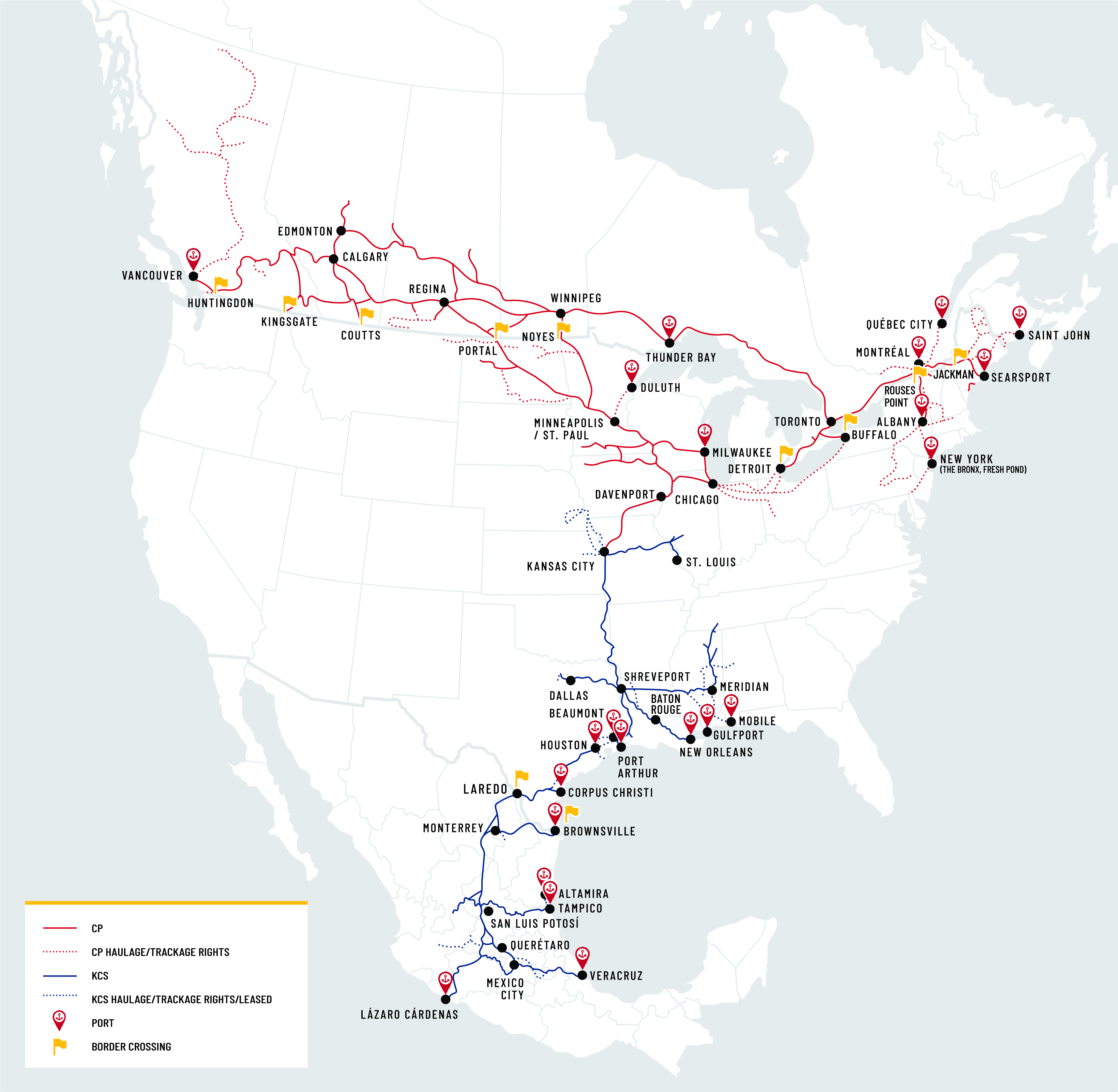

If the merger is allowed to go through, it would create a 32,000-kilometre (20,000-mile) rail network combining Canada, the United States and Mexico. The network would also include access to more than 20 ports.

CP/KCS map

It’s an exciting opportunity for the ag sector, said Daryl Fransoo, chair of Western Canadian Wheat Growers Association. He’s also a producer from near Glaslyn, Sask.

“We’re cognizant that a lot of our grain doesn’t go to Mexico, but (the merger) does open an integrated shipping line that could benefit Canadian farmers in the future,” he told Farms.com. “It’s a positive just to have the infrastructure in place to use if the opportunity presents itself.”

Another benefit of the proposed merger is it provides a kind of safety blanket for sectors relying on sea transport.

Canadian shipments have been delayed by weather and labour issues at national ports in the past.

Having such an extended rail network could prevent those kinds of issues from disrupting transportation, Fransoo said.

“If there’s a work stoppage at a Canadian port or some other situation, we’ve got this rail line that’s already integrated and it would be easy to redirect those goods to get to their destination,” he said.

The merger still has some regulatory hurdles to clear before it can become official.

The five-person Surface Transportation Board, an independent U.S. regulatory body, must approve the acquisition.

Shippers are likely to have input during the hearings, said Todd Tranausky, vice president of rail and intermodal at FTR Transportation Intelligence.

“Rail shippers will have a big voice at the Surface Transportation Board and if they are not satisfied that the carriers can maintain service levels during the transition and improve them going forward, then they may not support the transaction at the regulator,” he said, Trains.com reported. “The board has been increasingly focused on shippers’ concerns in recent years and I would expect they will play an outsized role in how the board views this transaction through the process.”

The final approval would happen in 2022, CP said in a statement.