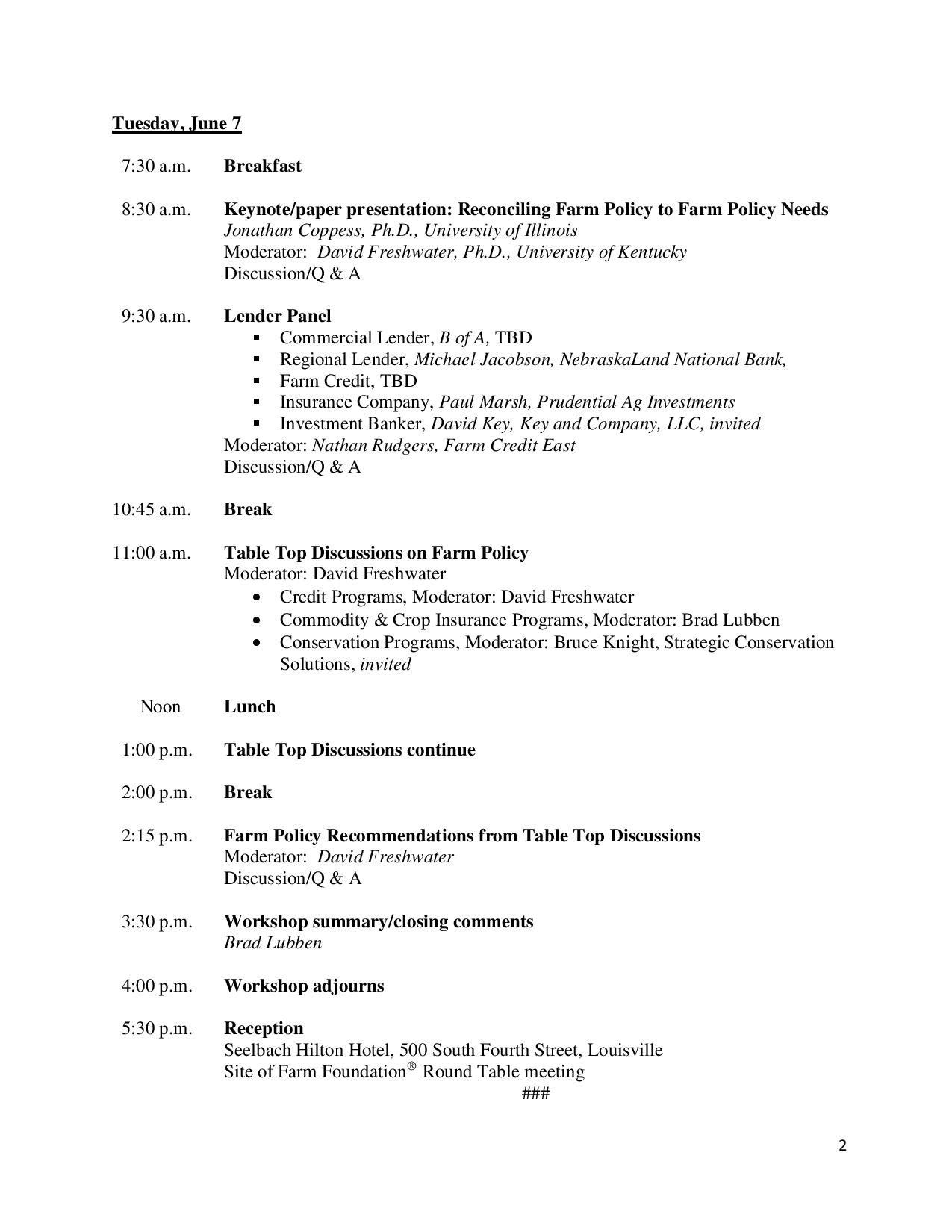

Workshop scheduled for June 2016

By Diego Flammini

Assistant Editor, North American Content

Farms.com

The way farms are owned has changed and a new workshop is designed to provide farmers with the knowledge they need to adapt.

The workshop is scheduled for June 6 and 7 at the Brown Hotel in Louisville, Kentucky; organizers say many factors have contributed to the change in farm ownership dynamics.

“It is clear that trends in farmland ownership and tenure patterns are changing,” said Farm Foundation, NFP President Neil Conklin in a release. “This workshop will explore the current interest in farmland, the players driving it and the implications for farmland ownership and tenure.”

"Several years of strong commodity prices, combined with high market demand, fueled investor interest in agricultural resources worldwide," he said. "Commodity prices have cooled significantly, but interest in farmland investments remains strong."

Conklin said the workshop is targeted to farmers, landowners, agribusinesses, investors and members of public policy communities because all are “key players whose actions are shaping the trends in farmland ownership and agricultural finance which, in turn, has potential implications for the social and political environments in which they operate.”

The workshop is free to attend but those interested must register.