Bipartisan bill designed to address high-risk threats to agriculture and livestock

By Diego Flammini

Assistant Editor, North American Content

Farms.com

Members of the Senate Agriculture Committee introduced a bipartisan bill designed to protect American agriculture from agro-terrorism.

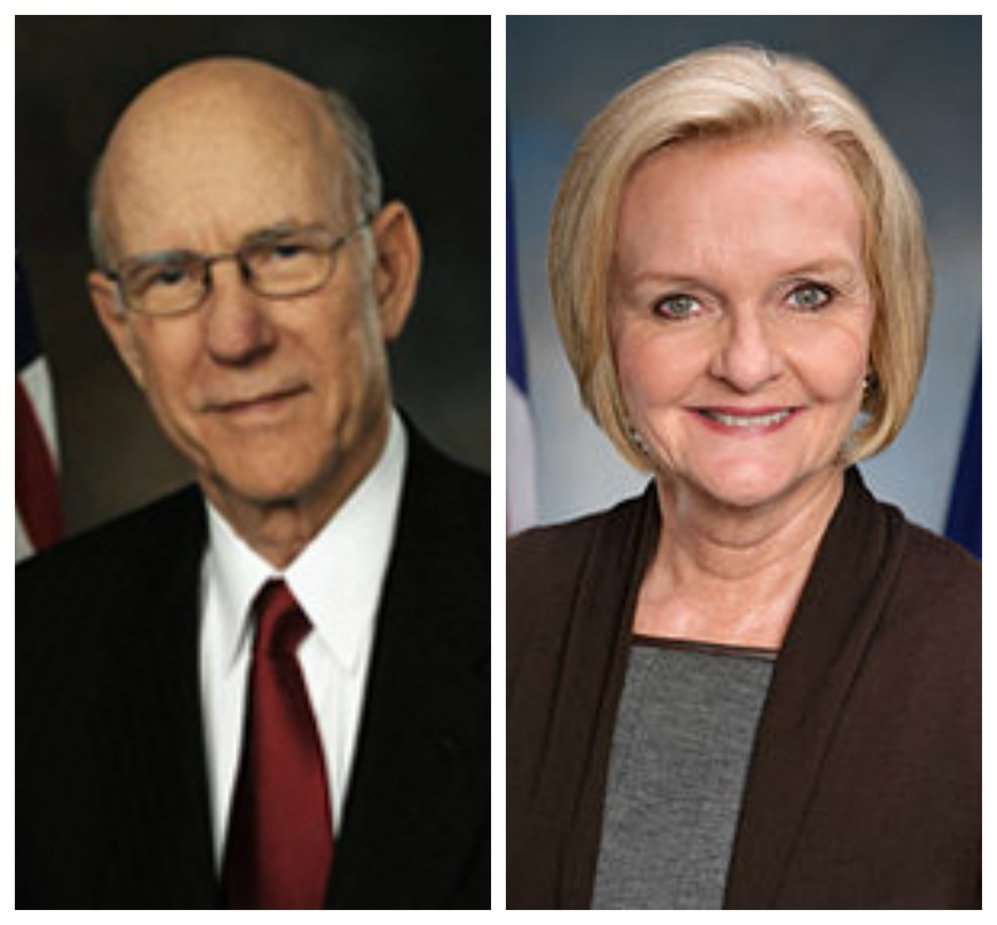

Committee chairman Pat Roberts and ranking member Claire McCaskill introduced the Securing Our Agriculture and Food Act. The bill would make sure the country has policies in place to respond to threats against U.S. agriculture and food production.

“We don’t always think of a terrorist attack as a deliberate, mass food contamination, or the danger a major disease outbreak could pose,” McCaskill said in a release. “Congress needs to think forward about the wide array of threats we face and take action before there’s a tragedy, not afterwards.”

The Department of Homeland Security will play a role in combatting agro-terrorism. The act would make the “Assistant Secretary of Homeland Security for Health Affairs responsible for coordinating the efforts of the Department of Homeland Security related to food, agriculture, and veterinary defense against terrorism, and for other purposes.”

Pat Roberts and Claire McCaskill

Farmers and their assets need to be protected, according to Senator Roberts.

“I understand the unique threat our farmers and ranchers face,” Senator Roberts said in a release. “As the backbone of the U.S. economy, the spread of any deadly pathogen among our livestock and plant population would cause irreparable damage.”

McCaskill cited two international scenarios that demonstrate the need for the bill:

- In 2002, foot and mouth disease in the United Kingdom required nearly six million animals to be euthanized, resulting in an economic impact of nearly $20 billion.

- In 1997, four million hogs in Taiwanwere killed because of foot and mouth disease. The estimated damage was $7 billion.

Farms.com has reached out to a number of American farmers and agricultural organizations for comments on the legislation.