Insight into what Ontario farmers are planting in 2015

By Denise Faguy, Farms.com

Commodity markets have always been volatile. Global factors such as weather, geo-economic stability, and innovation can have significant impacts on local commodity prices. Local factors can also play an important role in determining commodity prices.

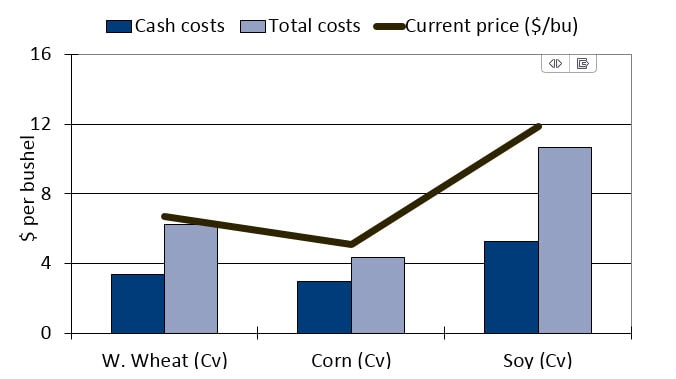

When JP Gervais, Chief Agricultural Economist for Farm Credit Canada spoke at the 2015 precision agriculture conference February 26, he noted that grain and oilseed margins are tight (see chart). What does this mean for you? How will Ontario be impacted by current market prices? What will you do in 2015? What does 2015 hold for Ontario Farmers?

Grain and Oilseed Margins*

* Source: Farm Credit Canada computation

As a group that is curious to get some insight into what other farmers are planting this year in Ontario, the Farms.com Risk Management team has decided to take the initiative of asking farmers in Ontario what they are planting. While at the Western Fair Farm Show in London, the group announced that it is inviting Farmers from across Ontario to complete the Farms.com Risk Management Planting Intentions Survey which is available online.

It takes less than 5 minute to complete. Those farmers who complete the survey will get a copy of the report that shares the overall data as well as Risk Management’s analysis of how the planting intentions gathered in the survey will impact Ontario commodity prices. (Only overall aggregate data will be shared, specific farm/farmer information will remain confidential.)

Besides curiosity and the desire to learn about Ontario planting intentions, the other reason to take the Farms.com Risk Management Planting intentions survey is anyone who completes the survey will have their name entered into a random draw for a chance to win one of three cash prizes: $100, $200, or $300. Farmers only have until March 31 to take the online survey.

For more information, or to take the survey, visit: www.farms.com/planting-intentions.