AEM released July 2016 report

By Diego Flammini

Assistant Editor, North American Content

Farms.com

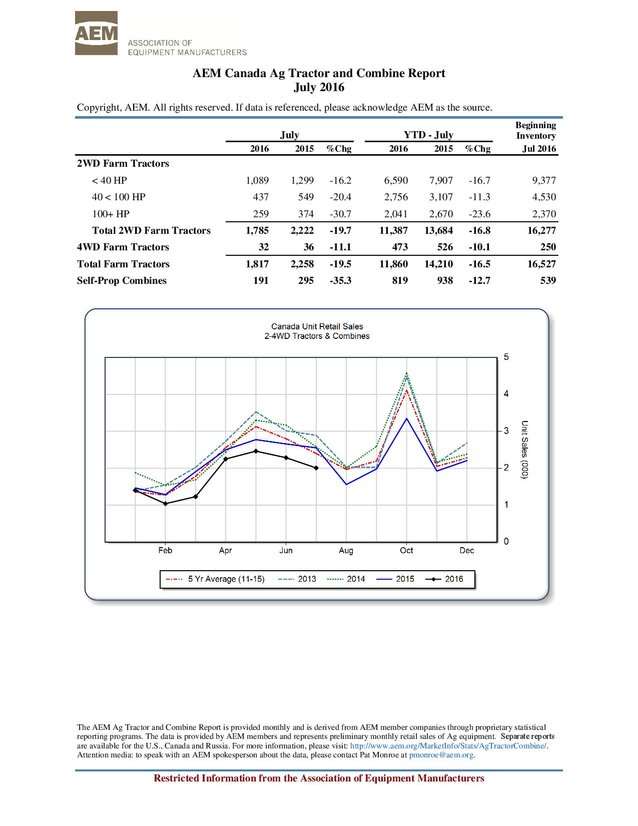

A new report by the Association of Equipment Manufacturers (AEM) shows a decline in Canadian combine and tractor sales.

According to the report, 473 4WD tractors were sold in July 2016, compared to 526 in July 2015. That represents a 10.1 per cent decline.

Sales of 2WD tractors fell by 16.8 per cent between July 2015 and July 2016. There were 13,684 sold in July 2015 compared to only 11,387 this July.

The report also shows a decline in self-prop combines.

In July 2016, 819 combines were sold, compared to 938 last July. Those numbers represent a 12.7 per cent drop.

The AEM’s report on American combine and tractor sales also indicates a declining market in the same time period.

The largest drops in American sales were in 4WD tractors and self-prop combines. The 4WD tractor sales dropped by 33.6 per cent, and the combine sales fell by 22 per cent between July 2015 and 2016.

HARDI North America CEO Wayne Buchberger said in an interview that commodity prices play a pivotal role in equipment sales.

“That ties directly then to disposable income on the farm and what they’re able to capitalize for expenditures each year,” he said.