Will $6.00 corn and $16 soybeans for new crop favour more soybeans acres in 2021?

Ontario farmers intend to plant 6.203 million acres of corn, soybeans and all wheat combined this year, according to a survey conducted by Farms.com Risk Management between January 22 to March 21, 2021. This is higher by 0.16% compared to last year, but below the 2019 total at 6.4 million. However, 95,500 acres are unaccounted for in Ontario in 2021 when compared to the 2019 total at 6.4.

A similar story is being played out in the 2021 U.S. acreage battle, where 3-3.5 million acres are unaccounted for when compared to last year. The 2021 intended Ontario corn acres are at a record 2.81 million, which is higher by 4.1% than last year, and above the 5-year average of 2.16 million. Total 2021 soybean acres fall below 3 million compared to last year and 2016.

OMAFRA is forecasting a big Ontario wheat crop, with acreage at 1.228 million versus this survey’s forecast of 1.066 million (154,000 acres less).

$6.00 corn and $16 soybeans for new crop, could favour more soybeans acres in 2021?

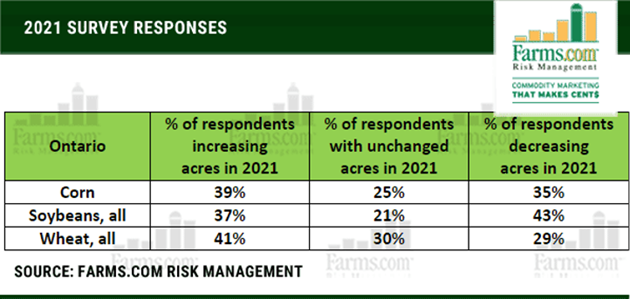

“If the farmer booked their fertilizer inputs early last fall, the intended corn acres will get planted. But we are hearing more and more reports of farmers switching corn seed bags for soybeans.” said Chief Commodity Strategist Moe Agostino. Fertilizer prices have soared by over 44% in just 5-months and many smaller farmers who usually do not book forward their input needs will be forced to plant soybeans instead. Forty percent of all respondents said they were increasing acres to corn, soybeans and wheat, 30% were unchanged and 30% on average were decreasing acres versus 2020.

In 2021, Ontario farmers are expected to plant 4.1% more corn acres year-on-year (Y/Y), which amounts to +90,058 acres, and sets a new record of 2,281,058 total Ontario corn acres, with most of the increase coming from Southern Ontario. 2021 Ontario soybean intended acres will be higher slightly, up by +6,511 acres, versus. last year, but below 3 million, with more acres in Central and Western Ontario. IP soybean acres are down slightly Y/Y (-0.57%), while canola acres are up 88.92% Y/Y at 7,536. Soft White winter wheat acres are up +30.79% Y/Y in the survey, while barley acres are down -41.14%, oats are also down -20.14% Y/Y.

A lower Canadian dollar (CDN $) continues to provide a bonus to Ontario farmers for the 6th consecutive year. Agostino says a new normal has arrived, despite a stronger commodity currency (up 12 cents since the COVID-19 lows in March of 2020), he also says basis is higher. As futures rise, so do basis, and vice versa. One key factor that continues to outweigh all others is record strong global demand Agostino says.

Greg Stewart agronomist for Maizex Seeds, says he is not surprised by the results but thinks that, “if we can get a fast start out of the gate with ideal weather conditions, we will hold onto the anticipated corn acres.”

Agostino agrees but says, “Most acres will stick to a rotation, but profitability in soybeans, soaring fertilizer prices, and more importantly availability, will put a cap on Ontario corn acres in 2021. The yield drag, with corn on corn acres, higher costs and the potential for increased disease will also weigh.”

Survey results were shared with survey participants. For more information, contact Farms.com Risk Management.