More than 600 organizations signed an open letter

By Diego Flammini

Assistant Editor, North American Content

Farms.com

More than 600 organizations with ties to agriculture signed a letter addressed to the Senate Agriculture Committee to confirm former Georgia Governor Sonny Perdue as the next head of the USDA.

“…we write to urge your support for the expeditious confirmation of Sonny Perdue to be Secretary of Agriculture,” reads the letter signed by organizations including the American Farm Bureau Federation, Iowa Soybean Association, Texas Grain and Feed Association, and the National Corn Growers Association.

The letter, addressed to Senate Agriculture Committee chairman Pat Roberts and ranking member Debbie Stabenow, says Perdue would be in exclusive company after his confirmation.

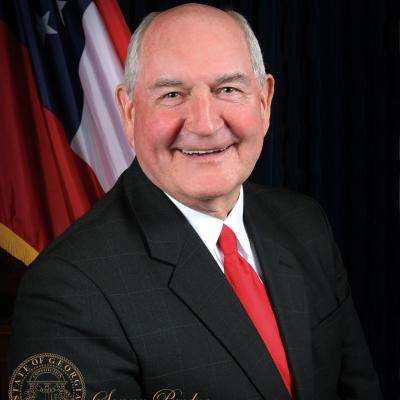

Sonny Perdue

“There have been 30 Secretaries of Agriculture since the job was created in 1889, and though some were raised on a farm, only two actually lived and worked in agriculture as adults. If confirmed, Sonny Perdue will be number three,” the letter says.

The letter says that Perdue, a former practicing veterinarian and founder of three agribusinesses, understands the importance of agriculture given his experience as the Governor of Georgia.

“As the former governor of a state that produces billions of dollars in food, fiber, specialty crops, nursery crops, dairy products, poultry, and livestock each year, Gov. Perdue understands the critical role of feeding our country and the world. He is also keenly aware of the importance of agriculture in powering our nation’s economy, providing jobs from farm to table.”

Perdue could be confirmed as Secretary of Agriculture by the end of February, according to reports.