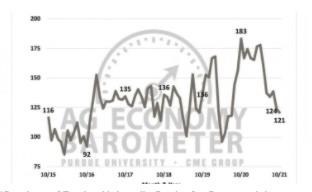

The skyrocketing cost and limited supply of fertilizer, combined with increases in other input costs continues to concern farmers according to the latest Purdue Ag Economy Barometer.

The survey found farmer sentiment weakened for a second month in a row. Farmers' deciding this winter how many acres of each crop they will plant in 2022 will affect consumers in the long-term.

Most fertilizers are produced through natural gas. High natural gas prices means fertilizer is getting more expensive. That price is passed on to corn and soybean farmers.

Barometer co-author Jim Mintert said the concern right now for farmers is whether they will be able to pay for fertilizer, if they can even get the supply they need.

“You look at output prices, things like corn and soybean prices, and from a historical standpoint, those look pretty attractive," Mintert said. "But then when you start factoring in this dramatic rise in production cost, it's just created a lot of angst among farmers. And I think that's showing up on our surveys.”

The monthly survey of 400 agriculture producers across the country found that about one-third of respondents believe input prices – the costs for farmers to produce crops – will increase more than 12 percent. The average cost increase over the last 10 years has been only 1.8 percent.

Mintert said this is a long-term issue with an impact that could be seen next year.

"It's going to eventually trickle into the retail prices," he said. “And I have to say though, in the short run, you know – there's been a lot of talk about the increase in retail prices of food. So far most of that has been related to other supply chain issues, not so much the raw ingredient prices for food.”

Mintert said things like packaging costs, inability to get products to market and factories not being able to run at full capacity have boosted food prices so far.

Click here to see more...