By Mike Rankin

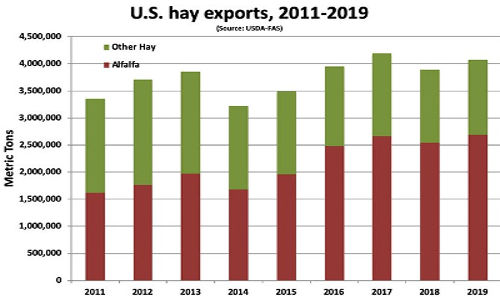

For the second time in three years, total U.S. hay exports in 2019 eclipsed 4 million metric tons (MT). This was accomplished despite the flurry of trade battles that waged on and off during the past year.

The USDA Foreign Agricultural Service (FAS) pegged 2019 total alfalfa and other hay (mostly grass) exports from the U.S. at almost 4.1 million MT, just shy of the 2017 record of 4.2 million MT. The past year’s total hay exports were 4.5% greater than 2018’s final tally.

Alfalfa

Alfalfa hay exports to all trade partners in 2019 totaled a record 2.7 million MT, just 21,000 MT above the previous high, which occurred in 2017. Alfalfa exports this past year exceeded 2018, another tariff-riddled year, by 5.5%.

Even with imposed tariffs that were 25% higher than normal for much of the year, China still holds down leading alfalfa trade partner status. In 2019, the country imported 865,393 MT of U.S. alfalfa (see graph below).

Exports to China were 0.7% behind 2018 and far behind the record 1.17 million MT that it purchased in 2017. Monthly export totals to China during 2019 were a roller coaster; they ranged from 25,461 MT in January to 128,582 MT in October.

China will most likely remain our biggest alfalfa trade partner into the future, and with tariffs now back to pre-trade war levels, there is optimism that the market will grow along with China’s dairy industry.

Japan’s alfalfa hay import total of 663,994 MT was 14.2% higher than 2018 and was that country’s largest amount of U.S. alfalfa purchased since 2009. The past year marked the fifth consecutive year of higher U.S. alfalfa exports to Japan.

Saudi Arabia, the third leading importer of U.S. alfalfa, was something of a good news-bad news story in 2019. The country imported 417,518 MT of U.S. alfalfa, but that total was over 63,000 MT (13.2%) less than was acquired in 2018.

For several years, we have heard reports of a Saudi phase out of alfalfa production to conserve water. Although that has occurred to some extent, it apparently isn’t happening as rapidly as was expected. Even so, we need to keep in mind that as recently as 2014 the Saudis were essentially nonplayers in the U.S. alfalfa export market.

Rounding out the top 5 of U.S. alfalfa importers in 2019 were the United Arab Emirates (UAE) and South Korea. The UAE’s total of 303,022 MT was 25.7% greater than 2018 but still only half as much as what that country imported during the early 2010s.

Click here to see more...