Seasonal price patterns are one factor to consider when developing a marketing plan and analyzing a market.

‘Many factors influence commodity prices,’ says Neil Blue, provincial crops market analyst with Alberta Agriculture and Forestry. ‘The main price determining factors for most commodities are supply and demand, and that is true for canola prices.’

Factors affecting the availability of crop or of a competing crop in the largest production areas together with demand for those crops have the greatest influence on a crop’s price.

‘Therefore, from the supply side, prices tend to follow the production cycle of a crop. To help with their pricing decisions, crop marketers should be aware of seasonal price patterns of crops that they produce.’

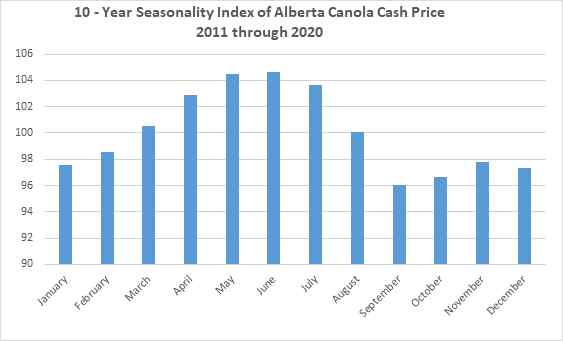

Seasonal prices are calculated by taking the average price for a certain period, such as a week or month, and comparing it to the average price over a longer period such as a year. Seasonal prices are often plotted on a bar graph, with the annual price average as Index 100. Usually, such a calculation uses data from several years, thus reducing the influence of contra-seasonal price moves that happen in some years.

Image 1. 10-Year seasonality index of Alberta canola cash price

‘Canola prices tend to make a low during the September/October period when there is abundant supply,’ explains Blue. ‘Harvest progress, yield reports and buyer demand all affect timing of harvest price lows. After a harvest low, prices usually rebound as harvest selling pressure subsides and as demand again becomes evident.’

Canola prices tend to level off into year-end, often improve during the December holiday period, trade sideways to lower into mid-February and then improve into spring. Prices tend to peak sometime in May-June and, unless production problems continue to support prices, usually erode from mid-July into a harvest low. Often that price decline into harvest is interrupted by a frost concern in August or early September.

‘Seasonal price patterns are one factor to consider when developing a marketing plan and analyzing a market. Fall delivered prices tend to be the highest at the beginning of the growing season when production uncertainty is the greatest. That is often the best time to forward price some expected production, considering cash flow needs and available storage for the expected new crop.’

However, Blue points out that in a year of reduced crop production in a major Northern hemisphere area, prices can rise during the growing season right into harvest. ‘Because of this possibility and that of an unexpected production shortfall on your farm, it is recommended to only forward contract with buyers up to about 50% of expected production. To price a higher percentage of canola prior to harvest, it is prudent to use the futures or options market to avoid additional physical delivery commitment.’

Seasonal prices should be considered as more of a tendency than a certainty. ‘However, of the many factors that can affect crop prices, the seasonal price pattern is deserving of a crop marketer’s respect,’ says Blue.

Source : alberta