By James M. MacDonald

Farming is a risky business. In addition to raising livestock or growing crops on their operations, producers must contend with forces beyond their control—including pest infestations, disease outbreaks, or weather events (such as droughts or floods)—that can diminish the anticipated production from a field or herd. Producers must also contend with sudden changes in product or input prices that can alter the revenues or costs anticipated from that production.

Farmers apply a range of tools to manage risks. They use on-farm strategies, such as commodity diversification—raising a diversity of crops and/or animals—to smooth the impact of various risks. They can draw on Federal risk management support programs, including commodity support programs, Federal crop and livestock insurance, and disaster assistance. They can also use market tools such as futures, options, and marketing contracts to manage the risks from product and input price fluctuations. The use of these market tools is far from universal in agriculture, but they do cover a significant amount of production in some commodities.

Researchers at USDA, Economic Research Service (ERS) investigated how futures, options, and marketing contracts are used by farmers. The researchers added questions on futures and options in the 2016 Agricultural Resource Management Survey, USDA’s annual survey of U.S. farms and their finances. The survey includes questions on marketing contracts in each year, so the researchers could track the use of all three tools. Among farmers who use futures and options contracts, more than 90 percent used them for corn and soybeans, so this research focused primarily on corn and soybean producers.

Futures, options, and marketing contracts

A futures contract is an agreement (enforced through the rules of the organized commodity exchange on which it is traded) to deliver or accept delivery of a specified amount of a commodity during a specified month, at a price established through trading in the exchange. For example, in late July 2020, a farmer (or any other market participant) could enter into a futures contract specifying December delivery of corn (in the terminology of futures markets, the farmer would have a “short position,” offering in late July to deliver corn in December). Corn futures for December delivery were trading at $3.36 a bushel at that time, while September delivery contracts were trading at $3.28 and those for March 2021 delivery were trading at $3.45. By entering into a futures contract, the farmer could assure a certain price for a crop that has not yet been harvested, as well as enter into contracts for delivery in different months. Farmers can also buy and sell futures contracts to hedge against the risks of future price fluctuations and hence manage price risks.

Options contracts provide farmers with more flexible risk management strategies in futures markets. In an options contract, a farmer can buy the right to buy or sell, at a set price, a futures contract on an agricultural commodity at any time during the life of the option. For example, a farmer might choose not to enter into a futures contract for December delivery, as in the example above. Instead, the farmer might buy a “put” option on a December futures contract at a certain strike price. If the futures price then falls below the strike price over the life of the option, the farmer could exercise the option to enter into the contract at the (higher) strike price, protecting against declines in the December-delivery futures price in months after July. On the other hand, if the December-delivery futures price were to rise above the strike price during the rest of the summer, the farmer could let the option expire and instead enter into a futures contract at the higher price. Thus, an option allows the farmer to protect against decreases in the futures price, while retaining the opportunity to take advantage of increases in the futures price, at the cost of an option.

Futures and options contracts usually do not result in actual delivery of the commodity because most participants reach final financial settlements with each other when the contracts expire. These contracts, therefore, work only to limit the price risks attendant upon commodity sales. In a marketing contract, by contrast, a farmer agrees to deliver a specified quantity of the commodity to a specified buyer during a specified time window. While futures and options contracts are highly standardized and focused for pricing purposes on a common quantity of a precisely specified product delivered to a single location, marketing contracts can be quite idiosyncratic and written to the needs of individual buyers and sellers. Marketing contracts may specify a fixed price at the time of agreement—thus locking in a price for the seller, or they may specify a base price (often tied to a futures price) with premiums and discounts applied to the attributes of products as delivered. For example, buyers of hogs under marketing contracts may pay premiums for hogs that reach certain targets for leanness, while buyers of cattle may deduct for cattle that are too large or too small.

Futures and options contracts are traded in large volumes on organized exchanges and are therefore excellent mechanisms for discovering market prices that will balance supply and demand, while allowing users to manage price risks. In addition to providing some price protection, marketing contracts can provide incentives to produce products with specified attributes that buyers value. Marketing contracts provide farmers with assured outlets for their production, and they can provide processors with steady flows of uniform products for their processing plants.

Corn and soybean farmers are the predominant users of risk management tools

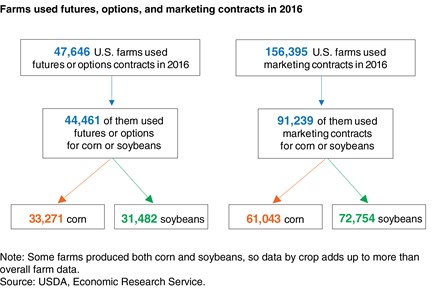

Farmer use of futures and options contracts is heavily concentrated among corn and soybean operations. During 2016, 47,646 farms used futures or options contracts, and more than 93 percent of these farms traded corn or soybean futures or options contracts. More than 300,000 U.S. farms grew corn or soybeans in 2016, and most of that number grew both crops.

While corn and soybean contracts are widely traded on exchanges, and corn and soybeans are the two largest U.S. crops by acreage or value, they are not the only agricultural commodities available for futures and options trading. There are also deep markets in cotton, rice, and wheat, as well as cattle, hogs, and dairy products. Although there are far more corn/soybean farmers than cotton, rice, or wheat farmers, corn/soybean farmers are also more likely to trade in futures and options: about 12 percent of corn/soybean farms were active in futures or options trading in 2016, compared with 7 percent of cotton farms, 5 percent of wheat farms, and 1 percent of rice farms.

Marketing contracts are more widely used across U.S agriculture: more than 156,000 farms used them in 2016. Marketing contracts are used by field crop and specialty crop operations and by cattle and dairy producers, but corn and soybean operations still made up 60 percent of all farms using marketing contracts in 2016. (See figure below.)

Embed this chart

Download higher resolution chart (2539 pixels by 1664, 300 dpi)

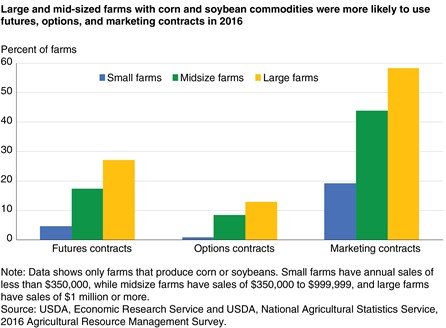

Larger corn and soybean producers are considerably more likely than smaller farms to use any of these market tools. ERS defines small farms as those with less than $350,000 in sales, as measured by gross cash farm income, while midsize farms have $350,000 to $999,999 in sales and large farms have at least $1 million in sales. Fewer than 5 percent of small corn and soybean producers used futures contracts, compared with 17 percent of midsize producers and 27 percent of large producers. Far fewer farms used options contracts, but farm size still mattered: less than 1 percent of small farms used options, compared with 9 percent of midsize operations and 13 percent of large producers. Marketing contracts were much more widely used than futures or options. About 19 percent of small corn/soybean producers used marketing contracts, but larger operations were still much more likely to rely on them—about 58 percent of corn/soybean producers with at least $1 million in sales (large farms) used a marketing contract in 2016. (See figure below.)

Embed this chart

Download higher resolution chart (2539 pixels by 1872, 300 dpi)

Corn and soybean futures and options contracts trade in standard units of 5,000 bushels, but there is also trading in “mini” corn and soybean futures and options contracts of 1,000 bushels. At average reported crop yields, a standard-sized futures contract would encompass 29 acres of corn production or 96 acres of soybeans, and mini-contracts would require one-fifth of that acreage. Small corn and soybean producers, who often operate a mix of other enterprises (such as cattle or poultry), do not typically harvest large acreages of corn and soybeans. Half of small corn and soybean operations harvested no more than 50 acres of soybeans and 42 acres of corn. As a result, most corn/soybean producers can cover most of their production with a single tool. Moreover, futures and options trading require some expertise, and the gains for small farmers from trading on small volumes of production may not be worth the investment in time required to gain skills and experience.

The personal characteristics of farmers also affect decisions to use contracts, particularly futures or options contracts. ERS researchers found that corn and soybean farmers who were at least 60 years old were considerably less likely to use futures or options than younger operators, even after controlling for differences in farm size. Education also had an impact, albeit modest: Operators of corn and soybean farms who had a college degree were a bit more likely to use futures or options contracts.

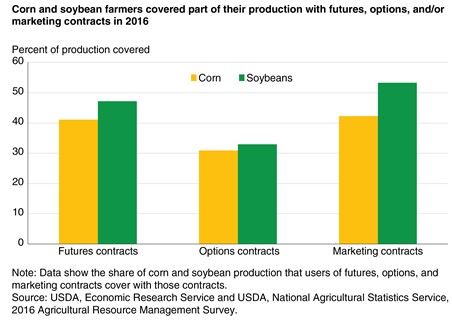

The 2016 survey showed 12 percent of corn and soybean producers were using futures, options, or marketing contracts, so most farmers of those crops do not rely on those tools to manage risks. The farms that do use those tools cover some, but not all, of their production with one tool. On average, farms that use futures contracts cover 41 percent of their corn production and 47 percent of their soybean production. When farms use marketing contracts, they sell similar shares under those contracts—42 percent of corn and 53 percent of soybeans. When they use options contracts, farmers cover a little over 30 percent of their production. Farms generally use a portfolio of risk management tools and do not rely exclusively on any one tool.

Embed this chart

Download higher resolution chart (2539 pixels by 1800, 300 dpi)

Farmers used a portfolio of risk management strategies in 2016

Farmers do not typically see futures, options, and marketing contracts as substitutes for each other. In fact, farmers that use one tool often use others as well. For example, corn/soybean farmers who use marketing contracts are four times more likely to use futures or options contracts than farmers who don’t use marketing contracts. What’s more, users of marketing contracts are noticeably more likely to invest in on-farm storage than operations that don’t contract. On-farm storage can serve as a risk management tool because it allows farmers to better time commodity sales if they anticipate higher prices in the future.

Farmers do not have to execute risk management strategies on their own. As one alternative, they could join a farmers’ cooperative and rely on it to execute futures, options, or marketing contracts, and to store commodities on behalf of the farmer. Farmers who use marketing contracts are also more likely to belong to cooperatives. Finally, farms that use marketing contracts tend to use them across all their crops: Farms that use marketing contracts for corn or soybeans place about 40 percent of their other crop production under contract, while farms that don’t use contracts for corn and soybeans place an average of about 5 percent of their other crop production under contract.

U.S. corn and soybean producers used different risk management strategies in 2016

Futures, options, and marketing contracts provide farmers with tools for managing several types of risks. Futures and options provide an effective mechanism for discovering market prices, a task that benefits all buyers and sellers of commodities, and they also provide farmer-users with tools for managing price risks. Marketing contracts provide farmers with another tool for managing price risks, while also providing an assured outlet for their products and compensation for specific product qualities that buyers want. While most farmers do not use them, they are valued marketing and risk management tools for many.

Source : usda.gov