By Don Shurley

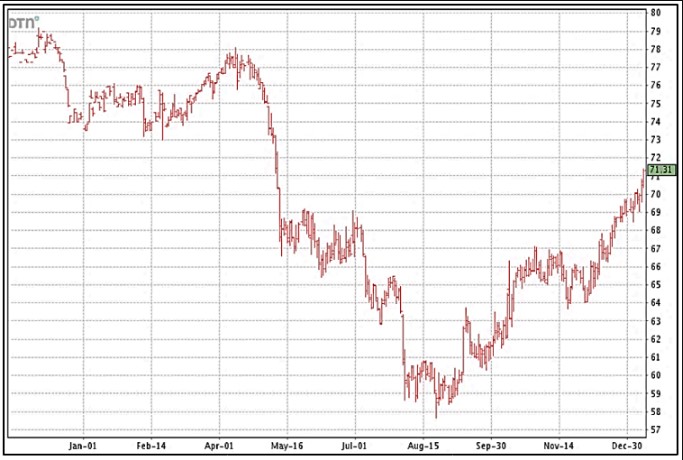

Old crop March futures closed over 71 cents today—the highest closing daily price in 8 months. How thankful we are as an industry for the recovery we’ve experienced when we once thought all was lost.

Prices have increased over 10%, since the most recent lows at 64 cents, and almost 22% since the lows back in late August and early September.

On the trek back up, prices have managed to break through “resistance” at 60, then 64, then 67, and now 70 cents. Prices have now recovered to 92% of the highs at over 77 cents we experienced last Spring.

We have advocated in these articles several times that better prices were possible, if and when economic fundamentals improved and trade uncertainties were resolved positively. Likewise, such improvements in prices would represent very good and reasonable “targets” for remaining marketing decisions and risk management.

The biggest positive adjustment in economics, frankly, has been the reduction in the US crop—which has been expected all along, and it was just a matter of time until USDA jumped on board. The crop was cut another 110,000 bales, based on a higher average yield, but a big reduction in harvested acres.

In my humble opinion, the biggest negative (bearish) adjustment continues to be World Use/demand. Use was cut another 50,000 bales. Projected Use for the 2019 crop year has been revised down 5.7 million bales or 4½% since the first estimate back in May. This concerns me now and for the future and is not getting enough attention. This is zero growth from the 2018 crop year and 2½ million bales less than 2017.

I suppose weakening demand is being overlooked because of lower US and World production, and as long as US exports are doing well? USDA’s January estimates lower exports for competitors like Australia and India, but reduce imports (demand for exports) for China, Bangladesh, and Vietnam.

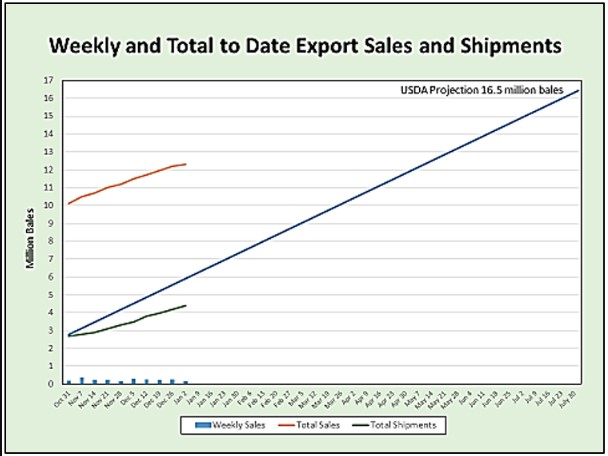

The projection for US exports (shipments) for the 2019 crop marketing year were unchanged at 16.5 million bales. We have mentioned before that this is a good, if not optimistic, estimate given the trade uncertainties with China.

The latest export sales figures (for the 7-day period ending January 2nd) were 161,900 bales—bringing total sales to date to 12.3 million bales. This compares to 11.7 million bales at the same time last year. Total shipments to date are 4.4 million bales compared to 3.9 million last season. Sales have averaged over 240,000 per week over the past month.

Shipments have averaged about 220,000 bales per week, but will need to average 400,000 bales per week to meet USDA’s 16.5 million bale projection. This seems a daunting task, but last season at this time, shipments were 26% of the total. Currently, shipments are at 27% of the projected total for the 2019 crop marketing year. Our largest export customers thus far are Vietnam, China, Pakistan, Turkey, and Bangladesh.

The market has improved due to: 1) prices simply being too low at the lower levels, 2) the reduced US crop, and 3) Increased optimism on trade policy—phase 1 the a US-China trade deal and completion of the USMCA.

Thankfully, prices have come back from those awful 60’s. Prices have jumped some hurdles to do so. With these previous “hurdles” behind us, this means the market should now have stronger support against prices moving significantly lower.

But, I’m nervous about the remaining outlook. While Phase 1 and the USMCA are positive, the facts are we have yet to know with much, if any, certainty specifically how each one may or may not benefit cotton. Optimism has fueled the price recovery—facts and numbers will be needed to ultimately justify and sustain it.

Growers should now be fairly well caught up on their pricing and risk management—the move from 67 to now over 71 cents has provided good opportunity. The next target up, if the market can achieve it, is at 73 to 74 cents. Given that we are already at 92% of where most growers admit they wish they had priced more of last spring, I would question holding too much of your crop waiting for something much higher—if you want to risk some of your crop continuing to hold, yes, but how much is too much? How much risk can and should you take and how?

Source : ifas.edu