After peaking at historic highs in the second quarter of 2022, prices for major fertilizer products have trended consistently downward over the past year. Supply and demand fundamentals, as well as some resolution of the ongoing impacts and uncertainties associated with the Russia-Ukraine conflict, have been contributing factors. With market expectations pointing towards lower commodity prices for 2024, and higher natural gas prices over the next 6 months, pricing at least a portion of 2024 fertilizer needs may warrant some consideration at this time.

Recent Fertilizer Price Trends

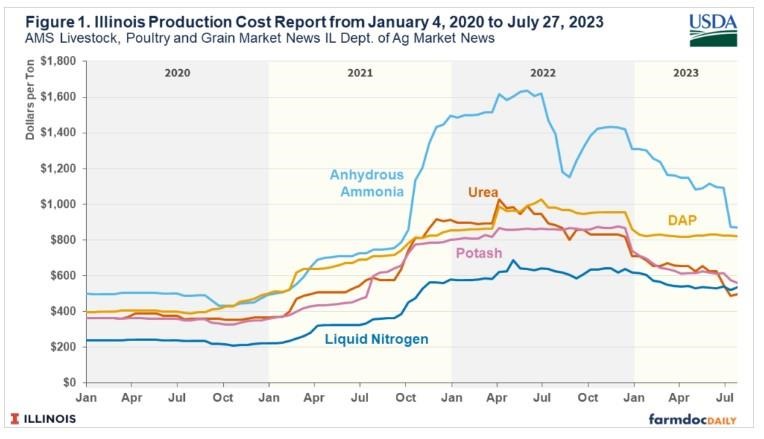

The prices of major fertilizer products in Illinois began increasing in 2021, peaking at various points in the 2nd quarter of 2022. Figure 1 reports average prices for fertilizer products in Illinois from the USDA’s Ag Marketing Service’s bi-weekly production cost report. Anhydrous ammonia topped at $1,635 per ton in June of 2022, and has since declined by nearly 47% to $870 per ton on July 27th, 2023. Urea and liquid nitrogen, at $497 per ton and $536 per ton as of July 27th, have declined just over 50% and nearly 22%, respectively, from their peaks in 2022.

Di-ammonium Phosphate (DAP) prices have fallen by 20% from over $1,000 per ton in June 2022 to $822 per ton as of July 27th. Potash prices have fallen over 35% to $558 per ton from their peak of $865 per ton in April of 2022.

Reasons for Declining Fertilizer Prices

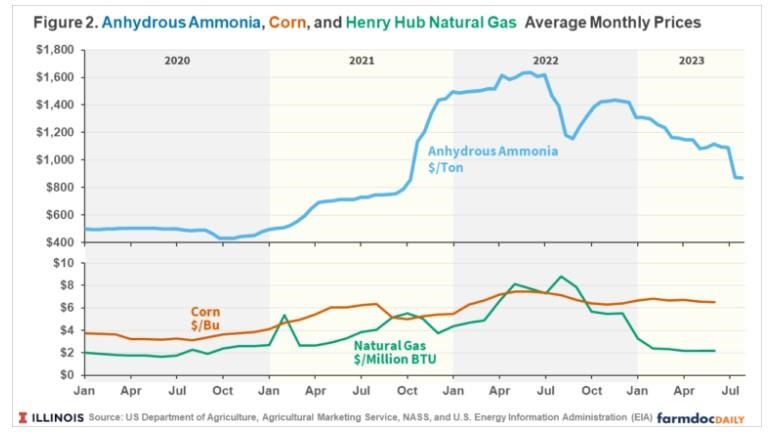

Previous articles have discussed the fundamental relationship between nitrogen fertilizers, natural gas, and corn prices (farmdoc daily, June 14, 2016; December 14, 2021). The cost of natural gas, the key energy input in the processing of anhydrous ammonia as well as other fertilizer products, has also trended downward over the past year after peaking in 2022. Average corn prices have also declined, reaching $6.49 in June 2023. This remains high by historical standards, but down 12% from last year’s high of $7.38 per bushel in June 2022.

As the saying goes “the cure for high prices, is high prices”, and the sharp increase in fertilizer and energy prices in 2022 led to demand destruction as farmers and consumers made adjustments to high price levels. Coupling that with investments in expanding fertilizer production capacities that either have come online over the past year or are expected to impact capacity in the coming year, has also helped to moderate fertilizer prices (farmdoc daily, February 28, 2023; USDA, 2023).

Much of the rise in fertilizer prices in the first half of 2022 was associated with uncertainty and trade disruptions stemming from the Russia-Ukraine conflict as sanctions were placed on exports from Russia and Belarus, and other global producers implemented export restrictions to protect fertilizers for domestic use (Hedebrand and Glauber, 2023). Markets have seemingly been able to adjust to disruptions better than were initially anticipated at the start of the conflict, helping to bring prices down. However, the ongoing risk of conflict escalation or other geopolitical developments which lead to global trade flow disruptions remain. This could cause further supply chain disruptions and higher prices.

Implications

Declining fertilizer prices should, on their own, point to improved prospects for farm-level returns in 2023 and 2024. However, prices remain relatively high by historical standards and the extent to which individual farm operations were able to take advantage of price declines for fertilizers used for the 2023 crop depends on the timing of their purchases over the past year.

Looking ahead to 2024, current price levels might provide some opportunities to lock in prices at levels last experienced in mid to late 2021 prior to when any risk premiums associated with the Russia-Ukraine conflict. The year-long downward trends in prices may tempt producers to continue to take a wait-and-see approach to booking any fertilizers for the 2024 crop year. However, natural gas futures indicate market expectations for prices to move from the current $2 range back to the the mid- to high-$3 range over the next 6 months, while corn futures currently suggest cash prices near or just below $5 per bushel for the 2024 crop.

These market expectations for corn and natural gas prices and current price levels for fertilizer products seem consistent with conditions during late-summer and fall of 2021, prior to the turmoil introduced by the Russia-Ukraine conflict in February of 2022. Thus, it may be prudent to consider pricing at least a portion of 2024 fertilizer needs given the ongoing risks in the market.

Conclusions

Fertilizer prices, while still at historically high levels, have continued what is now a year-long decline from peak levels reached in the second quarter of 2022. Demand destruction from high prices, investments in expanding global production capacity, and market adjustments to the Russia-Ukraine conflict have all been contributing factors in the decline in fertilizer prices.

The extended downward trend in prices might arguably suggest a wait-and-see approach to pricing 2024 fertilizer needs. However, current futures bids for the 2024 corn crop and natural gas suggest markets may be headed back to conditions last experienced in mid- to late-2021. Fertilizer prices are also approaching levels experienced in 2021. Therefore, market expectations and ongoing risks suggest considering the pricing of at least a portion of fertilizer needs for the upcoming year.

Source : illinois.edu