While Canada is a strong exporter of pork, total global exports are forecast to decrease in 2022 from 2021 levels.

“Global market analysis by USDA forecasts a pork production increase of nearly 3% year-over-year in 2022 at 110.5 million tonnes (carcass weight equivalent),” says Ann Boyda, provincial livestock market analyst with Alberta Agriculture, Forestry and Rural Economic Development. “Much of this growth is based on China’s rebuild of its hog industry. China’s significance as a global player in the market cannot be overestimated. China’s forecast production is 46% of global pork or 51 million tonnes.”

Canada is ranked seventh, with a production forecast of 1.54 million tonnes, representing 2% of total global pork production. Canada is also a strong exporter of pork (estimates of 1.465 million tonnes in 2022). Canada’s competitors are forecast to remain the European Union, United States, Brazil and Mexico. USDA forecasts total exports to decrease in 2022 from 2021 by 4.3%, primarily attributed to the reduced imports of China and the Philippines.

“Uncertainty in the global marketplace stems from supply-chain disruptions due to COVID-19, the war in Ukraine, and the threat of African Swine Fever (ASF). Rabobank, in their ‘Global Pork Quarterly Q2 2022’, also forecasts global pork trade in 2022 to decline, driven by weaker economic trends and ample pork supply,” explains Boyda.

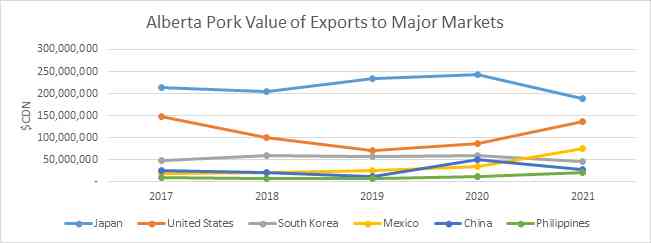

The major markets for Alberta pork sales (fresh, frozen, chilled, including offal) in 2021 included Japan, United States, Mexico, South Korea, China and the Philippines. These countries account for nearly 96% of the total value of Alberta pork exports ($515 million).

Image 1. Alberta pork value of exports to major markets

Source: Statistics Canada, Agri-Food Trade Data

“These 6 major markets are well established but opportunities in new and emerging markets should not be overlooked,” says Boyda. “There are growing appetites around the globe and the largest increase in consumption may take place in developing countries. ASF has the potential to change global trade flows as major exporters cope with the disease. Biosecurity remains Canada’s best protection against ASF and our industry remains diligent.”

Source : alberta.ca