By Mary Hightower

Beef and pork processing rebounded last week after dropping sharply, while wholesale beef prices continued rocketing to new record highs, according to an analysis done by John Anderson, economist for the University of Arkansas System Division of Agriculture.

Anderson is head of the agricultural economics and agribusiness department, with a joint appointment in the Dale Bumpers College of Agriculture, Food and Life Sciences. His analysis was drawn from the May 8 Estimated Daily Livestock Slaughter under Federal Inspection Report. The report is issued by the U.S. Department of Agriculture’s Agricultural Marketing Service.

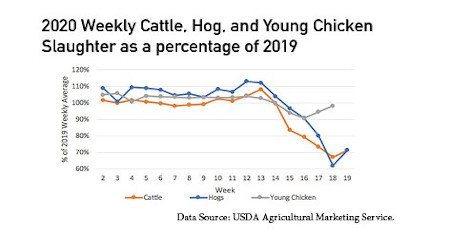

Cattle and hog slaughter figures finally turned higher last week after several weeks of falling sharply because of multiple plant shut-downs and slow-downs due to COVID-19.

“Cattle slaughter was projected to rebound to 452,000 head this week after falling to 425,000 head the prior week,” he said. “Hog slaughter was estimated to hit 1.768 million head last week, up from 1.533 million head the prior week.”

Anderson said that while the modest bounce in slaughter levels “is a positive development, suggesting at least the beginning of a move back toward normal, processing capacity remains constrained.

“Last week’s cattle and hog slaughter numbers both remain about 28 percent below last year’s average weekly slaughter level,” he said.” Considerable further recovery in processing rates will be needed to alleviate major production disruptions and stabilize markets.”

The April 30 report noted wholesale beef prices soared to a new record level – $272.33 per hundredweight, breaking the old record of $263.19 set back in 2015. The May 8 report was not to be outdone.

“Choice boxed beef cutout value averaged $441.53 per hundredweight, an unprecedented average price for wholesale beef. The Choice cutout has almost doubled since the first week of April, Anderson said.

While major beef cuts surged, Anderson said the growth in the value of beef trimmings, a major component of ground beef, “has been particularly astonishing.”

For the week ending April 3, the price of fresh 50 percent lean beef trimmings averaged $28.49 per hundredweight.

“Last week, it averaged $275.28 per hundredweight, an increase of more than 800 percent,” he said. “With production sharply lower and demand for this staple item strong, prices have exploded.”

This is not the first time beef trimmings have seen this level of pricing.

“While little remembered now, fresh 50 percent lean trim prices topped $200 per hundredweight about this time of year in 2017,” Anderson said.

Poultry

Poultry production seems to be closer to the light at the end of the COVID-19 tunnel.

“Data suggests that the broiler sector, as a whole, has come closer to resuming normal operations,” he said. "Broiler slaughter hit 162 million birds, which is 98 percent of 2019’s weekly average rate of production.”

To read more of Anderson’s take on COVID and consumer spending, see this and other economic impact reports at https://bit.ly/AR-Ag-Eco-Impacts2020

Source : uaex.edu