According to the latest U.S. Drought Monitor report, drier-than-normal conditions across the western U.S. have persisted since early January. During the second week of February, above-normal temperatures prevailed throughout the West and much of the Great Plains.

In the southern Plains, an expansion of extreme drought was made across north-central Oklahoma, based on 90-day SPI and worsening soil moisture indicators. Despite a dry week, a reassessment of SPI values at various time scales and soil moisture indicators supported a 1-category improvement from moderate drought (D1) to abnormal dryness (D0) across the southern Edwards Plateau in central Texas. According to the USDA’s National Agricultural Statistics Service, 77% of the topsoil moisture was rated as poor to very poor across Texas as of Feb. 13. Nearly two-thirds of oats, winter wheat and rangeland and pasture was rated in poor to very poor condition.

In the High Plains, moderate drought was degraded to severe drought across central Kansas and merged with ongoing in southwest Kansas, based on 120-day SPI and soil moisture indicators. Since a 1-category degradation was made the previous week across northern Kansas and eastern Nebraska, these areas remained status quo this week given the time of year when worsening conditions are slower to be realized in terms of impacts. Farther to the north, recent dryness with a lack of snow cover and above normal temperatures resulted in an increase of abnormal dryness and moderate drought across northern Nebraska and South Dakota. The updated depiction across the northern to central Great Plains follows closely the 30-to-90-day SPI and soil moisture indicators. Also, the SPI dating back 24 months was also weighed. Drought impacts for South Dakota include many days of high fire danger which is unusual during the winter, low stock ponds, and adverse conditions for recreational snowmobiling. Farther to the north across northern and eastern North Dakota, SPIs at various time scales supported a 1-category improvement. Recent snowfall (6 to 12 inches) and 6-month SPIs prompted a 1-category improvement to the Denver/Boulder metro areas, while 1-category degradations were made to parts of western and southern Colorado, based on longer-term SPIs and current snowpack.

In the West, an expansion of extreme drought was made to parts of south-central Montana, based on SPI and EDDI at various time scales and soil moisture indicators. Although only light precipitation (less-than-0.25-inch liquid equivalent) was observed in northeast Montana, a small area was improved from D3 to D2 due to a reassessment of indicators such as SPI values. Continued improvement of long-term SPI supported a slight reduction in northwest Montana. Severe drought was increased slightly in coverage across southwest Utah, as a result of low streamflows (below the 10th percentile) and 30-day SPI. 12-month SPEI along with worsening soil moisture indicators and 28-day average streamflows supported a 1-category degradation across parts of Oregon and adjacent areas of northwest California. The lack of precipitation since early January resulted in 28-day average streamflows falling below the 10th percentile throughout much of western Oregon. Following the persistent dryness since early January and above normal temperatures from early to mid-February, California’s statewide snowpack decreased to 73% of normal on Feb. 14. If the dry pattern persists through the remainder of February, degradations in the current drought levels may be necessary for the remainder of California.

To view the Contiguous U.S. Drought Map, click here.

Today, a low-pressure system is developing with a subsequent track northeastward to the Ohio Valley and Northeast. A swath of snowfall, potentially more than 6 inches, is expected from the central Great Plains to the Midwest. In the warm sector of this storm system, thunderstorms with locally heavy rainfall (more than 1 inch) are forecast from the Ohio River south to the Lower Mississippi Valley. As mid-level low pressure develops over the West from Feb 20 and 21, snow is anticipated to overspread the Cascades, Sierra Nevada Mountains, Great Basin and the Rockies.

The 6-10-day outlook (valid Feb 22-26, 2022) depicts a major pattern change over the West and the north-central U.S. from earlier in the month. Large probabilities (more than 70%) of below normal temperatures are forecast throughout the West and much of the Great Plains. Conversely, large probabilities (more than 70%) of above-normal temperatures are forecast across the Mid-Atlantic and Southeast. Below-normal precipitation is favored for the Pacific Northwest, Great Basin, California, and Florida. A storm track, consistent with La Niña, elevates probabilities for above-normal precipitation across the Ohio and Tennessee Valleys.

To view the 6 - 10 Day Precipitation Outlook, click here.

To view the 6 - 10 Day Temperature Outlook, click here.

According to the Monthly Drought Outlook map, drought conditions are expected to persist in areas adjacent to the Pacific Northwest that were seeing drought improvement or removal in December. Drought development is likely in the Great Plains and southern Arizona. In southeastern Oklahoma and the eastern half of Texas, drought conditions are expected to improve.

To view the Monthly Drought Outlook map, click here.

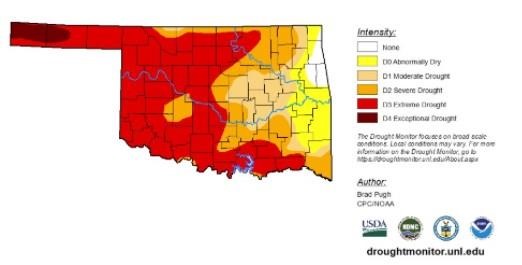

Oklahoma

With data ranging between Feb. 9 through Feb. 15, drought conditions expanded, closing in on the small area of eastern Oklahoma that has continued to fight off drought conditions. At this point, every county in Oklahoma is experiencing abnormally dry conditions or worse. Parts of Adair, Cherokee, Delaware and Ottawa counties make up the small area that accounts for the 2.33% of the state not suffering from abnormally dry conditions or worse.

Click here to see more...