By Gary Schnitkey and Jim Baltz et.al

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Current corn and natural gas price projections suggest anhydrous ammonia prices above $1,100 per ton in the spring of 2022. In addition, global economic conditions and supply issues could increase nitrogen fertilizer prices. However, lower prices also are possible. Given high and volatile prices, we give four risk management strategies.

Current Prices and Situation

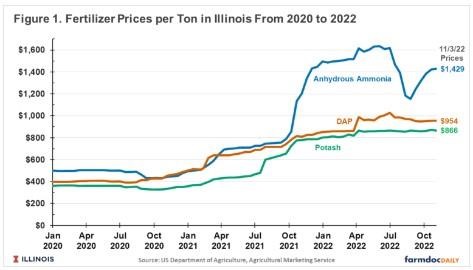

According to the Agricultural Marketing Service, an agency of the U.S. Department of Agriculture, anhydrous ammonia prices in Illinois averaged $1,429 per ton on November 3, 2022, increasing substantially from $1,153 per ton in August 2022 (see Figure 1). Nitrogen fertilizer prices have been high and volatile since August 2021, causing difficulties for farmers when making fertilizer decisions. Several factors contribute to these high, volatile prices, including the aftermath of Covid and resulting supply chain problems. High corn prices traditionally lead to high nitrogen fertilizer prices. In 2021, planned manufacturing shutdowns were lengthened because of weather issues in the lower Mississippi Delta, a major production area of nitrogen fertilizers. Moreover, the Russia-Ukraine conflict has contributed to high and volatile prices.

Farmers have concerns about both the availability and price of fertilizers. While one cannot rule out availability issues, U.S. manufacturers have incentives to produce nitrogen fertilizers. U.S. manufacturers typically make about 88% of nitrogen fertilizers used in the U.S., with the remaining 12% imported from producers outside the United States (see farmdoc daily, March 17, 2022). Natural gas is a major input into nitrogen production in the U.S. and Western Europe. Abundant supplies of natural gas exist in the U.S. Availability issues likely will only occur if weather conditions disrupt natural gas or nitrogen production or supply chain issues impact the transportation of nitrogen from production regions to use areas. Such scenarios must be considered, but they seem improbable to have large impacts. However, the prices of nitrogen fertilizers remain uncertain.

Factors Impacting Prices of Nitrogen Fertilizers

Factors influencing fertilizer prices moving into spring include the typical dynamics between corn, natural gas, and nitrogen fertilizer prices. Moreover, world events could impact prices, particularly related to the Russia-Ukraine conflict. Weather conditions will play a role as well.

Corn and Natural Gas Prices: Both corn and natural gas prices are positively correlated with nitrogen fertilizer prices (see farmdoc daily, December 14, 2021, July 19, 2022, and September 27, 2022). Corn prices continue to be strong, with USDA reporting the average September price for corn at $7.09 per bushel. The Office of the Chief Economist, USDA, is projecting corn’s Market Year Average price at $6.80 for 2022 (see, WASDE, November 2022). A $6.80 price would be the second highest in history, exceeded only by $6.88 in 2012. Futures prices on Chicago Mercantile Exchange (CME) contracts suggest continued high corn prices, with all future contracts in 2023 currently having prices above $6.50 per bushel. Corn prices can change quickly, but the outlook is for continued good prices through spring.

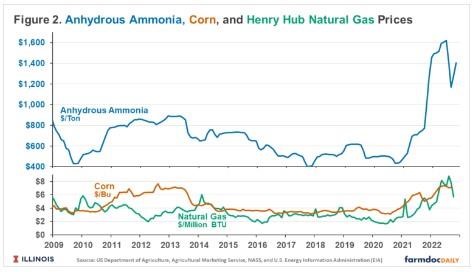

According to the U.S. Energy Information Agency, natural gas prices at the Henry Hub averaged $8.81 per million BTUs in August (see Figure 2). The last time Henry Hub prices exceeded this level was in July 2008 during the 2008 financial crisis.

Since August, natural gas prices have moderated, with an October price of $5.66 per million BTUs. Future markets point to Henry Hub prices near $5 per million BTUs in spring 2022, comparable to levels in fall 2021. That $5 per million BTU price still would be significantly above prices from 2009 to 2020 when natural gas prices averaged $3.26 per million BTUs. Natural gas prices could be higher than the $5 million BTU going into spring, with colder winter weather being a likely culprit in the increase. A mild winter could lead to lower natural gas prices.

Current forecasts suggest a $6.80 per bushel corn price and a $5 per million BTU natural gas price. Historical relationships suggest that these corn and natural gas prices would be consistent with Illinois anhydrous ammonia prices between $1,100 and $1,300 per ton, slightly below current levels. Turbulence around the world could impact Illinois prices.

World Conditions: Nitrogen fertilizer is traded in world markets, and disruptions in one part of the world will raise prices in other parts. The current conflict between Russia and Ukraine could have ramifications. Because of sanctions and other geopolitical considerations, Russia has reduced natural gas flows to Western Europe, resulting in higher natural gas prices in Europe than in the U.S. (see Figure 3). Since 2021, some manufacturers have curtailed fertilizer production in Europe because high natural gas prices made European production uncompetitive with production elsewhere. Reducing European production increases world prices because fertilizer production from other sources fills in for European production.

Events in the Ukraine-Russia conflict are challenging to predict. An end to the conflict would likely result in lower natural gas and fertilizer prices. Grain prices likely would decline as well. On the other hand, a heightening of tensions could exacerbate natural gas and nitrogen flow from Western Europe, thereby raising prices.

Other events around the world could also impact nitrogen prices. For example, China is a significant nitrogen exporter (see farmdoc daily, April 26, 2022), and recession or geopolitical events could impact trade flows from China.

Supply Issues in the U.S. Supply issues could impact nitrogen fertilizer prices. The majority of U.S. nitrogen fertilizers are produced in the lower Mississippi Delta. Weather events there could disrupt production, although the seasonal hurricane season has ended. Natural gas production also could be disrupted because of weather or other supply issues. Transportation issues could be a concern as well.

Risk Management Strategies

In this volatile environment, the following strategies will aid in risk management.

- Reduce rates to university recommended levels. Those recommendations are given on the Corn Nitrogen Tool for Midwest states. For 2023 expected prices, these recommendations are 159 pounds per acre for northern Illinois, 168 pounds per acre for central Illinois, and 187 pounds for Southern Illinois (farmdoc daily, October 11, 2022).

- Price nitrogen fertilizers multiple times during the year, with one pricing point in the fall and one in the spring. Pricing nitrogen at multiple points will reduce the risk of pricing all nitrogen at its highest point and will result in an average price for the farm nearer the average for the season.

- Wait to apply some of the nitrogen post-planting. Waiting to apply allows decisions to be made when corn prospects have a clearer focus.

- Price grain as fertilizers are purchased. One of the greatest risks when purchasing high-priced fertilizer is the risk that corn prices fall before the crop is marketed. Marketing a portion of the crop with fertilizer purchases can mitigate this risk.

Summary

Continued volatile prices should be expected. A recent webinar dealt with nitrogen fertilizer decisions in 2023 provides more detail than given here.

Source : illinois.edu