By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Gary Schnitkey, Krista Swanson, Jonathan Coppess, and Ryan Batts

Department of Agricultural and Consumer Economics

University of Illinois

Prevent plant corn and soybean acres may be a record in 2019 (Irwin and Hobbs, May 9, 2019). Prevent plant is an insurance product. It is also a conditional land diversion program. The condition is that an insured cause of loss, such as wet weather, delays planting until the final insurance plant date set by USDA, RMA (US Department of Agriculture, Risk Management Agency). After the final planting data has arrive, a farmer opting for prevent plant diverts land from production. This article examines prevent plant as a land diversion program and policy issues that arise from this perspective.

Prevent Plant as Land Diversion

Once an insured cause of loss delays planting until the final insurance plant date, prevent plant creates a farm management decision: “On insured acres, do I plant the crop or not plant and take prevent plant?” A key input to this decision is the relative return of prevent plant vs. late plant. Return to prevent plant equals prevent plant payment minus incurred costs minus farm-paid crop insurance premium. Prevent plant payment equals a farm’s APH (Average Production History) insurance yield times the farm’s elected insurance coverage level times the crop’s projected insurance price times the prevent plant coverage factor. Return to late plant equals expected price times expected yield minus production cost plus expected net insurance payment. The latter includes a decline in insurance guarantee at the rate of 1% per day after the final insurance plant date until the insurance late plant period ends, at which time the insurance guarantee becomes a floor equal to 60% of a farm’s original, timely-planted insurance guarantee. The only insurance program variables unique to the prevent plant decision are the prevent plant coverage factor and the decline in insured guarantee. For more discussion of this decision, see Swanson and others (June 4, 2019) and articles cited therein.

Prevent Plant Coverage Factor

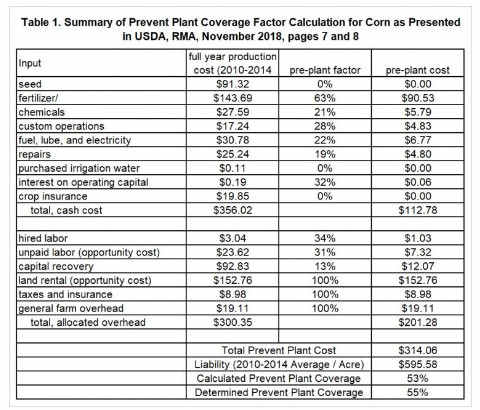

“Coverage for prevented planting is designed to cover the entirety of normal costs associated with preparing the land up to the point of the seed going into the ground.” (USDA, RMA, November 2018, page 2). In determining a crop’s prevent plant coverage factor, RMA assigns each cost category a share incurred before planting based on a review of commonly-accepted practice, consulting reports (most recently, Agralytica Consulting), and comments received during the regulatory process. The sum of pre-panting costs, which for a cost category equals its total cost times its pre-plant share, is expressed as a ratio to insured liability. As an example, Table 1 contains the data and calculations RMA used to establish the current 55% prevent plant coverage factor for corn, as presented in its November 2018 document. Total category cost comes from USDA, ERS (Economic Research Service) cost of production data for available crops and from state extension budgets and other sources for other crops.

A prominent pre-plant expense for most crops, including corn, is land. Its share is as high as 75% (potatoes) and exceeds 33% for all crops in Figure 1 except tobacco (12%) and peanuts (29%). Land’s prominence reflects its importance as a cost and that 100% is a pre-plant expense.

Examining the Prevent Plant Decision

The prevent plant coverage factor and the components used to derive it are the same for all individual farm insurance contracts for a given crop. In contrast, insured liability varies across farms with its elected insurance coverage level and APH yield. Costs also vary across farms, as Agralytica Consulting notes (pages 18 and 19). Land cost in particular varies. Cash rents in a given area can vary by over $100 per acre, even for similar quality land (for example, see Ward, August 13, 2018); and farmers self-assign value to owned cropland. Moreover, timing of inputs vary. For most crops, herbicides can be applied pre- or post-plant. For many crops, notably corn, nitrogen; can be applied pre- or post-plant.

Existence of distributions on variables treated as the same means that, once the final insurance plant date is reached, even among farms which qualify for prevent plant, some farms have a higher return to prevent plant than other farms, thus altering the willingness to plant differentially. While few in number, studies consistently find evidence for what Kim and Kim (2018) call ex post moral hazard. Availability of prevent plant causes some farms with delayed planting to alter their intension to plant. Specific factors found to be related to a change in decision include share tenancy and ownership structure (Rejesus, Escalante, and Lovell, 2005), insurance coverage level (Kim and Kim, 2018, Boyer and Smith, 2019), expected price and yield (Kim and Kim, 2018), and prevent plant coverage factor and lower yield expected from late planting, especially for corn (Boyer and Smith, 2019). Swanson and others (June 4) find the 2019 prevent plant decision will likely vary with insurance coverage level, APH yield, and cost incurred prior to planting. To summarize, while the prevent plant decision depends on a conditioning factor, such as wet weather; other factors are also important.

Given the preceding discussion, it is not surprising that, despite highly profitable corn and soybean production, share of corn and soybean prevent plant acres did not decline during 2009-2013 except for 2012, a year of exceptionally fast planting (see Figure 2 and the data note). Since farmers are considered rational economic managers, a reasonable interpretation is that some farmers with delayed planting found prevent plant to be more profitable even in these highly profitable years. This observation prompts two important, interrelated policy questions: “Does prevent plant provide too much incentive to divert land?” and thus, “Did prevent plant exacerbate the high prices of 2009-2013?”

Impact of Land Diversion

Land diversion hurts crop input suppliers by reducing input use; hurts US consumers, especially the poor, livestock producers, biofuel refiners, and other domestic users of crops by reducing supply and raising prices; and encourages production by US export competitors. This argument led Congress to eliminate annual land diversion tied to US commodity programs in the 1996 farm bill (Orden, Paarlberg, and Roe, 1999); Coppess, 2018). Land diverted under prevent plant can exacerbate these negative impacts because it diverts land when more acres are likely needed to offset the lower yields that often accompany late planting.

Policy Issue – Incentivizing Planting

The negative impacts of lost production from prevent plant acres imply the need to examine policy options that incentivize production over prevent plant. Reinforcing this need is the largeness of the prevent plant payment. For example, given 85% insurance coverage and corn’s 55% prevent plant coverage factor, the resulting prevent plant payment equates to a yield loss of 53% (1-(0.85 times 0.55)).

One policy option is to offer prevent plant as a separate, elected insurance option with its own premium, similar to HPO (Harvest Price Option). This option increases the transparency of prevent plant, both as public policy and for farm’s making insurance decisions. Transparency is important in part because the USDA, Office of Inspector General report (September 2013) concluded prevent plant payments exceeded the losses of those who claimed prevent plant.

A second policy option is to allow farms to elect the share of pre-plant costs they wish to insure, say at 5 percentage point intervals; and vary premium accordingly. This option is similar to the way insurance coverage level is treated.

A third policy option is to vary the prevent plant coverage factor by features associated with the prevent plant decision. For example, it could differ by whether fertilizer and pesticides are applied pre- or post-planting or by ownership structure, as proposed by Rejesus, Escalante, and Lovell (2005). Ease of accurate verification is an important consideration in implementing this option.

A fourth policy option is to more equitably treat insurance yield for prevent plant and late plant. Currently, no insurance yield is assigned for a year in which prevent plant is chosen. In contrast, yield of a crop planted after the final insurance plant date has a higher likelihood of being lower than normal. RMA recognizes this decline by reducing the insured guarantee during the late plant period. The 2013 USDA Inspector General’s report questioned this differential treatment. As noted in the report, RMA’s position is that Congress has not given it authority to assign yield when no crop is planted. Congress could give RMA this authority. Alternatively, no yield could be added to the APH yield record when planting occurs after the final plant date. This would reduce the incentive to take prevent plant in order to avoid a reduction in APH yield. Other alternatives are to create a formula for prevent plant yield that differs from the APH formula, and to moderate, even eliminate, the decline in insured guarantee during the late plant period. To limit the cost of the last alternative, insurance payment for a late planted crop could be capped at the payment for prevent plant.

Prevent Plant and the Environment

Land is diverted from production by both CRP (Conservation Reserve Program) and ACEP (Agricultural Conservation Easement Program). Both programs have environmental objectives. Prevent plant has no environmental objective. Prevent plant does require that weeds be controlled. Cover crops can perform this task. Moreover, a variety of potential environmental benefits from cover crops have been identified (see Schnitkey and others, June 25, 2019). Disagreement exists if these benefits exceed the cost of establishing cover crops. This situation falls within the well-established public policy category of subsidizing private market behavior to attain broader societal goals. Boyer and Smith (2019) discuss requiring cover crops for prevent plant acres, noting environmental benefits and the potential to reduce moral hazard by making prevent plant a more costly option. The latter occurs if cover crops are a more expensive weed control method.

Summary Observations

- Prevent plant creates a farm management decision once planting is delayed by an insured cause of loss until the final insurance plant date: “On insured acres, do I take prevent plant and divert land from planting?” A key input in this decision is relative return of prevent plant vs. planting.

- Insurance program parameters unique to the prevent plant decision are the prevent plant coverage ratio and the schedule of decline in insured guarantee after the final insurance plant date.

- Primary input RMA uses to determine the prevent plant coverage ratio is the ratio of average US cost of production incurred before planting the crop to the crop’s average insured liability.

- Insured liability and pre-plant cost vary across farms. Land cost in particular vary, and pesticides and fertilizers can be applied pre- or post-plant.

- Farms with lower-than-average pre-plant cost or higher-than-average insured liability are more likely to take prevent plant among farms with delayed planting.

- Thus, among farms impacted by a prevent plant conditioning factor, such as wet weather; some will opt for prevent plant while others will opt to plant the crop late.

- Understanding the different responses of farmers is important because the prevent plant decision impacts others. By diverting land, prevent plant reduces supply and increases price, which negatively impacts consumers, input suppliers, farm output processors, and US exporters.

- Potential size of prevent plant acres in 2019 underscores the importance of the broad policy issue that emerges from the previous point: “Does prevent plant provide too much incentive to divert land?”

- If society decides to temper land diversion by prevent plant, potential policy options are to:

- offer prevent plant as an elected option with its own premium, similar to the Harvest Price Option; to improve program transparency;

- allow farms to elect the share of cost they wish to insure under prevent plant and vary premium with this share, just as premium varies with the farm’s elected insurance coverage level;

- vary the prevent plant coverage ratio by easy-to-verify features that impact prevent plant; and

- treat insurance yield and guarantee for prevent plant and late plant more equitably.

- Requiring cover crops on prevent plant would control weeds, which is currently required; temper land diversion if it increases weed control cost; and provide other environmental benefits.

Data Note

2012 is the only year since 2007 (first year of available USDA, Farm Service Agency data) that USDA stopped reporting planting progress by May 20th for corn and June 10th for soybeans, signaling planting was considered complete.