Producers can expect to see higher premiums for the 2022 crop year. These increases to premium costs are mainly due to higher commodity prices as a number of forces, including low yields in 2021, have pushed commodity prices higher.

“In 2021, AFSC programs supported producers who faced the challenges of extreme dry conditions and prolonged heat. This year, we’re seeing the consequences of that challenging year,” said CEO Darryl Kay.

“The investment producers will have in the ground this year will be higher than ever, due to rising input costs and the expected value of the crop. This means producers are insuring a more valuable crop this spring and will have higher coverage as a result.

“Total AgriInsurance coverage for 2022 is expected to exceed $8.1 billion on 16.2 million annual acres. That means the average coverage is estimated at $501/acre, up significantly from $365 in 2021.

“This substantial increase in coverage reflects the expectation of continued strength in commodity prices into the 2022 crop year,” Kay shared.

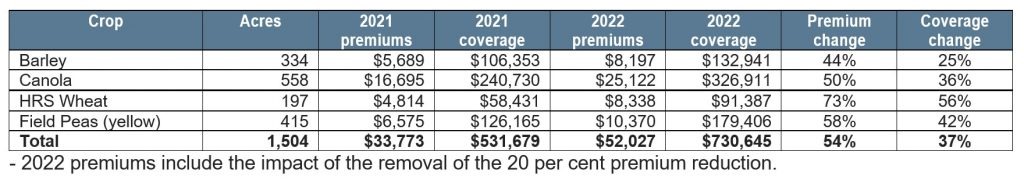

For 2022, AgriInsurance spring insurance prices for annual crops (dollar coverage) will increase by an average of 37 per cent, while pasture and hay crops will increase by approximately 15 per cent, also increasing premium costs. Producers’ coverage levels will increase by the same percentage.

For example, an average 1,500-acre Alberta farm growing a mixture of crops will see increased premium costs of approximately 54 per cent for annual insurance and Hail Endorsement, the majority of which is from increased coverage. The average farm that insures pasture acres under the Moisture Deficiency Insurance (MDI) program will see premium costs increase by $834 or 27 per cent.

However, while producers will be paying more for their insurance due to increased coverage caused by high commodity prices, the cost to insure has not risen as dramatically.

Annual and perennial premium rates will increase by an average of 10 per cent. With Hail Endorsement, although premium rates have decreased, clients will see an overall premiums increase by 11 per cent due to removal of last year’s Alberta Premium Reduction discount.

“This is the first year premium rates for annual insurance will see such a widespread increase, reversing a downward trend in average premium rates,” said Kay.

Major weather events of 2021 and record claim payments, the highest in AFSC’s history, have resulted in a significant decrease in the fund reserve, contributing to the cancellation of the 2021 premium discount and the increase to premiums for 2022.

Source : afsc.ca