By Gary Schnitkey and Krista Swanson

Department of Agricultural and Consumer Economics

University of Illinois

Illinois crop budgets for 2020 have been revised with lower corn and soybean prices: $3.30 for corn and $8.30 for soybeans. Given trend yields, these prices will result in negative returns. At this point, projected corn returns are lower than projected soybean returns, bringing into question previously planned shifts in acres from soybeans to corn in Illinois. Returns could be better than currently projected in 2020 budgets because of a combination of 1) higher yields, 2) higher prices, or 3) government aid similar to the last two years of Market Facilitation Program (MFP) payments. The $3.30 corn price and $8.30 soybean price are based on current cash bids for the 2020 crop and are not necessarily the worst-case scenario for returns in 2020.

2020 Budgets for High-Productivity Farmland in Central Illinois

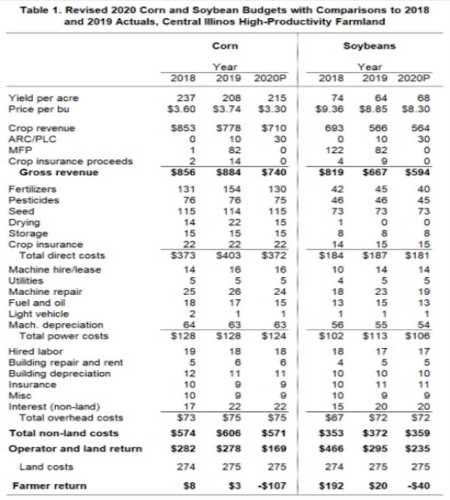

Table 1 shows 2020 budgets for high-productivity central Illinois farmland, along with actual results from 2018 and 2019. Actual results are summarized from farms enrolled in Illinois Farm Business Farm Management (FBFM). Budgets also have been prepared for northern Illinois, lower-productivity farmland in central Illinois, and southern Illinois. These 2020 budgets, along with actual results for 2018 and 2019, are available in the management section of farmdoc: https://farmdoc.illinois.edu/management#handbook-crop-budgets.

Several items to note about 2020 budgets:

- Projected 2020 yields are 215 bushels per acre for corn and 68 bushels per acre for soybeans. These are trend yields, above the actual yields for 2019. The trend yields projected for 2020 are below the actual yields for 2016 through 2018. In 2018, for example, corn yield was 237 bushels per acre, 22 bushels per acre higher than the projected 2020 trend yield. Similarly, soybean yield was 74 bushels per acre in 2019, 6 bushels per acre higher than the projected 2020 trend yield.

- Projected 2020 corn prices are $3.30 per bushel for corn and $8.30 per bushel for soybeans. These are very low prices but are representative of current bids for fall delivery. Hopefully, prices will rebound, but there is no guarantee that higher prices will occur during the 2020 marketing year.

- The 2020 budgets include $30 per acre in ARC/PLC payments. These are estimates for payments associated with the 2020 production year, which will be received in October 2021. Prices in budgets would trigger Price Loss Coverage (PLC) payments for corn. Small PLC payments would occur on soybeans at an $8.30 price; however, most farmers likely took Agricultural Risk Coverage at the county level (ARC-CO) for soybeans. ARC-CO would not generate a 2020 payment on soybeans at an $8.30 price without a soybean yield shortfall. The $30 payment is composed of roughly $60 payments on base acres in corn and a very low payment on base acres in soybeans. The same $30 payment is used for both corn and soybeans budgets because payments are made on base acres. Therefore, planting decisions do not impact payments from the PLC and ARC-CO programs. Note that this will vary by farm to farm depending on how base acres of a given farm are allocated by crop. Also, note that ARC at the individual coverage (ARC-IC) plantings will have impacts on commodity title payments. Implications of this fact will be discussed in future articles.

- There are no MFP payments included in the 2020 budgets. In both 2018 and 2019, MFPs were significant sources of revenue. Without MFPs in 2019, both corn and soybean returns would have been negative.

- Crop insurance payments are not included for 2020. At current price levels, crop insurance payments would not be triggered without yield declines.

- Costs are projected lower in 2020. Declines are projected to occur for energy-related costs: fertilizer, drying, fuel and oil.

- Land costs are projected the same in 2020 as in 2019: $275 per acre. This represents the average cash rent for high-productivity farmland in central Illinois.

The projections result in extremely low returns for 2020. Serious cash flow shortages would result at these projected prices, yields, and expenses, even for farmland rented at the average cash rent level.

Scenarios for higher returns

Several scenarios could result in higher returns than those projected in Table 1. Farmer return for corn is projected at -$107 per acre. Scenarios that would increase returns are:

- Higher yields. A corn yield of 230 bushels per acre would result in a -$57 per acre farmer return, $50 per acre higher than the -$107 shown in Table 1. A 230 bushel per acre yield would be consistent with the above-trend yields experienced from 2016 to 2018.

- MFP payment. An $82 per acre MFP payment — the same as in 2019 — would increase corn returns to -$25 per acre.

- Increase in corn price. A $3.50 corn price would increase returns to -$64 per acre, up by $43 per acre from the returns projected with the $3.30 price. Note, however, that an increase in corn price would likely reduce or eliminate the ARC/PLC payment depending on the resulting marketing year average price.

For corn, none of these scenarios results in break-even returns individually. A combination of two or more of the above three reactions is likely needed to achieve positive returns with corn in 2020.

Farmer return for soybeans is projected at -$40 per acre. Scenarios that would increase returns are:

- Higher yields. A soybean yield of 74 bushels per acre would result in a $10 per acre farmer return, $50 per acre higher than the -$40 shown in Table 1. A 72 bushel per acre yield would be consistent with the above-trend yields experienced from 2016 to 2018.

- MFP payment. An $82 per acre MFP payment — the same as in 2019 — would increase soybean returns to $40 per acre.

- Increase in soybean price. An $8.60 corn price would increase the return to -$19 per acre, up by $59 per acre from the returns projected with the $8.30 price.

It appears there are more scenarios and a greater likelihood for positive returns of soybeans than corn.

Scenarios for lower returns

The scenarios presented in Table 1 are not intended to represent a worst-case scenario, but rather show budget projections if current fall cash bids were to remain throughout the 2020 marketing year. The scenario of a $3.00 corn price and $8.00 soybean price were examined using budgets in Table 1. In these scenarios, all costs were held the same. The ARC/PLC payment was raised to $50 per acre for both corn and soybeans.

A $3.00 corn price results in a -$151 per acre return for corn. An $8.00 soybean price results in a -$40 per acre (lower revenue from soybeans is offset by higher ARC/PLC payments).

Commentary

Projected returns for 2020 using current fall delivery prices are very low and would result in serious erosions of farm financial positions. Several factors could combine to change outlook, including higher prices, higher yields, and MFP-like payments or another form of government aid in 2020.

At this point in April, the outlook for 2020 is worse than at the same point in time in recent years. Prices declined in 2018 as a result of trade disputes. The continued trade disputes and weather led to price fluctuations throughout 2019. MFP payments greatly aided in farm returns in both 2018 and 2019. Now, COVID-19 has worsened outlook for 2020 from the already depressed prices due to ongoing trade disputes and weakened Chinese demand because of African Swine Fever. The COVID-19 pandemic suggests prospects of economic slowdown, reductions in fue and ethanol demand, and continued cloudy export demand. At this given time, it seems prudent to plan on a prolonged impact resulting in already weak prices from 2018 and 2019 to be lowered further in 2020.

Budgets shown here bring into question the possibility of shifting acres from soybeans to corn in Illinois. In the March 31st Prospective Plantings report, the National Agricultural Statistics Service estimated an overall increase in crop acres, with corn and soybeans each expected to increase by 8% from 2019. For corn, that would amount to the second-largest corn acres on record. Actual planted acres and production will influence corn supply. What will happen to corn supplies is an open question (see farmdoc daily, April 6, 2020).

Just a month ago, prices indicated corn would be slightly more profitable than soybeans (see farmdoc daily, March 10, 2020). However, the extreme changes in our national economy over the past month have had a relatively larger negative impact on corn prices than soybean prices. Now, farmers may want to consider the more likely scenarios for higher returns for soybeans than for corn. Another important consideration is that soybeans cost less to grow as compared to corn, which may help ease current cash flow restraints. But also weighing into the decision for acreage shifts between crops with planting season already underway will be inputs already applied for a specific crop.

Source : illinois.edu