By Daniel Munch

Key Takeaways

- Safety-net gaps remain for specialty crops: Specialty crops generate more than $75 billion in annual farm-gate value, over one-third of U.S. crop sales, yet these farmers have access to fewer risk-management and commodity safety-net tools than other sectors.

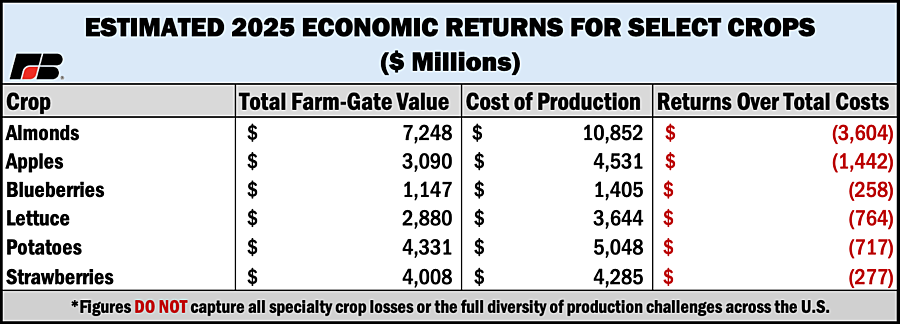

- Costs have risen faster than prices across diverse crops: Case studies covering almonds, apples, blueberries, lettuce, potatoes and strawberries show labor, input, compliance and capital costs climbing sharply, while farm-gate prices are not keeping pace with the costs.

- Losses are widespread: These six crops alone account for roughly one-quarter of total specialty crop receipts and collectively reflect billions of dollars in 2025 economic losses, indicating that sector-wide hardship extends well beyond the crops analyzed.

- Trade, labor and weather pressures compound financial stress: Ongoing trade uncertainty, rising labor costs, disease and pest pressures and increasing weather volatility have tightened margins across regions and marketing channels, leaving many growers unable to recover full economic costs.

- Recent aid leaves gaps: Specialty crop farmers do not qualify for the $11 billion Farmer Bridge Assistance Program, and while USDA has announced $1 billion in additional support for other crops, the funding falls far short of documented economic need.

For specialty crop farmers, 2025 has offered little relief from mounting financial pressures. Markets that once delivered stable margins are now marked by volatility, while production expenses continue to rise faster than prices. Trade uncertainty further threatens already-thin farm-gate revenues. Despite generating more than $75 billion in annual farm-gate value – over one-third of all U.S. crop sales – specialty crop producers operate with far fewer risk-management and safety-net tools than other farmers. The result is a widening cost-to-revenue gap that is placing broad swaths of the specialty crop economy under severe financial strain.

Specialty crops encompass more than 350 commodities across 220,000 farms, accounting for roughly one-fifth of U.S. agricultural cash receipts. Yet the diversity that makes the sector so economically important also heightens its vulnerability. Each crop carries unique production systems, marketing channels, labor needs and biological risks. These differences have made it historically challenging to design an effective safety net and also complicates access to reliable economic data. Unlike other commodities such as row crops, milk, cattle or hogs, many specialty crop producers lack consistent, up-to-date, publicly reported cost-of-production and farm-gate price data. For many crops, USDA does not publish average prices until well after the year ends, if at all, and even then, prices often represent only a subset of the market, such as fresh or processed.

This lack of consistent data should not be mistaken for a lack of hardship. One part of U.S. agriculture benefits from publicly supported, frequently updated market information; the other does not. That gap makes it significantly harder to quickly and credibly quantify the economic losses specialty crop farmers are absorbing.

To illustrate the scale of need, this analysis examines six representative crops: almonds, apples, blueberries, lettuce, potatoes and strawberries. These crops were selected because they are among the few specialty commodities with enough available data to conduct analysis, while collectively reflecting the diversity of production systems, regions and marketing channels that define the broader sector. Together, they account for roughly one-quarter of total specialty crop receipts, meaning the true sector-wide losses are significantly larger than what these case studies alone capture. Yet the pressures outlined here (high labor and input costs, tightening margins, weather and disease challenges and ongoing trade instability) are shared across nearly the entire specialty crop sector.

These growers will not benefit from the $11 billion in the Farmer Bridge Assistance Program, leaving substantial unmet need among the commodities examined here and beyond. USDA also announced a welcomed $1 billion specialty crop growers expect to be eligible for, but details and timing remain unknown, and the scale of funding falls well short of the sector’s outstanding economic need.

Any cost-of-production studies used in this report that predate 2020 have been indexed to 2025 dollars. Importantly, this adjustment remains conservative, as many input categories have increased at rates exceeding general inflation.

Click here to see more...