By Nick Paulson and Gary Schnitkey et.al

Department of Agricultural and Consumer Economics

University of Illinois

By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

The Enhanced Coverage Option (ECO) is a new supplemental insurance program that will be available in 2021. ECO is an option that can only be added to an underlying individual plan of insurance and provides area-based coverage similar to the Supplemental Coverage Option (SCO). This article outlines ECO and provides some coverage examples.

Overview of ECO

ECO will be available for purchase on 31 spring-planted crops including corn, soybeans, and wheat (RMA 2020a and 2020b). ECO is purchased as an endorsement to an eligible individual insurance plan such as Revenue Protection (RP), Revenue Protection with the Harvest Price Exclusion (RP-HPE), or Yield Protection (YP). It cannot be used with an underlying area plan of insurance (i.e. Area Risk Protection Insurance (APRI) or Margin Protection). ECO mimics coverage type of the underlying product. For example, ECO provides county yield coverage when purchased with YP and county revenue coverage when purchased with RP or RP-HPE.

ECO operates in a similar manner to SCO. ECO can be purchased at either a 95% or 90% coverage level. Coverage extends from the selected level down to 86%, the point where SCO begins to offer coverage. SCO will provide coverage from 86% to the coverage level of the underlying RP, RP-HPE, or YP policy. Producers do not have to purchase both. A producer could purchase ECO and not SCO, and vice versa. In contrast to SCO, individuals are eligible to purchase ECO regardless of the farm commodity program (ARC/PLC) in place for the insured acres. SCO can be only be purchased on acres on which PLC is chosen.

Producers will be required to pay a premium for ECO coverage. ECO premiums will be subsidized at a rate of 44 percent when combined with revenue coverage and 51 percent when combined with yield coverage. Note that both subsidy rates are below the 65 percent rate for SCO premiums, and lower than the subsidy rates for individual products using enterprise units.

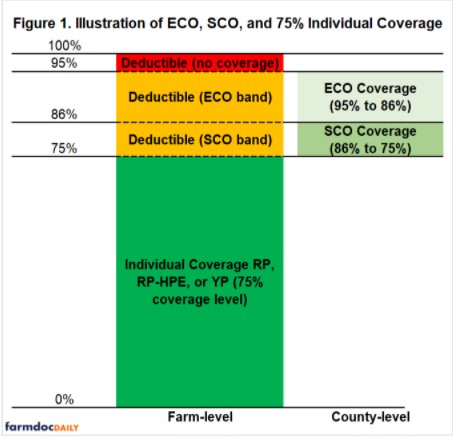

Conceptually, ECO is intended to offer producers an option to purchase additional coverage for a portion of their insurance deductible as shown in figure 1. However, since ECO uses a county-based trigger, ECO could result in indemnities being paid when individual losses are not realized. Similarly, individual losses could be triggered without leading to an ECO indemnity payment. Choosing 90% ECO covers 4% of the insurance deductible, while 95% ECO covers 9% of deductible value. SCO can then also be used for county-based coverage from 86% down to the coverage level of the individual plan elected.

In Figure 1, this is illustrated for a 75% individual plan with both SCO and 95% ECO. The ECO and SCO policies provide combined coverage for county-level losses from 95% down to 75%, and the individual plan covers farm-level losses starting at the 75% guarantee. While this combination could be viewed as providing a continuous band of coverage up to 95% of expected revenue or yield, there is basis risk introduced by using the county-based triggers for ECO and SCO. The losses covered by the ECO and SCO programs are not the same as those covered by the individual plan of insurance.

ECO Coverage with Examples

ECO triggers payments when county average revenue (yield) falls below 90% or 95% of expected county revenue (yield). Expected revenues (yields) at the county level are defined the same way as other existing area-based products. The 90% or 95% coverage level is elected by the producer. ECO coverage extends from the elected coverage level down to 86% of expected revenue or yield for the county.

Payments are then based on the individual’s insurance liability. The county loss, measured in percentage points, up to a maximum of 9%, is multiplied by the individual’s expected insured value per acre to calculate the ECO indemnity payment.

SCO payments operate in the same way, with coverage beginning at 86% and ending at the coverage level elected by the farmer for their individual plan of insurance.

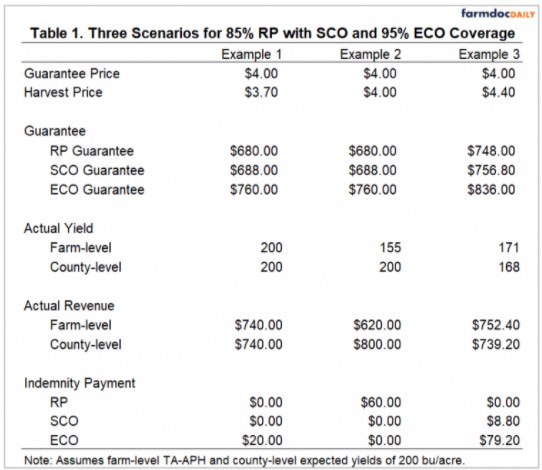

Consider a corn farmer with a trend adjusted APH yield of 200 bushels per acre. For simplicity, we will also use an expected yield for the county of 200 bushels per acre. The projected price used to set insurance guarantees is $4 per bushel. An 85% RP policy would provide a minimum revenue guarantee of $680 per acre (85% coverage level x $4 projected price x 200 APH yield), with the guarantee increasing if the harvest price is greater than $4 per bushel. If 95% ECO coverage was also elected, ECO indemnities would be triggered if county revenue fell below $760 per acre (0.95 x $4/bu x 200 bu/acre), and SCO indemnities would be triggered if county revenue fell below $688 per acre (0.86 x $4/bu x 200 bu/acre). Note that the county revenues at which ECO and SCO indemnities are triggered could also increase if the harvest price exceeds the projected price of $4 per bushel.

Table 1 outlines three different examples for the combination of 85% RP, SCO, and 95% ECO. In example 1, the harvest price is $3.70 and actual yields at both the farm and county levels are as expected at 200 bushels per acre. Actual farm-level revenue is $740 per acre ($3.70 x 200), and losses are not sufficient to trigger an RP payment.

Actual county-level revenue is also $740 per acre, or $20 below the $760 trigger for 95% ECO coverage. The $20 county-level loss is 2.5% of the $800 expected county revenue. This percentage loss is multiplied by farm-level expected revenue, which is also $800, resulting in a $20 ECO payment. Actual county-level revenue exceeds the SCO guarantee, so no SCO payment is triggered.

Example 2 represents a scenario where a farm might experience localized yield losses, but average yields for the county, and harvest prices, are as expected. The actual farm-level yield of 155 bushels per acre results in actual revenue of $620 per acre ($4 x 155), resulting in an RP payment of $60 per acre ($680 – $620). No ECO or SCO payments are triggered since no revenue losses are realized at the county level.

Example 3 is a scenario of low yields for the farm and county along with a higher than expected harvest price. The $4.40 harvest price increases the expected revenue and guarantees for the RP, SCO, and ECO policies. Expected revenue is now $880 per acre ($4.40 x 200 bushels per acre). The revenue guarantee for the RP policy is now $748 per acre (0.85 x $880). The ECO policy now triggers payments if county revenues fall below $836 per acre (0.95 x $880), and the SCO policy triggers payments if county revenues fall below $756.80 per acre (0.86 x $880).

The 171 bushel per acre farm-level yield implies actual farm revenue of $752.40 per acre, exceeding the $748 guarantee and resulting in no RP payment. In this example, RP payments would begin to be triggered if actual farm yield was below 170 bushels per acre.

The county yield of 168 bushels per acre implies actual county revenue of $739.20, or a total loss of $96.80 ($836 – $739.20). The $96.80 loss is 11% of expected county revenue ($96.80/$880 = 11%), which exceeds the 9% cap for the ECO coverage and the additional 1% cap on the SCO coverage. Therefore, the maximum ECO indemnity of $79.20 per acre (9% x $880) is paid, and the maximum SCO indemnity of $8.80 (1% x $880) is also triggered. ECO and SCO provide a total of $88 to offset the county-based loss of $96.80.

In each of the examples above, the farmer would have paid separate premiums for each policy – RP, SCO, and ECO. The calculated indemnity payments represent only that amount and do not account for premiums paid.

Summary

The Enhanced Coverage Option (ECO) is a new crop insurance product that will be rolled out to a wide range of spring-planted crops for the 2021 crop year. ECO allows producers to further supplement the coverage offered by their underlying individual plan of insurance. Like SCO, ECO coverage mimics the underlying individual plan and payments are made based on county-level triggers. While SCO provides coverage across a band of 86% down to the underlying plan of insurance, ECO provides coverage from either 90% or 95% down to 86% of expected county revenue or yield.

To be eligible for ECO and SCO coverage, producers must purchase an individual plan of insurance (RP, RP-HPE, YP). They cannot be used with other types of area coverage (ARPI, MP, etc.). While SCO use is limited to acreage enrolled in the PLC program, ECO can be used on acres enrolled in both PLC and ARC.

ECO premiums will be subsidized at a rate of 51% if used with individual yield coverage or 44% if used with individual revenue coverage. Both rates are below the 65% subsidy rate for SCO and the subsidy rates for underlying individual plans for enterprise units at all available coverage levels.

Individual revenue plans at high coverage levels have been established as the most popular types of coverage with producers, with much less interest in use of area-based plans (November 17, 2020). Both ECO and SCO are designed to provide additional area-based coverage of an individual plan’s deductible. Historical experience with SCO suggests somewhat limited interest in such coverage, with overall participation declining from 2014 through 2018 and then increasing in 2019 (January 31, 2020). Compared with SCO, ECO offers even higher coverage options to cover a wider band of the deductible value, and use is not limited by farm program choice. While ECO will give producers more options and flexibility for yield and revenue coverage, it remains to be seen what the level of participation might be as the new program is rolled out.

Source : illinois.edu