“Plant Milk is healthier than dairy milk.”

“It’s just not true,” said Kathleen Merrigan, professor of sustainable food systems at Arizona State University and a deputy secretary of agriculture under President Barack Obama, in the article. But indeed, the myth persists, despite how plant-based beverages have much-lower protein, numerous additives of dubious value, and a lack of uniform quality that should give anyone pause.

It’s also not shocking the misinformation continues. Money talks, and the plant-based sector is well-funded, with plenty of media allies and a ready-made base of support in a vegan community that insists a diet that’s impossibly difficult to follow and prone to malnourishment should be adopted by everyone. It also comes down to the names of the products themselves. If (whatever substance of the moment) is put in front of the word “milk,” then a false impression of nutritional equivalence, if not superiority, is easy to create. If that weren’t the intention, the plant-based beverage peddlers wouldn’t be doing it.

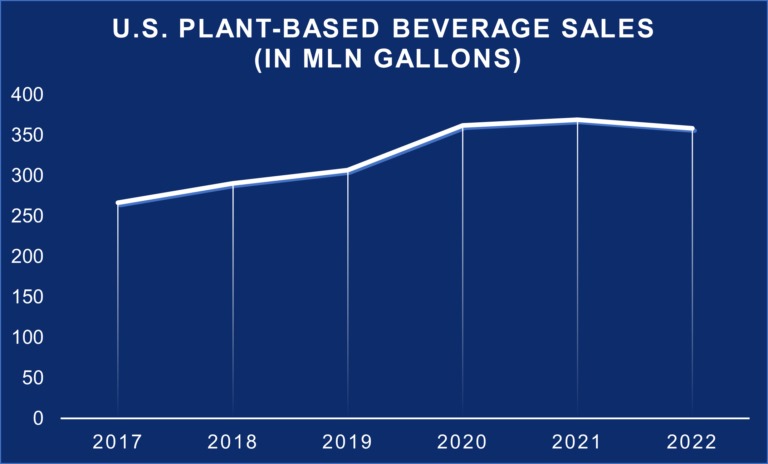

The good news is, nutrition experts are seeing through it – hence endorsement of integrity in dairy labeling from the American Academy of Pediatrics and others. And consumers are seeing through it, which is why we’re seeing data like this, in which after years of gains, the plant-based tide is starting to recede.

But we still have the problem of the federal government — specifically the U.S. Food and Drug Administration — which often lags behind science and citizens.

Click here to see more...