By Yu-Chi Wang and Joe Janzen

Soybean oil and palm oil are the two most widely available vegetable oils in the world and are substitutes in many products, including as feedstocks in the production of biofuels. For many years, soybean oil and palm oil prices moved together, but since 2020, the close co-movement between soybean oil and palm oil prices has weakened. Prices now diverge more often and for longer periods. This change suggests that the types of supply and demand shocks hitting these markets has shifted. We suggest these shocks are becoming less global and more regional or national; aggregate vegetable oil supply and demand still matter, but these now interact with region-specific disruptions, particularly those related to biofuels policy, that affect one oil more than the other.

The goal of this article is to document how the price relationship between soybean oil and palm oil has changed and what this change means for future price dynamics. We first describe the global roles of soybean and palm oils and the different production systems behind them. We use monthly and daily prices to show how their historical co-movement has broken down since 2020. We then draw on several recent market episodes to explain soybean-palm price divergences and end with implications for U.S. soybean oil and future biofuel policy.

Overview of Global Vegetable Oil Production

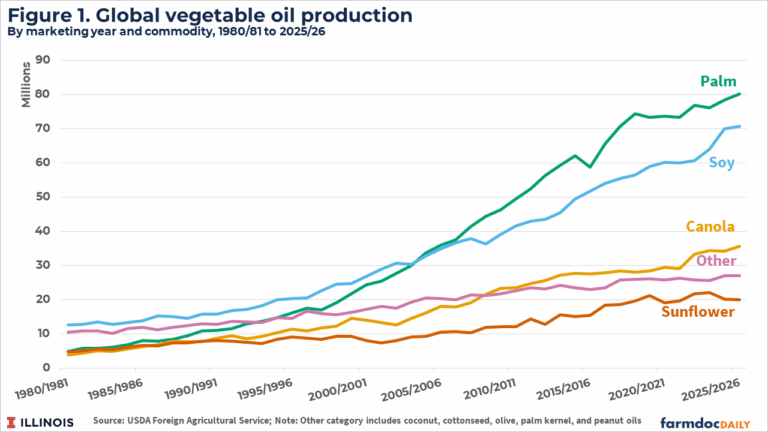

Soybean oil and palm oil are the two leading vegetable oils in the world, a position they have held since the 1980s when palm oil surpassed production of canola and sunflower oils. Figure 1 plots changes in the production of leading vegetable oils over time. Soybean oil was long the world’s largest vegetable oil, but global production of palm oil began to exceed soybean oil beginning in the 2004/2005 marketing year. Together, they account for more than 60s% of global edible oil supply. Other vegetable oils such as canola, sunflower, and others play an important but mainly supporting role in meeting global demand.

The location of soybean and palm production and the process for extracting oil are important differences between the two commodities. Palm oil production is heavily concentrated in Indonesia and Malaysia, where output expanded rapidly in the 2000s. Palm oil refining, logistics, and trade are strongly geographically clustered. Soybean oil production is less concentrated than palm oil but focused in large agricultural exporting countries such as the United States, Brazil, and Argentina and major soybean importers, principally China. Major exporting nations typically have varying forms of biofuels mandates that incentivize domestic demand for soybean or palm oil as a feedstock and these mandates typically target domestically produced feedstock. Structural differences in location and policy may help explain why the two oil markets may not always respond in the same way to changes in demand.

Historical Price Relationships

To the extent that vegetable oils are substitutable and trade costs like transportation, tariffs, and others are low, soybean and palm prices should move closely together. To document this connection over a long time period, we analyze monthly benchmark prices tracked by the World Bank’s so-called ‘Pink Sheets’. These prices represent vegetable oils delivered to ports in Northwest Europe so they account for location differences. Figure 2 shows historic prices for both soybean and palm oil since 2000. While soybean oil has typically been valued at a slight premium to palm oil, prices have typically moved closely together over this period. Increases in prices correspond to increases in the other. Episodes like the 2008 price spike that affected many agricultural and energy prices are common to both series and the gap between prices has remained fairly stable over time. Despite substantial changes in price levels, the difference or ratio between soybean and palm oil prices was generally stable, at least until about the year 2020.

Source : illinois.edu