Overview

Corn and wheat were down; cotton and soybeans were up for the week.

How many corn, soybean, and cotton acres will be planted in spring 2021? This will be debated and speculated over the next few months. With the August-February price rally there is an improved incentive to plant additional acres of corn, soybeans, and cotton. Since 2000, according to USDA NASS, the greatest number of acres planted for each commodity was: corn - 97.3 million acres (2012); soybeans - 90.2 million acres (2017); and cotton 15.8 million acres (2001). In 2020, the Prospective Plantings report projected 96.99, 83.51, and 13.7 million acres of corn, soybeans, and cotton planted - the final USDA NASS estimates were 90.8, 83.1, and 12.1 million acres planted.

The current soybean-to-corn harvest futures price ratio of 2.62 would tend to favor soybeans over corn, but if weather cooperates total corn plantings may still exceed soybean – 2018 was the only year from 2000-2020 that soybean plantings (89.2 million acres) were estimated to be greater than corn (88.9 million acres). This year the U.S. could easily plant over 180 million acres of the two commodities - 87-94 million acres of corn and soybeans seems like a reasonable estimate. The additional acres would be pulled from smaller acreage crops and acres that were not in row crop production in recent years.

At the end of 2020, many thought (me included) that cotton would lose planted acres to corn and soybeans, particularly in the Mississippi Delta and Eastern Seaboard. Then December cotton futures prices increased from 75 cents to 84 cents. This will likely buy-back some of those acres that may have been lost and also encourage those producers heavily invested in cotton infrastructure (cotton specific equipment) or supply chains (gins and warehouses) to increase acres planted or contracted. An increase in cotton planted acres over last year’s 12.1 million now seems likely.

In Tennessee 2.37-2.8 million acres of corn, cotton, and soybeans have been planted annually since 2000. Approximately 55-60% of acres have been planted to soybeans, 25-30% to corn and 10-15% to cotton. Tennessee could see increased planted acres for all three commodities, compared to 2020, as additional acres are pulled into production. One factor to watch in Tennessee is the very strong corn basis this winter, particularly in Southern-middle and East Tennessee. The strong basis could tilt the price relationship between soybeans and corn, counter to the futures prices, and favor increased corn planting in the region.

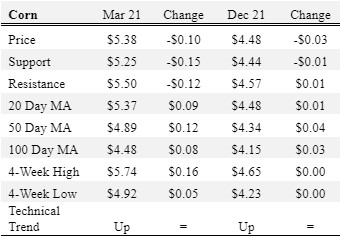

Corn

Ethanol production for the week ending February 5 was 0.937 million barrels per day, up 1,000 barrels from the previous week. Ethanol stocks were 23.796 million barrels, down 0.52 million barrels compared to last week. Corn net sales reported by exporters for January 29-February 4 were down compared to last week with net sales of 57 million bushels for the 2020/21 marketing year and 0.5 million bushels for the 2021/22 marketing year. Exports for the same time period were up 57% from last week at 61.6 million bushels – a marketing year high. Corn export sales and commitments were 87% of the USDA estimated total exports for the 2020/21 marketing year (September 1 to August 31) compared to the previous 5-year average of 62%. Across Tennessee, average corn basis (cash price-nearby futures price) strengthened at Northwest, North-Central, West-Central, West, and Mississippi River elevators and barge points. Overall, basis for the week ranged from 5 over to 39 over, with an average of 25 over the March futures at elevators and barge points. March 2021 corn futures closed at $5.38, down 10 cents since last Friday. For the week, March 2021 corn futures traded between $5.24 and $5.74. Mar/May and Mar/Dec future spreads were -2 and -90 cents. May 2021 corn futures closed at $5.36, down 11 since last Friday.

December 2021 corn futures closed at $4.48, down 3 cents since last Friday. Downside price protection could be obtained by purchasing a $4.50 December 2021 Put Option costing 41 cents establishing a $4.09 futures floor.

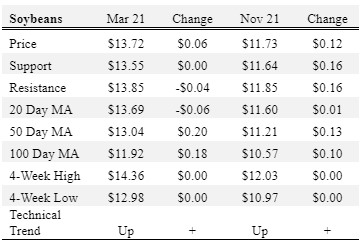

Soybeans

Net sales reported by exporters were down compared to last week with net sales of 29.6 million bushels for the 2020/21 marketing year and 6.6 million bushels for the 2021/22 marketing year. Exports for the same period were up 13% compared to last week at 81.3 million bushels. Soybean export sales and commitments were 97% of the USDA estimated total annual exports for the 2020/21 marketing year (September 1 to August 31), compared to the previous 5-year average of 78%. Across Tennessee, average soybean basis strengthened or remained unchanged at West-Central, West, North-Central, Northwest and Mississippi River elevators and barge points. Basis ranged from 5 under to 34 over the March futures contract. Average basis at the end of the week was 19 over the March futures contract. March 2021 soybean futures closed at $13.72, up 6 cents since last Friday. For the week, March 2021 soybean futures traded between $13.37 and $14.09. Mar/May and Mar/Nov future spreads were -1 and -199 cents. May 2021 soybean futures closed at $13.71, up 6 cents since last Friday. March 2021 soybean-to-corn price ratio was 2.55 at the end of the week.

November 2021 soybean futures closed at $11.73, up 12 cents since last Friday. Downside price protection could be achieved by purchasing an $11.80 November 2021 Put Option which would cost 90 cents and set a $10.90 futures floor. Nov/Dec 2021 soybean-to-corn price ratio was 2.62 at the end of the week.

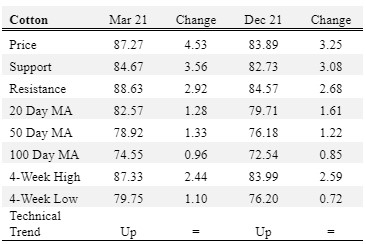

Cotton

Net sales reported by exporters were up compared to last week with net sales of 275,400 bales for the 2020/21 marketing year and 170,100 bales for the 2021/22 marketing year. Exports for the same time period were up 36% compared to last week at 433,600 bales. Upland cotton export sales were 91% of the USDA estimated total annual exports for the 2020/21 marketing year (August 1 to July 31), compared to the previous 5-year average of 81%. Delta upland cotton spot price quotes for February 11 were 84.41 cents/lb (41-4-34) and 86.66 cents/lb (31-3-35). Adjusted World Price (AWP) increased 3.94 cents to 70.32 cents. March 2021 cotton futures closed at 87.27, up 4.53 cents since last Friday. For the week, March 2021 cotton futures traded between 82.73 and 87.33 cents. Mar/May and Mar/Dec cotton futures spreads were 1.39 cents and -3.38 cents. May 2021 cotton futures closed at 88.66 cents, up 4.64 cents since last Friday.

December 2021 cotton futures closed at 83.89 cents, up 3.25 cents since last Friday. Downside price protection could be obtained by purchasing an 84 cent December 2021 Put Option costing 7.17 cents establishing a 76.83 cent futures floor.

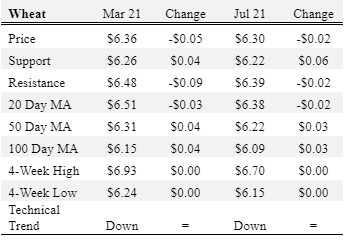

Wheat

Wheat net sales reported by exporters were down compared to last week with net sales of 21.7 million bushels for the 2020/21 marketing year and 1.6 million bushels for the 2021/22 marketing year. Exports for the same time period were down 12% from last week at 16.1 million bushels. Wheat export sales were 87% of the USDA estimated total annual exports for the 2020/21 marketing year (June 1 to May 31), compared to the previous 5-year average of 86%. In Tennessee, spot wheat prices ranged from $6.63 to $6.86. March 2021 wheat futures closed at $6.36, down 5 cents since last Friday. March 2021 wheat futures traded between $6.26 and $6.60 this week. March wheat-to-corn price ratio was 1.18. Mar/May and Mar/Jul future spreads were 5 and -6 cents. May 2021 wheat futures closed at $6.41, down 4 cents since last Friday.

In Tennessee, new crop wheat cash contracts ranged from $6.15 to $6.67. July 2021 wheat futures closed at $6.30, down 2 cents since last Friday. Downside price protection could be obtained by purchasing a $6.30 July 2021 Put Option costing 45 cents establishing a $5.85 futures floor.

Source : tennessee.edu