New U.S. Biodiesel Tax Credits - Risks for Canadian Producers

Starting January 1, 2025, the U.S. will implement tax credit adjustments for biofuel production, a move that could challenge Canadian biodiesel producers’ market access.

This change sparks concerns about the impact on demand for refined canola and soy oil from Canadian fuel producers, especially as more domestic crush facilities are becoming operational. With new facilities aiming to boost Canada’s capacity, potential hurdles in finding buyers could pose a challenge for canola and soy oil markets says Farm Credit Canada (FCC).

The U.S. currently provides a $1-per-gallon tax credit to blenders who mix biodiesel or renewable diesel with conventional diesel, a significant incentive that helps balance the higher costs of these biofuels compared to conventional diesel.

Combined with credits from other initiatives, such as the Renewable Fuel Standard and California’s Low Carbon Fuel Standard, these policies have been crucial in keeping biofuel plants profitable. To date, Canadian biodiesel exports have largely been directed to the U.S., where they benefit from these credits.

However, as outlined by Farm Credit Canada, the Inflation Reduction Act shifts this tax credit from blenders to producers, limiting eligibility to biodiesel or renewable diesel produced within the U.S. though imported feedstocks remain eligible for now.

Canadian biofuel experts warn that, without a parallel credit system in Canada, it may become difficult to establish new biofuel facilities domestically.

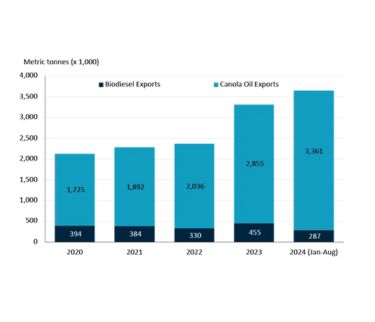

Meanwhile, Canadian oilseed processors have been active exporters, setting record volumes of canola oil to the U.S. in 2024. Despite lobbying from some U.S. farm groups to prevent foreign feedstocks from benefiting from American tax credits, Canadian crushers continue to enjoy profitability, driven by robust demand for canola.

This highlights the ongoing importance of the U.S. market for Canadian oil exports, yet uncertainty looms with changing regulatory landscapes warns FCC.

Photo Credit: pexels.com