Riding lawn tractors could crash

By Diego Flammini, Farms.com

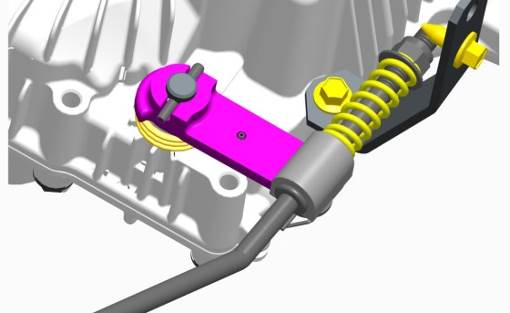

John Deere is recalling close to 2,000 riding lawn tractors, including 370 in Canada because the brake arm on the lawn tractor could fail, causing the tractor to crash.

The recall involves John Deere models D110, D125, D130, D140, D155, D160 and D170 with serial numbers beginning with 1GXD.

The model numbers can be found on the bottom left and right of the hood in yellow and the serial number can be found on the left side of the tractor, under the fender, above the left rear tire.

The lawn tractors were manufactured in the United States and sold at Home Depot, Lowe’s and John Deere dealers between May 2015 and August 2015. The tractors sold for between $1,700 and $2,700.

So far there have been no reported injuries as a result of the brake arm failing, but John Deere is suggesting owners stop using the machine immediately and contact a John Deere dealer for a free repair.

John Deere is also directly contacting owners of the recalled items.

More information can be found on John Deere’s website.

According to the United States Consumer Product Safety Commission, this is John Deere’s first product recall since August 14th, 2013. At the time, the company recalled compact utility tractors due to spring locking pins in the rollover protective system breaking.

Join the conversation and tell us if you own one of the recalled items and noticed anything wrong with the brake arm. Has it been looked after?