Data shown in new AEM report

By Diego Flammini

Assistant Editor, North American Content

Farms.com

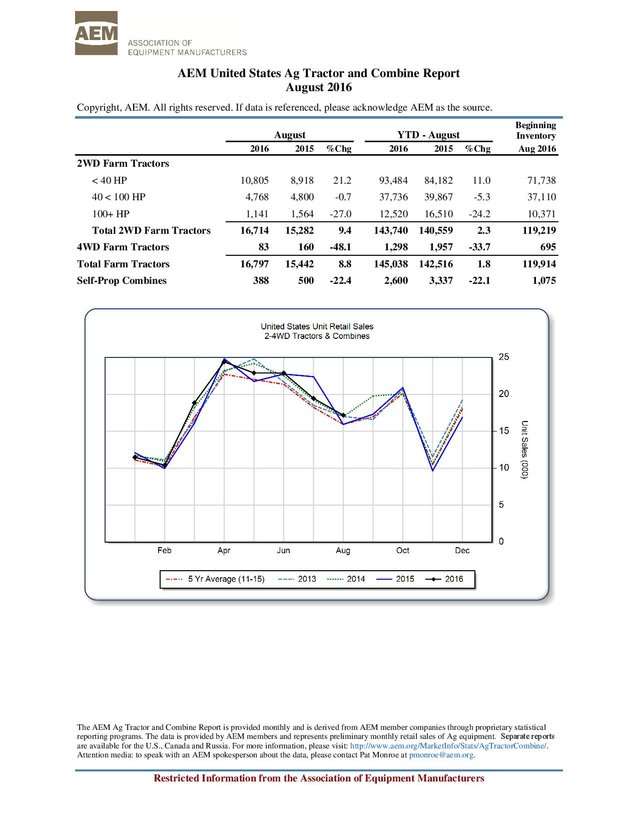

A new report by the Association of Equipment Manufacturers (AEM) indicates that the sales of tractors and combines were down in the United States between August 2015 and 2016.

According to the report, 12,520 2WD tractors in the 100+ HP range were sold this August. When compared to 16,510 last August, that’s a decline of 24.2 per cent.

The sale of 2WD tractors in the 40 to 100 HP range were down by 5.3 per cent, but sales of 2WD tractors under 40 HP were up by 11 per cent.

4WD tractors saw an even greater drop than most 2WD tractors.

The report shows that 1,298 4WD tractors were sold in August 2016, compared to 1,957 in August 2015. Those numbers represent a decline of 33.7 per cent.

When it comes to combines, sales are also down.

The AEM report shows that 2,600 combines were sold this past August, compared to 3,337 in August 2015.

Those numbers represent a decline of about 22.1 per cent.

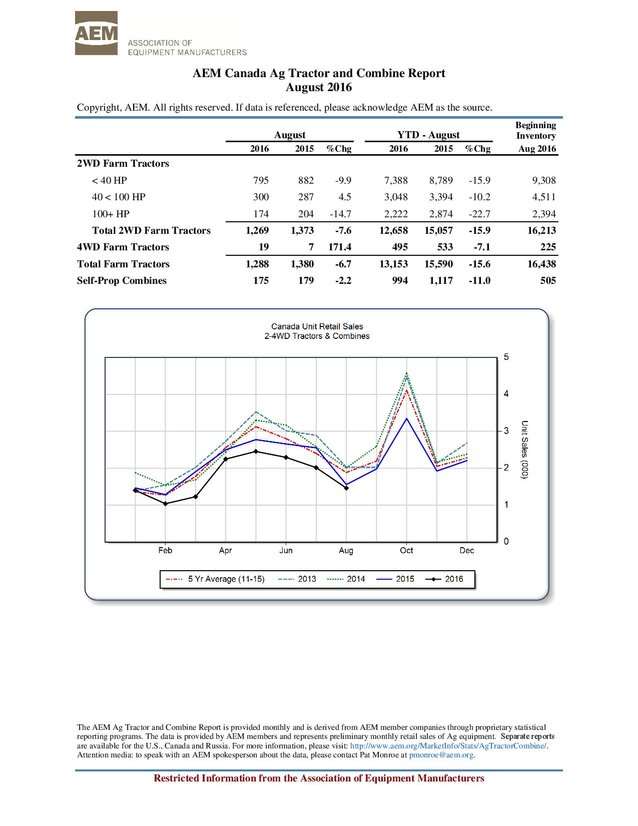

When it comes to tractor and combine sales in Canada, it’s a similar story.

The AEM’s Tractor and Combine Report for the Canadian market shows sales of 2WD tractors in the 100+ HP range were down by 22.7 per cent this August compared to last year.

Sales of 4WD tractors were down by 7.1 per cent. 495 tractors were sold in August in contrast to 533 last August.

Canadian combine sales dropped by 11 per cent since last August. 1,117 combines were sold in August 2015, compared to 994 this August.