Inauguration takes place on January 20

By Diego Flammini

Assistant Editor, North American Content

Farms.com

With only a few weeks before President-elect Donald Trump’s official inauguration into the White House, he’s yet to name his Secretary of Agriculture.

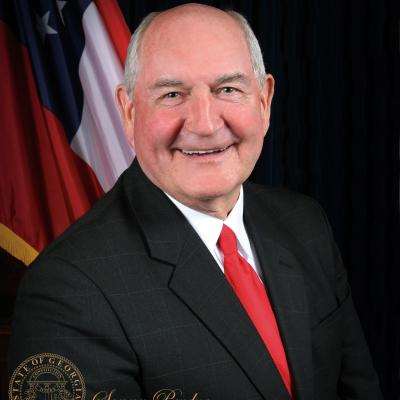

Politico reports indicate that Sonny Perdue, a former governor of Georgia, is the leading candidate for the position.

Other possible candidates include former Texas A&M University president Elsa Murano, current Texas Commissioner Sid Miller, former Texas Agriculture Susan Combs, Idaho Governor Butch Otter, North Dakota Senator Heidi Heitkamp and former U.S. Deputy Secretary of Agriculture Charles F. Conner.

But as other people are named to key positions and farmers wait to hear who their representative will be in the White House, what kind of message is the delay sending?

Sonny Perdue

To some, it sends a good message.

“While it has taken longer than expected for a nominee to emerge, I am hopeful that the delay is simply due to the large number of qualified individuals being considered for the position,” Amanda Zaluckyj,” whose family runs a corn and soybean farm in Michigan told Farms.com in an email. “This is a very important pick for the new administration, as the next USDA Secretary will have to deal with a variety of hot button issues, including passage of the next Farm Bill. I think it is perfectly acceptable to take the time necessary to choose the right person for the job.”

On Twitter, David Smasne, a fruit and vegetable farmer from Roosevelt, Washington, said it’s an important position and should be treated as such.

Karen Livesay, a ninth generation farmer from Iowa, said the delay shows "he's taking his time to find the right match."

Farms.com has reached out to the American Farm Bureau Federation and the American Soybean Association for their comments.