Company now offers a stand-alone solution for tractor insurance

By Diego Flammini

Assistant Editor, North American Content

Farms.com

Farmers in Ontario now have another insurance option when it comes to protecting their tractors.

Duliban Insurance Brokers, with offices in the Niagara and Haldimand regions, announced its Tractor Protect – a new, stand-alone tractor and farm machinery insurance program.

“The standard home policy is not designed to insure home/farm machinery or farm liability,” the company says on its website. “It may contain exclusions for tractors and farm equipment based on horsepower, value and use. Tractor Protect is designed specifically for this job.”

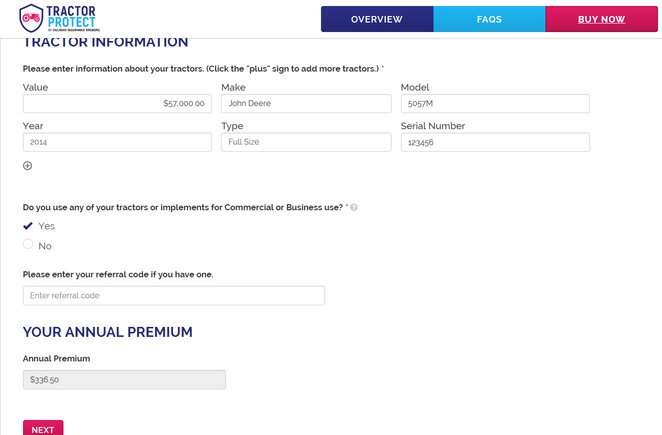

Farmers can visit Tractorprotect.com to enter information about their tractors including make, model, value and year.

Tractor Protect screenshot

After answering a few questions, farmers can get a general idea of what it might cost to insure their tractors.

In a Jan. 2 release, Duliban said the policies help “Ontario’s rural homeowners, farm and hobby farm owners (with) their personally used tractors, compact tractors, farm implements and zero-turn lawnmowers.”

The policies are underwritten through Trillium Mutual Insurance Company. In the release, Trillium said it “prides itself on having dedicated specialists who are knowledgeable, client-focused and who understand the farm business intimately.”

Farms.com has reached out to Duliban Insurance Brokers for more information on the Tractor Protect program.