By Gary Schnitkey and Nick Paulson et.al

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Non-land costs for 2022 corn and soybean production are projected to be at all-time highs. Despite these high costs, corn and soybean production is projected to be profitable in 2022 because projected prices are considerably higher than average prices from 2014 to 2020. A return to average 2014-2020 prices will result in negative 2022 returns if yields are at or below trend. The July 2021 version of the publication entitled Revenues and Costs for Illinois Grain Crops and the 2022 Illinois Crop Budgets provides more detail on these estimates.

Corn and Soybean Returns for Central Illinois

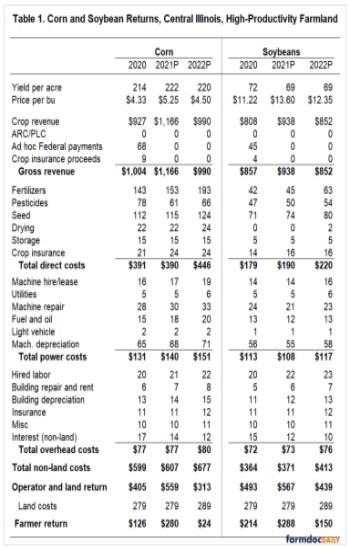

Table 1 contains estimates of revenues and costs for corn and soybeans grown on high productivity farmland in central Illinois. These values are taken from the July 2021 version of Revenues and Costs for Illinois Grain Crops, a publication available on farmdoc showing actual returns from 2015 to 2020 and projections for 2021 and 2022. This publication includes budgets for northern, central, and southern Illinois, with central Illinois further broken down into estimates for 1) high-productivity farmland having a 2022 expected corn (soybean) yield of 220 (69) bushels per acre and 2) low productivity farmland with a 2022 expected corn (soybean) yield of 209 (62) bushels per acre. Further refined estimates for corn-after-corn, corn-after-soybeans, soybeans-after-corn, soybeans-after-soybeans, wheat, and double-crop soybeans are shown in the publication entitled 2022 Illinois Crop Budgets.

There are three years shown in Table 1. For 2020, revenues and costs are summarized from grain farms enrolled in Illinois Farm Business Farm Management (FBFM). These represent averages across a variety of farms with different situations. Note that ad hoc government payments, including Market Facilitation Program (MFP) and Coronavirus Food Assistance Program (CFAP) payments, were important sources of revenue. These ad hoc payments are not scheduled in the future. Projections are made for 2021 and 2022. Several points on projections:

Yields: The 2022 projections are trend yields of 220 bushels per acre for corn and 69 bushels per acre for soybeans. Yields for 2021 have been raised slightly from trends, as the growing season appears favorable across much of Illinois. However, the remaining portion of the growing season may impact yields.

Prices: Prices for 2021 and 2022 are based on forward bids and prices on Chicago Mercantile Exchange futures contracts. Obviously, much can change between now and delivery in both years. For corn, a $5.25 per bushel price is used for 2021 and a $4.50 per bushel price for 2022. Both prices are significantly above the 2014 to 2020 average price of $3.73 per bushel. For soybeans, a $13.60 per bushel price is used for 2021, and a $12.35 per bushel price is used for 2022. Like corn, both the 2021 and 2022 prices are well above the average price for 2014 through 2020 of $9.91 per bushel.

Non-land Costs: Costs are projected to rise considerably for the 2022 crop year. The cost category with the largest increase is fertilizer, with an increase of $40 per acre for corn and $18 per acre for soybeans. Pesticide and seed in 2022 are projected to increase by 8 percent over 2021 levels. Machinery repairs are projected to increase 10%. The only category with a projected decline is interest costs. On corn, for example, interest costs are projected to decline from $14 per acre to $12 per acre. Higher returns in 2021 likely will lead to debt retirement, causing lower debt levels in 2022 with steady interest rates.

Total non-land costs for corn are projected at $677 per acre, up by $70 per acre from the 2021 level of $607 per acre. The $677 per acre is higher than all previous non-land costs, surpassing the previous high of $617 per acre in 2014.

For soybeans, 2022 non-land costs are projected at $413 per acre, an all-time high. The $413 per acre projection would be $42 per acre higher than the 2021 projection of $371 per acre. The previous high in non-land costs was $378 per acre, occurring in 2014.

Operator and Land Return: Operator and land returns represent a return to the farmer and the landowner. Operator and land returns for 2022 are projected at $313 per acre for corn and $439 per acre for soybeans. If farmland is cash rented, subtracting the cash rent from the operator and land return gives the farmer return.

Cash Rents: Table 1 includes an estimate of 2022 cash rent at $289 per acre, up $10 per acre from the 2021 projected level of $279 per acre.

Importance of Higher-than-Average Prices

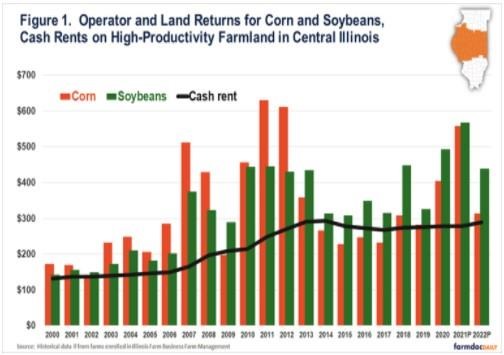

Even with rising costs, projections are for positive 2022 returns to farmers of $24 per acre for corn and $150 per acre for soybeans on cash rented land. The $24 per acre corn projection compares to an average farmer return of $4 per acre from 2014 to 2020. The $150 soybean projection compares to an average of $88 per acre from 2014 to 2020 (see Figure 1).

The projected higher returns in 2022 would occur because of higher-than-average corn and soybean prices. The 2022 corn price of $4.50 per bushel is $.77 per bushel higher than the 2014-2020 average of $3.73 per bushel. The $12.35 price for soybeans is $2.44 higher than the 2014-2020 average of $9.91. A return to 2014-2020 average prices will cause negative 2022 projected farmer returns if yields remain at or below trend yields. At the 2014-2020 average price of $3.73 per bushel, farmer return would be -$145 per acre, well below any recent return. Since 2000, when comparable returns have been compiled, the lowest return was -$50 per acre in 2015. For soybeans, a return to the 2014-2020 average results in a -$18 per acre return, well below the $11 low set in 2000.

Summary

Reasonably optimistic projections can be made for 2022 corn and soybean returns based on projected corn and soybean prices being above 2014-2020 average prices. A central question then is: How long will higher prices last? One expects supply responses in both Brazil and the U.S., as well as Russia, Ukraine, and Kazakhstan, to lead to lower commodity prices eventually. That could occur next year if Brazil plants more soybean and corn acres, and weather conditions return to normal. Combined with yields at or above trend in the U.S., those conditions would likely lead to lower corn and soybean prices in 2022. But, of course, poor growing conditions could also occur in major production regions in 2022. Demand factors also will impact prices, with primary importance being demand from China.

A return to 2014-2020 average prices seems quite possible. In 2018, 2019, and 2020, ad hoc Federal payments were important sources of revenue. Without a return of these ad hoc programs, returns in 2021 will be below those experienced in 2018 through 2020 if prices return to 2014-2020 prices without having yields well above trend. Higher costs have led to a situation were higher prices and above trend yields are needed for profitability.

Source : illinois.edu