By Russ Quinn

Retail fertilizer prices continue on their path lower, according to prices tracked by DTN for the first full week of March 2023. This welcome trend has been in place for over two months.

All eight of the major fertilizer prices are once again lower compared to last month. Five of the eight fertilizers had a considerable price decline. DTN designates a significant move as anything 5% or more.

Leading the way lower were both anhydrous and UAN28. Anhydrous was 13% lower compared to last month and had an average price of $1,059/ton while UAN28 was also 13% less expensive and had an average price of $436/ton.

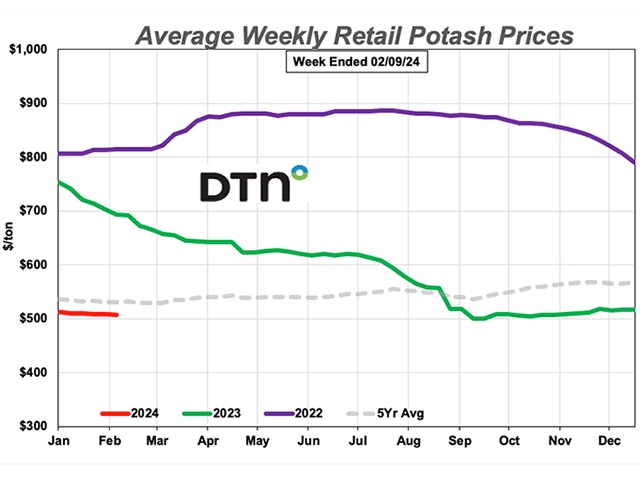

UAN32 was 10% lower looking back a month and had an average price was $522/ton. Urea was 7% less expensive compared to the previous month with an average price of $643/ton. Potash was 5% lower compared to last month with an average price of $657/ton.

The remaining three fertilizers were all just slightly lower compared to the prior month. DAP had an average price of $825/ton, MAP $823/ton and 10-34-0 $740/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.70/lb.N, anhydrous $0.65/lb.N, UAN28 $0.78/lb.N and UAN32 $0.82/lb.N.

In a presentation at the 2023 University of Minnesota Extension Nutrient Management Conference, University of Minnesota Extension Agricultural Economist Bill Lazarus discussed the economics of fertilizer.

Prices moved higher last year due to several supply-side reasons, including high natural gas prices, export restrictions in China and the Ukraine conflict. As we moved into 2023, nutrient prices have begun to decline, but prices are still high, he said.

"Fertilizer prices are coming down, which is good," Lazarus said.

Click here to see more...