By Gary Schnitkey and Jim Baltz et.al

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Illinois crop budgets for 2022 have been revised from their December release (farmdoc daily, December 7, 2021). Projected costs have been raised for 2022, and corn and soybean costs are at their highest in history. Positive farmer returns are still expected because of high projected corn and soybean prices. While profits are projected, risks remain. Corn is projected to be more profitable than soybeans. However, Illinois farmers do not intend to increase planted corn acreage, likely due to higher risks with corn. In particular, price and supply risks associated with nitrogen fertilizer risks can be avoided by planting soybeans. Moreover, adjusting acres and changing input plans now could be problematic given input certainty.

Updated Crop Budgets

Updated 2021 and 2022 projections are contained in two publications in the Management section of farmdoc. First, the 2022 Crop Budgets give corn-after-corn, corn-after-soybeans, soybeans-after-corn, soybeans-after-soybeans, and wheat budgets for four regions: northern Illinois, central Illinois with high-productivity farmland, central Illinois with low-productivity farmland, and southern Illinois. In addition, a double-crop soybeans budget also is given for all regions except northern Illinois. The second publication — Revenue and Costs for Illinois Grain Crop — shows yearly returns and costs of producing corn, soybeans, wheat, and double-crop soybeans by region of Illinois. These budgets represent average returns no matter the preceding crop and are summarized from farms enrolled in Illinois Farm Business Farm Management (FBFM).

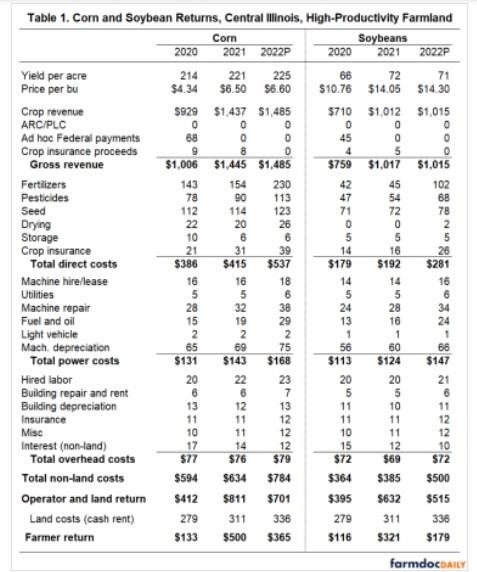

Table 1 shows corn and soybeans’ actual and projected performance for 2020, 2021, and 2022 on high-productivity farmland in central Illinois. Similar results for northern Illinois, central Illinois low-productivity farmland, and southern Illinois are available in the Revenue and Costs for Illinois Grain Crops Crop publication. Trends in Table 1 for high-productivity farmland also occur across regions.

We projected the average returns and costs for farms enrolled in Illinois FBFM. Actual results on individual farms can vary considerably from these averages. This year, the timing of input purchases will greatly impact costs, particularly fertilizers.

Yields for 2022: Yields for 2022 are set at 225 bushels per acre for corn and 71 bushels per acre for soybeans (see Table 1). These are trend yields, representing likely yields under normal growing conditions for 2022.

Prices: Prices are projected at $6.60 per bushel for corn and $14.30 per bushel for soybeans. Both prices are below current (mid-April 2022) fall delivery bids. Lower prices are used because some of 2022 production has been forward priced on most farms, likely at lower prices than current fall bids.

Other revenue: Commodity title payments in Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) are not projected for 2022. Moreover, additional ad hoc Federal payments are not expected. If ARC/PLC makes payments in 2022, drastic changes from current expectations will have occurred.

Fertilizer: Fertilizer costs for corn are projected at $230 per acre. There will be a great deal of variability in fertilizer costs because prices have changed dramatically over the past nine months. For example, anhydrous ammonia prices were $750 per ton in the late summer of 2021. In April 2022, anhydrous ammonia prices are over $1,600 per ton. Therefore, farmers who booked most of their fertilizer in 2021 could realize $50 per acre or more in lower costs than the $230 average. On the other hand, fertilizer prices in the spring could result in $50 or more in higher costs than $230 per acre.

Pesticides: Pesticides are projected up by 25% from 2021 levels. Supply chain issues have caused many pesticides to be in short supply and costs to be much higher.

Seed: Seed costs are estimated up by 8% from 2021 levels, roughly in line with historical rates of increase. In 2022, seed is not expected to increase as much as fertilizer and pesticides.

Machinery repair: Repair costs are projected up by 20% from 2021 levels. Machinery parts have been in short supply due to supply issues.

Fuel and oil: Fuel and oil prices are projected up by 50% from 2021 levels.

Commentary

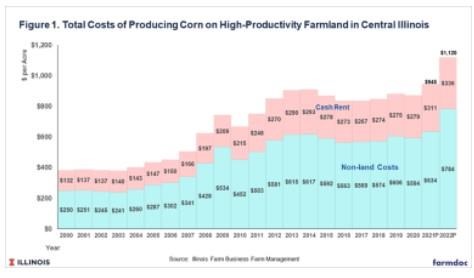

Costs will be much higher in 2022 than in 2021. For corn, non-land costs are projected at $784 per acre, up by $150 per acre from the $634 level in 2021. Adding an average cash rent of $336 per acre gives $1,120 per acre in total costs (see Figure 1). At $1,120 per acre, total costs for corn would exceed $1,000 per acre for the first time.

High costs lead to high break-even prices. At a 225 bushel yield, the price of corn has to be above $4.97 per bushel for the farmer to break even, an exceptionally high level from an historical perspective. From 2014 to 2020, central Illinois farmers averaged $3.75 per bushel, $1.22 per bushel below the $4.97 break-even.

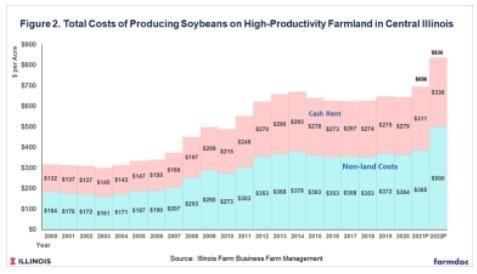

Total costs for soybeans have also increased dramatically. For 2022, non-land costs are projected at $500 per acre. With an average cash rent, the total costs of producing soybeans are $836 per acre, $140 higher than the $696 level in 2021. Like corn, soybean costs will be the highest in history in 2022.

At a 71 bushel per acre trend yield, the break-even soybean price is $11.77 per bushel, an exceptionally high break-even level. From 2014 to 2020, central Illinois farmers received an average price of $9.84 per bushel, $1.93 per bushel below the $11.77 break-even price.

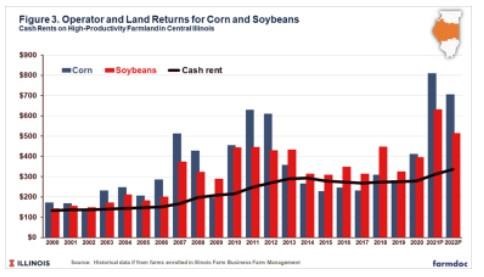

Even given these high costs, corn and soy

bean production are projected to be profitable in 2022 (see Figure 3). The operator and land return for corn is projected at $701 per acre and soybeans at $515 per acre. These projected returns are above the $336 per acre cash rent, indicating that farmers are projected to be profitable on cash rent farmland at average cash rent levels.

Profitability is based on high corn and soybean prices: $6.60 per bushel for corn and $14.30 per bushel for soybean. Declines in corn and soybean prices will reduce returns if yields do not increase above-trend levels. In recent years, wide swings have occurred in prices. It is possible that prices will fall between now and harvest, causing farmers to have much lower returns.

Corn is projected to be more profitable than soybeans: $701 operator and land return for corn compared to $515 per acre for soybeans. Corn has been projected as more profitable than soybeans for 2022 since the first 2022 budget release last July. Still, the recent Prospective Plantings report indicates that Illinois farmers will not plant more corn in 2022. We suspect the reasons that farms do not intend to plant more corn include:

- Non-land costs of corn production are much higher for corn than for soybeans, increasing the potential for losses with corn, and

- Nitrogen fertilizer pricing and supply have been a large concern. Corn uses nitrogen much more than soybeans. Therefore, planting soybeans reduces the risks associated with nitrogen fertilizer.

- Changing acreage decisions now would require changes in input purchase plans. Given input availability uncertainties, changing plans now could be problematic.

Summary

The 2022 budgets have been revised from the previous two releases in July 2021 (farmdoc daily, July 27, 2021) and December 2021 (farmdoc daily, December 7, 2021). Projected costs for 2022 continue to increase from earlier releases. Still, 2022 is projected to be profitable as projected prices are at high levels.

While projections are for profitability, one senses unease among farmers. Non-land costs are high, and positive returns are based on high prices. One wonders if an unwelcome event may occur, causing lower prices and much lower profits. Those concerns could have also been among the reasons farmers are not shifting to more corn in 2022 even though corn is projected to be more profitable. This unease likely will carry over into planning for 2023 production.

Source : illinois.edu