By Scott Irwin

Implementation of the Renewable Fuel Standard (RFS) in the U.S. has been controversial from the start (e.g., farmdoc daily, September 10, 2019). The latest controversy revolves around a seemingly obscure provision of the RFS that allows small refineries to be exempted from mandated volume requirements. The policy of the Environmental Protection Agency (EPA) under the Trump Administration has been to issue a relatively large number of individual small refinery waivers (SREs) in a way that has resulted in substantial across-the-board cuts in mandated volumes (farmdoc daily, July 12, 2018). While there is a vigorous debate about the distribution of the mandate reductions across biofuel types, there is no doubt about the overall impact on aggregate biofuel demand. The resulting controversy has prompted the Trump Administration to search for alternative approaches to implementing the RFS that address the economic hardship concerns of small refineries but avoids substantial cuts in the level of the mandates. The purpose of this article is to develop a simple plan for implementing the RFS that simultaneously provides economic hardship relief for small refineries and fully implements mandated volumes.

Background on SREs

The U.S. Renewable Fuel Standard (RFS) was created under the Energy Policy Act of 2005, and was later modified and expanded under The Energy Independence and Security Act of 2007. The 2005 version of the program is known as “RFS1” and the 2007 version as “RFS2.” Since its inception, the program has been administered by the U.S. Environmental Protection Agency (EPA). RFS1 included a provision to exempt small refineries (fewer than 75,000 barrels of average aggregate daily crude oil throughput) from the specified biofuel mandates based upon a finding of a disproportionate economic hardship for the small refinery (or refiner), and this provision was not changed in RFS2. The implementation of small refinery exemptions (SREs) has changed substantially over time. Initially, RFS1 provided a statutory blanket exemption for all small refiners through 2010. In 2011, EPA temporarily extended the blanket exemption through 2012 in response to demands from Congress for a reassessment of the impacts on small refineries (Coppess and Irwin, 2017). From 2013 through 2016, only a few SREs were awarded by the EPA under RFS2. This policy was reversed in 2017, with the EPA granting a total of 85 SREs for the 2016-2018 compliance years representing 38.31 billion gallons of exempted gasoline and diesel volumes. (Based on data as of August 22, 2019 at the

EPA webpage for small refinery exemptions.)

The RFS statutes require the EPA to implement the standards via annual rulemakings, with the final rules to be released by the end of November prior to the compliance year. The 2010 EPA rulemaking that first implemented the RFS2 mandates provided a formula for calculating the yearly percentage standards that obligated parties must meet to demonstrate compliance with the RFS. That formula included an estimate of the amount of surface transportation fuel produced by exempted small refineries. The effect of this is to require an estimate of gallons attributable to SREs when formulating the annual standards. This is straightforward to incorporate into the formula when a blanket exemption is provided to small refineries at the time of the annual rulemaking, as was the case for the 2010 through 2012 compliance years. A difficulty arises when individual SREs are awarded after the EPA has issued its final rulemaking for a compliance year, which generally has been the case since 2013. The EPA could revise the percentage standards when individual SREs are awarded retroactively since the exempted volumes were not accounted for in the final rulemaking. However, the EPA argued in its 2010 rulemaking that any SREs granted after the final rule was announced would not result in a revision to the percentage standards. The EPA’s position on this matter is stated as follows in the

final RFS rulemaking for 2011:

“If any small refinery exemptions for 2011 are approved after this final rulemaking, the parties in question would be exempt but we would not intend to modify the applicable percentage standards and announce new standards for 2011. EPA believes the Act is best interpreted to require issuance of a single annual standard in November that is applicable in the following calendar year, thereby providing advance notice and certainty to obligated parties regarding their regulatory requirements. Periodic revisions to the standards to reflect waivers issued to small refineries or refiners would be inconsistent with the statutory text, and would introduce an undesirable level of uncertainty for obligated parties.” (p. 76804).

In essence, the argument is that any after the fact adjustments to the percentage standards would be difficult to administer and the changing standards would be unreasonably difficult for obligated parties to meet.

EPA policy on SREs was not a major issue before 2017 because either blanket waivers were issued to all small refineries or relatively few individual waivers were awarded. Denials of some individual SRE petitions by the EPA were challenged in court and this caused some changes in the criteria for awarding SREs (farmdoc daily,

December 6, 2017). As noted above, a major change in EPA policy on SREs occurred in 2017. The new policy consisted of two related components: i) awarding an unprecedented number of individual SREs retroactively; and ii) making no adjustments to the percentage standards for the compliance year to account for the SREs. The last component was a continuation of EPA policy to not retroactively change percentage standards, as discussed earlier. The net impact of this changed policy was to substantially reduce the total volume obligations previously specified by the EPA for the year in question (farmdoc daily

, July 12, 2018).

An example using data for 2017 will help illustrate how the new EPA policy substantially reduced RFS obligations. In November 2016, the final EPA rulemaking specified a total renewable volume obligation (RVO) for 2017 of 19.29 billion gallons. The EPA converted this RVO to a percentage standard using the following formula:

Percentage standard = 100 X [RVO/(petroleum gasoline & diesel use – SREs)].

The formula simply divides the RVO by total petroleum and gasoline use in the lower 49 states net of SREs. The EPA calculation for the total renewable percentage standard for 2017 using this formula was:

Percentage standard = 10.70% = 100 X [(19.29bg)/(180.74bg – 0)].

Based on this formula, obligated parties could simply multiply their production of gasoline and diesel in gallons in 2017 by the percentage standard to get their individual RVO obligation in gallons. Note that EPA assumed SREs would be zero when computing the 2017 percentage standard of 10.70%. If SREs turned out to be zero as projected by the EPA and gasoline and diesel use also equaled projections, the actual total RVO for 2017 would have turned out to be exactly 19.29 billion gallons.

The EPA actually awarded 35 SREs for 2017 that represented 17.05 billion gallons of gasoline and diesel use. Because the EPA granted the 2017 SREs retroactively during the 2018 calendar year, this effectively reduced the 2017 RVO in proportion to the to the total volume of the SREs. In other words, the fixed percentage standards for 2017 were applied to a smaller base of petroleum and gasoline use than was assumed when originally computing the percentage standards. This is illustrated below:

Effective total renewable RVO = 17.51bg = (10.70%/100) X (180.74-17.05bg).

The end result is that the total renewable standard for 2017 was effectively reduced from 19.28 to 17.51 billion gallons, or a reduction of 1.77 billion gallons, through the impact the new EPA policy on SREs. Similar computations can be used to compute effective RVOs of the sub-mandates for cellulosic, biomass-based diesel, total advanced, and (implied) conventional. From a logistical standpoint, the reduction in the 2017 RVO was accomplished by returning 1.77 billion gallon of RINs to the exempted small refineries, who could sell the RINs in the secondary market or bank them for future use.

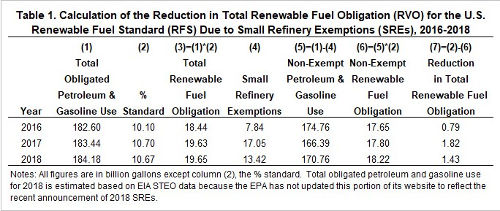

The exact impact of the SREs on RVOs depends on the actual volume of gasoline and diesel use for exempt and non-exempt obligated parties for a given year, which, of course, can differ from that projected in the final rulemaking. Table 1 provides the calculations necessary to precisely determine the reduction in total RVOs due to SREs for the 2016 through 2018 compliance years. The calculations begin with total (actual) obligated petroleum and gasoline use in gallons, which is multiplied by the final percentage standard to arrive at the total RVO in gallons. Next, non-exempt petroleum and gasoline use is computed as the total obligation petroleum and gasoline use minus small refinery exemptions. Lastly, the non-exempt RVO is computed by multiplying non-exempt petroleum and gasoline use by the percentage standard.

The last column in Table 1 presents the reduction in total RVO due to the SREs, which ranges from a high of 1.82 billion gallons in 2017 to a low of 0.79 billion gallons in 2016. (These reductions are exactly the same as those computed by the EPA and found at the agency’s webpage for small refinery exemptions as of August 22, 2019.) The reduction of 1.82 billion gallons for 2017 computed in Table 1 is slightly larger than the earlier figure due to the fact that actual obligated petroleum and gasoline use turned out to be higher than projected in the final 2017 rulemaking (183.44 vs. 180.74 billion gallons). The average reduction in total RVO for the three years is 1.35 billion gallons. The magnitude of the RVO reductions in column (7) is further highlighted by comparison to the total RVO in column (3). The RVO reductions represent 4.3%, 9.3%, and 7.3% in 2016, 2017, and 2018, respectively, and average 7.0%. In sum, the RVO reductions due to EPA policy regarding SREs in recent years have been large by any reasonable standard.

Impact of SREs

The economic impact of the EPA’s recent policy on SREs involves a tradeoff between the economic losses of the biofuel sector and the economic gains to small refineries. To begin, there is approximately a one-for-one decline in the overall demand for biofuels associated with the RVO reductions shown in Table 1. All major categories of biofuels have been negatively impacted, including corn ethanol, cellulosic ethanol, biogas, biodiesel, and renewable diesel. There is some debate about the distribution of the reductions in total RVOs across biofuel types. For example, the available evidence shows that the aggregate blend rate for ethanol has been not been impacted by SREs (farmdoc daily, September 13, 2018; December 13, 2018). The reason for this counter-intuitive result is that the vast majority of ethanol in the U.S. is consumed in the form of E10 and ethanol generally has been price competitive in the E10 gasoline blend. The situation is different for ethanol demand above the E10 blend wall. It is generally assumed that higher ethanol blends, such as E15 and E85, must be subsidized in order to incentivize use. Under the RFS, the subsidy is provided by D6 ethanol RINs, with a high price of the RIN providing a high subsidy and a low price providing a low subsidy. Since SREs have had the effect of sharply reducing D6 RIN prices, demand for ethanol in the form of E15 and E85 should be reduced as a result. While this is true, the amount of ethanol used in the form of E15 and E85 is at most a few hundred million gallons, so the impact of lower RIN prices on consumption of higher ethanol blends is hard to detect in the data (farmdoc daily, January 16, 2019).

The lion’s share of the negative impact of SREs has been borne by biodiesel (FAME biodiesel and renewable diesel). The reason is that biodiesel has been the marginal (lowest cost) gallon for filling three “buckets” in the RFS. The first bucket is the biodiesel mandate itself. The second bucket is the advanced gap, which is the difference between the total advanced mandate and the biodiesel mandate. The third bucket is the conventional gap, which is the difference between the conventional mandate and the E10 blend wall. The effective biodiesel mandate is the sum of these three buckets, and before SREs were applied, this was estimated to be about 3 to 3.5 billion gallons of physical (“wet”) biodiesel (farmdoc daily, March 14, 2019).

Given the important marginal role of biodiesel in filling different buckets in the RFS, SREs have wreaked considerable demand destruction on biodiesel. Over 2016-2018, it is estimated that biodiesel demand has been reduced by an average of 667 million gallons due to SREs (farmdoc daily, March 14, 2019). By comparison, U.S. domestic production of biodiesel was 1.9 billion gallons in 2018. Estimates of the economic magnitude of the losses total $6.4 billion across the three years and exceed $2 billion in 2017 and 2018. This is a large economic loss by any standard.

Positive economic benefits of SREs depend on the waived economic hardship costs experienced by small refineries. This too is a subject filled with considerable controversy. Individual small refineries claim that they are not able to pass RIN costs downstream, and this represents a considerable negative impact on their operating profits in the absence of SREs. There is no doubt that nominal RIN expenses of small refineries have been substantial at times in the past. For example, assume that the weighted-average RIN cost of small refineries is $0.10 per gallon, near the peak in 2016 and 2017, and before the impact of SREs was evident. Next, assume that annual small refinery production is 17.05 billion gallons, the same as the total exempted in 2017. This implies a total nominal RIN cost of $1.7 billion. Hence, the upper bound on annual RIN expenses for small refineries appears to be near the upper bound of annual damage to biodiesel producers, about $2 billion. However, there is the possibility that part or all of the RIN costs for small refineries can be passed downstream in the fuel supply chain. The economics literature suggests that at least, on average, crude oil refineries in the U.S. can fully pass RIN costs downstream through the fuel supply chain (Knittel, Meiselman, and Stock, 2017; Lade and Bushnell, 2019). It seems plausible that small refineries pass through at least part of their RIN expenses, which would make the economic gains of small refineries less than the economic losses to biofuel producers.

Proposal

Before introducing the proposal, it is useful to reconsider the intent of the U.S. Congress for the RFS program. This was summarized by Judge Brett Kavanaugh in his U.S. Court of Appeals ruling for

Americans for Clean Energy et al. in July 2017 as follows:

“By requiring upstream market participants such as refiners and importers to introduce increasing volumes of renewable fuel into the transportation fuel supply, Congress intended the Renewable Fuel Program to be a “market forcing policy” that would create “demand pressure” to increase consumption of renewable fuel.” (pp. 20-21)

This statement by Judge Kavanaugh demonstrates that the U.S. Congress intended the RFS to force usage of biofuels into the U.S. surface transportation sector, even if it required higher fuel prices. The RFS statutes do specify that the “demand pressure” can be relieved through a general waiver authority, but invoking this authority requires meeting the high hurdle of “severe economic harm.” The EPA has made no effort in recent years to justify the volumetric reductions caused by its SRE policy based on this criterion.

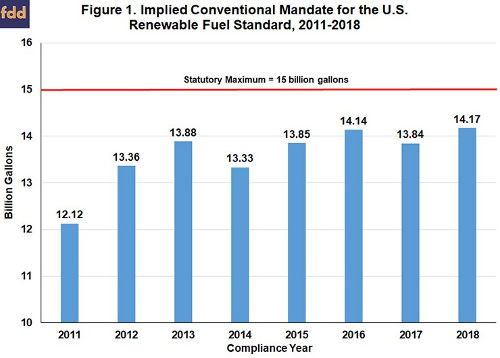

The contradiction between Congressional intent and the impact of recent EPA policy on SREs is best illustrated by the conventional mandate. While this part of the RFS mandates is implied based on the difference between the total and advance RVOs, it is also the largest component of the RFS mandates by a wide margin. It has been met primarily by corn ethanol, although that is not necessary. Figure 1 show that before 2016 the conventional mandate was growing steadily, with the statutory maximum of 15 billion gallons clearly becoming achievable. Note that the levels of the conventional mandate presented in Figure 1 are those implied by the final obligated gasoline and diesel use reported to the EPA by obligated parties and the final percentage standards for each compliance year. Consequently, these volumes will differ from the levels of the conventional mandate reported in EPA final rulemakings during this period, particularly so for 2016-2018. EPA’s policy on SREs since 2016 capped growth in the conventional mandate about a billion gallons short of the maximum. Hence, the biggest component of the RFS has been flat for three years, which is inconsistent with the intent of Congressional for conventional volumes to have reached 15 billion gallons by this date.

The objective, then, is to develop a plan for implementing the RFS that simultaneously provides economic hardship relief for small refiners and implements mandated volumes consistent with the original intent of the U.S. Congress. This is not an impossible task and can be accomplished by making the following two changes to upcoming annual EPA rulemakings:

Provide a blanket waiver for all small refineries as part of the 2020-2022 annual rulemaking process. This will allow SREs to be accounted for when computing the final percentage standards for each year.

Add 1.35 billion gallons to total renewable volumes for 2020-2022 to restore the reduction in volumes over 2016-2018 due to SREs. The total reduction in renewable volumes over 2016-2018 is 4.05 billion gallons (see Table 1), or an average of 1.35 billion gallons. In this way, the backfilling of the SRE reductions in total volume is spread out over three years.

Note that the proposed changes are temporary, as they only apply to the 2020-2022 compliance years. Elements of the plan could be carried forward after 2022, when the volume standards will be reset. Finally, these changes may require Congressional action, but not necessarily changes to the RFS statutes themselves.

The first part of the plan, a blanket waiver for small refineries, has the benefit of addressing concerns of small refineries with the RIN costs of complying with the RFS. This would eliminate the RIN cost concerns of small refineries and the controversy surrounding how many SREs are awarded and to whom. Since all small refineries (and refiners) receive a waiver there is no need for any applications to be written by small refineries or considered by the EPA. This would also eliminate the need for legal challenges to individual SREs since all entities that meet the threshold for being a small refinery would receive a waiver. As discussed in the “Background on SREs” section, this is something that has actually been done before by the EPA. A blanket small refinery waiver through 2010 was written into the RFS1 statute and the EPA temporarily extended the blanket waiver for the 2011 and 2012 compliance years. So, a blanket waiver for all small refineries was in place between 2008 and 2012, or the first five years of the RFS.

There is some uncertainty whether the EPA would need Congressional authority to again issue a blanket SRE. The EPA was explicitly given this authority for 2008-2010 in RFS1 but it appears that EPA temporarily extended the blanket authority for 2011 and 2012 without explicit authority as it waited for a Congressionally-mandated study. Given the history of the EPA previously issuing a blanket SRE, it would be surprising if a legal pathway did not exist for the EPA to do so again. This may also be helped by the fact that the proposed blanket small refinery waiver is temporary, as it only applies to the 2020-2022 compliance years.

In the past, when the EPA provided a blanket small refinery waiver it did so as part of the annual rulemaking process and incorporated the waived volumes into the determination of percentage standards. This meant that the exempted volumes for small refineries were effectively transferred to the obligations for non-exempt refineries. The present plan assumes that the same procedure will be followed again in the 2020-2022 rulemakings, which will assure that total renewable fuel volumes are not reduced as they were in 2016-2018. It is also important to note that this part of the plan does not increase the mandated volumes; it only changes the distribution of the volumes across exempt and non-exempted refineries. In this way, the volumes in final rulemakings will actually be enforced as Congress intended and not reduced after the fact by SREs.

The second part of the plan is the restoration of total renewable volumes that were reduced by SREs over 2016-2018. A fixed 1.35 billion gallons would be added on to the total renewable fuel obligation each year over 2020-2022, thereby spreading the backfilling over three years. This seems reasonable given that the SRE reductions occurred over three years. By adding the 1.35 billion gallons on to the total renewable fuel obligation each year, obligated parties would have maximum flexibility in how to meet the additional volumes. Any category of RIN could be used to comply with the additional mandate, but it is expected that D6 ethanol RINs would be the first choice, followed by D4 biodiesel RINs.

This part of the plan does imply that the conventional volume requirement would exceed 15 billion gallons during 2020-2022. An alternative is to add the 1.35 billion gallons directly on to the advanced requirement each year, which would allow the conventional requirement to remain at 15 billion gallons. This is the more straightforward alternative from a legal standpoint, as it would be a continuation of past EPA practice of backfilling part of waived cellulosic volume requirements with other advanced biofuels. However, this would limit the flexibility of obligated parties in complying with the additional volume requirements over 2020-2022.

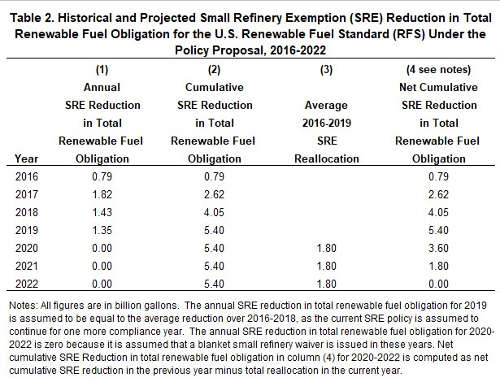

A specific example of how this proposal could work in practice over 2020-2022 is found in Table 2. Note that: i) the annual SRE reduction in total renewable fuel obligation for 2019 is set equal to the average reduction over 2016-2018 because the current SRE policy is assumed to continue for one more compliance year; and ii) the annual SRE reduction in total renewable fuel obligation for 2020-2022 is zero because it is assumed that a blanket small refinery waiver is issued in these years. Under these assumptions, the net cumulative SRE reduction in total renewable fuel obligation peaks at 5.4 billion gallons in 2019. Starting in 2020, the average SRE reduction over 2016-2019 of 1.8 billion gallons is reallocated from smaller exempt refiners to larger non-exempt refiners. The combination of no SRE reductions (due to the blanket waiver) over 2020-2022 and reallocating 1.8 billion gallons per year results in the net cumulative SRE reduction in total renewable fuel obligation reaching zero in 2022, which is the goal of the proposed policy.

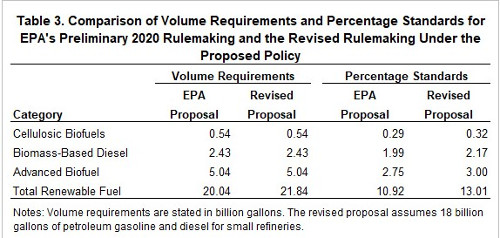

Table 3 provides a detailed comparison of volume requirements and percentage standards for 2020 based on the EPA’s preliminary rulemaking and the revised proposal. The volume requirements are identical across the two proposals except total renewable fuel, which is increased by 1.80 billion gallons in the revised proposal. The largest differences between the two proposals emerge when considering percentage standards. Note that the assumptions for projected volumes of gasoline, diesel, renewables in gasoline, and renewables in diesel are exactly the same across the two proposals and were collected from Table VIII.C-1 of the

2020 preliminary rulemaking document (p. 36798). The EPA proposal assumes SREs are zero, but in the revised proposal it is assumed that a blanket SRE exempts 18 billion gallons of petroleum and gasoline from RFS obligations in 2020. This estimate was computed by simply adding 1 billion gallons to the total obligated gasoline and petroleum volume of exempt small refineries in 2017, when 35 out 37 petitions for SREs were approved. Accounting for the blanket SRE in this manner increases the percentage standards across-the-board under the revised proposal. Not surprisingly, the increases are small except for total renewable fuel, which increases from 10.92 to 13.01 percent.

The revised plan would almost certainly increase RIN prices across-the-board due to both the higher total renewable fuel requirement and the blanket small refinery waiver being incorporated into the percentage standards. The largest increase would likely be associated with D6 ethanol RIN prices because the enforced requirements would once again surpass the E10 blend wall. It is important to note that any increases in RIN prices would not impact small refineries since they would be exempted from complying with the volume requirements over 2020-2022. Non-exempt refineries would have to manage increased RIN price exposures, but, again, the available evidence suggests that refineries can pass higher RIN costs downstream through the fuel supply chain (Knittel, Meiselman, and Stock, 2017; Lade and Bushnell, 2019).

The impact on biofuel feedstock prices is likely to be positive since the enforced volume requirements will be higher over 2020-2022 compared to what would be the case under the current EPA policy on SREs. However, which feedstock prices would be most impacted and by how much is difficult to predict without knowing which biofuels will be used to comply with the higher requirements. If biodiesel continues to be the marginal gallon for filling the different parts of the RFS requirements, as discussed earlier, then biodiesel feedstock prices would be expected to increase the most. The main biodiesel feedstocks are soybean oil, fats and waste grease, and corn oil, with soybean oil representing more than half of the total. This suggests that soybean complex prices would be most impacted by the plan proposed here. Given the surplus of soybeans currently available in world markets, there should be adequate supplies to absorb the additional demand and moderate any price pressure from the higher RFS requirements.

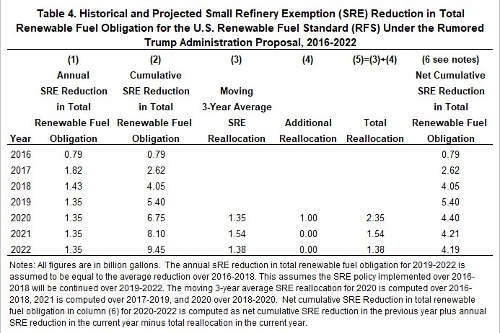

Finally, a somewhat different proposal is apparently being considered by the Trump Administration at the present time. Based on reporting in recent days (Renshaw and Kelly, 2019), this alternative proposal includes the following components: i) a 3-year moving average reallocation of waived SRE gallons starting in 2020, and ii) an additional reallocation of 1 billion gallons in 2020, reflecting an additional 500 million gallons for the advanced mandate and 500 million gallons for the total renewable mandate. No further details are available at this point. Table 4 estimates how this proposal might work in practice over 2020-2022. Key assumptions include: i) SRE policy continues unabated over 2019-2022; ii) the annual SRE reduction in total renewable fuel obligation for 2019-2022 is set equal to the average reduction over 2016-2018; and iii) the 3-year average reallocation is lagged by two years, with 2020 based on 2016-2018, 2021 based on 2017-2019, and so on. Under these assumptions, the net cumulative SRE reduction in total renewable fuel obligation again peaks at 5.4 billion gallons in 2019. The net SRE reduction then declines over 2020-2022 but only to 4.19 billion gallons. The reason is that SRE reductions continue to accumulate over 2020-2022, in contrast to the plan proposed here which stops SRE reductions starting in 2020 due to blanket SRE waivers. Consequently, the plan currently under consideration by the Trump Administration will not result in a significant restoration of waived SRE gallons. This, of course, assumes the assumptions used to make the projections in Table 4 are an accurate representation of the Trump Administration plan.

There is a way to modify the Trump Administration plan to completely restore waived SRE gallons. This is shown in Table 5 and it involves boosting the additional reallocation each year over 2020-2022 to 1.73 billion gallons. The total reallocation is then over 3 billion gallons each of these years, reflecting the backfill of waived SRE gallons from 2016-2019 and the continued granting of SREs over 2020-2022. The end point of zero waived SRE gallons is achieved as a result.

Summary

Implementation of the U.S. Renewable Fuel Standard (RFS) in recent years has been mired in controversy due to a seemingly obscure provision of the RFS that allows small refineries to be exempted from mandated volume requirements. A plan for implementing the RFS starting in 2020 is proposed that simultaneously provides economic hardship relief for small refineries and implements the mandates consistent with the original intent of the U.S. Congress. The plan entails two changes to the setting of annual standards: i) provision of a blanket waiver for all small refineries over 2020-2022; and ii) addition of 1.35 billion gallons to the total renewable volumes each year over 2020-2022 to restore reductions in effective volume requirements for 2016-2018. This plan would eliminate the RIN cost concerns of small refineries and the controversy surrounding how many SREs are awarded and to whom. It would also allow SREs to be accounted for when computing the final percentage standards each year. Finally, the plan is temporary, as it only applies to the 2020-2022 compliance years. Elements of the plan could be carried forward after 2022, when the volume standards will be reset.

The proposed plan would almost certainly increase renewable identification number (RIN) prices across-the-board due to both the higher total renewable fuel requirement and the blanket small refinery waiver being incorporated into the percentage standards. The largest increase would likely be associated with D6 ethanol RIN prices because the enforced requirements would once again surpass the E10 blend wall. The impact on biofuel feedstock prices is likely to be positive since the enforced volume requirements will be higher over 2020-2022 compared to what would be the case under the current EPA policy on SREs. If biodiesel continues to be the marginal gallon (least cost) for filling the different parts of the RFS requirements, then biodiesel feedstock prices would be expected to increase the most. Since soybean oil is the main biodiesel feedstock, this indicates that soybean complex prices would be most impacted by the plan proposed here. Given the surplus of soybeans currently available in world markets, there should be adequate supplies to absorb the additional demand and moderate any price pressure from the higher RFS requirements.