Weather wise, the month of May has not been kind. The US cotton production area has experienced extremes in weather. New crop futures prices have seen a bit of a bounce, but nothing to say we’re on the “road to recovery” yet.

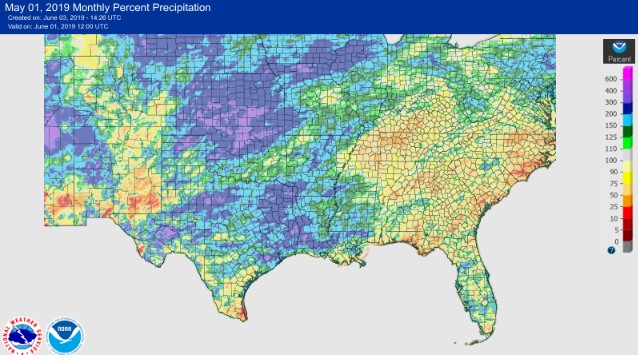

The Southeast is in a moderate drought with the non-irrigated crop being hammered by a combination of well below normal rainfall and record high temperatures. The entire “Coastal Plain” area from Southeast Alabama and the Florida Panhandle through Southern Georgia through the Carolinas and Virginia is extremely dry, with May rainfall well below normal. Dry conditions extend into west Tennessee, while most areas of the Mid-South have received heavy rainfall. Rainfall has been mostly above normal for most portions of Texas and Oklahoma.

So, over the past 30 days, we have had near drought conditions in some parts of the US cotton area, but much above normal rainfall in other areas. As of May 26, Georgia is ahead of average in planting, but producers are planting under dry conditions, and the crop will need moisture soon for a good start. The Mid-South is well behind normal due to abundant rainfall and planting delays (Arkansas and Louisiana—8 to 13 points behind; Mississippi and Missouri—21 to 37 points behind).

Overall, in the Mid-South there are questions and concerns about planting delays, prevented plantings, and the acres that ultimately will be planted or not planted. In the Southeast, there are concerns about the dry start, a dry May, and the outlook for enough rainfall to give marked improvement.

After dropping to the 65 to 66-cents area, prices (Dec19 futures) have solidified somewhat and are currently in the 68 cents neighborhood. This improvement is in-part due to the weather uncertainties. While the improvement is welcome, a 2-3 cent “rally” is not sufficient to make us feel like this market is ready to “recover”. The next numbers to watch will be the first USDA estimate of actual acres planted released on June 28th.

USDA’s May numbers contained some positive aspects—2019 crop year US exports are forecast at 17 million bales (a good level given the China uncertainties) and World use/demand at a record level. The 2019 US crop was pegged at 22 million bales, and early thoughts have been that the crop will have potential to do more than that—but the crop is off to a rocky start in many areas.

Combine the “positives” in the May numbers with an uncertain US crop, and THAT might be what sparks further rally. On the other hand, if those positives don’t pan out, and the US ends up with a 23+ million bale crop, prices might be hard pressed to see a “7” as the front number.

Talking with a few producers and gin managers, it seems producers might not be as far along in pricing and risk management of this year’s crop as we would like (back when Dec19 was in the 77-cents area). Some producers, for example, did not feel comfortable pricing because they were still waiting on financing for this year’s production. Producers who missed the opportunity at 77 cents, seem in no hurry to price now and wait and hope for a “rally” whatever that turns out to be.

We will eventually get the WHIP disaster funding, once all the political posturing is out of the way. The trade assistance program for 2019 has been announced, but with little details yet as to specifically how it will work and payments determined. This adds to the cash-flow uncertainty facing producers for 2019.