By Gary Schnitkey and Krista Swanson

Department of Agricultural and Consumer Economics

University of Illinois

By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

As wheat planting season approaches, we evaluate expected returns for crop rotations that include wheat. Given current 2021 grain bids, a combination of wheat and double-crop-soybeans is projected more profitable than either corn or stand-alone-soybeans in southern Illinois. Wheat alone is not more profitable than either corn or stand-alone soybeans. In central Illinois, stand-alone soybeans are projected more profitable than wheat-double-crop-soybeans.

Current 2021 Commodity Bids in Historical Perspective

Current bids for 2021 delivery in southern Illinois are:

- Wheat: $5.40 per bushel

- Corn: $3.45 per bushel

- Soybeans: $9.15 per bushel

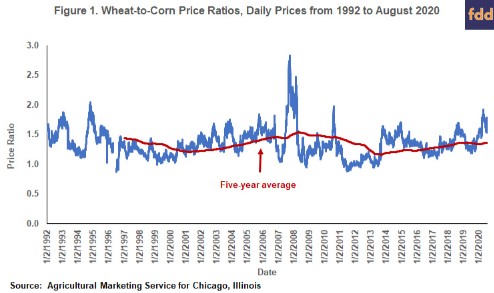

Currently, the wheat-to-corn price ratio is 1.56 ($5.40 wheat price / $3.45 corn price). Historically, the wheat-to-corn price ratio has averaged 1.34 from 1992 to the present (see Figure 1). Wheat prices now are relatively more favorable than corn prices from a historical perspective.

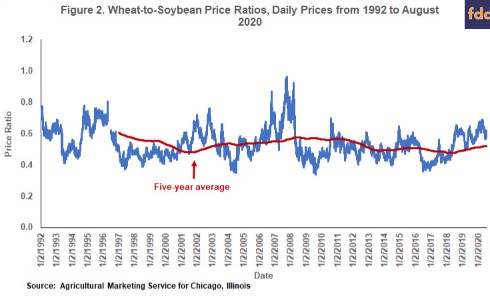

The current wheat-to-soybean price ratio equals .62 ($5.40 wheat price / $9.15 soybean price). Historical the wheat-to-soybean ratio averaged .53 from 1992 to the present (see Figure 2). Current bids place the wheat-to-soybean price ratio well above these historical averages, again suggesting that wheat prices are relatively high compared to soybean prices.

Southern Illinois Budgets

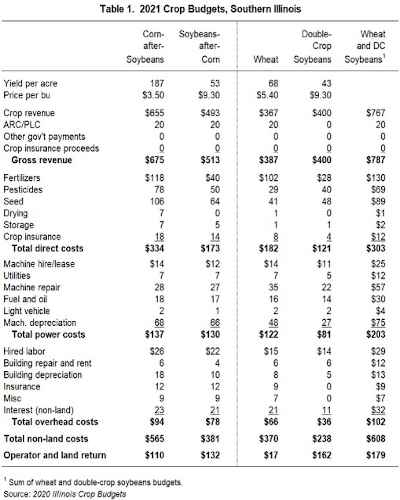

Table 1 shows 2021 crop budgets for Southern Illinois. These are adaptations of budgets published in the 2021 Illinois Crop Budgets, with commodity prices being the only values that have been changed. Commodity prices are set at current cash bids for 2021 delivery. Operator and land returns give the return to each crop and represent a return to both the farmer and landowner. If the farmland is cash rented, the cash rent would need to be subtracted from the operator and land return to arrive at farmer return. Property tax and mortgage interest would be subtracted from operator and land returns to arrive at farmer return for owned farmland.

The operator and land return for stand-alone wheat without double-crop soybeans is $17 per acre. This return is based on a 68 bushel per acre yield, which also happens to be the average estimated yield for Illinois in 2020. The $17 operator and land return is below the $110 return for corn with a 187 bushel per acre yield. The wheat yield would have to average over 85 bushels per acre for the stand-alone wheat return to exceed corn return. The $17 return also is below the $132 operator and land return for soybeans. For stand-alone wheat returns to exceed soybean returns, wheat yields would have to be above 89 bushels per acre.

Table 1 also shows double-crop soybean returns. Yields are at 43 bushels per acre, based on trend yields from Illinois FBFM farms raising double-crop soybeans. Wheat combined with double-crop soybeans has an expected return of $179 per acre, higher than returns for both corn ($110 per acre) and soybeans ($132 per acre).

Operator and land returns for southern Illinois from 2014 to 2019 averaged $103 per acre for corn, $181 per acre for soybeans, and $157 wheat-double-crop soybeans. On average, wheat-double-crop-soybeans have been more profitable than corn in recent years, but less profitable than soybeans. Current 2021 bids cause wheat-double-crop soybeans to be more profitable than soybeans and corn.

Central Illinois Budgets

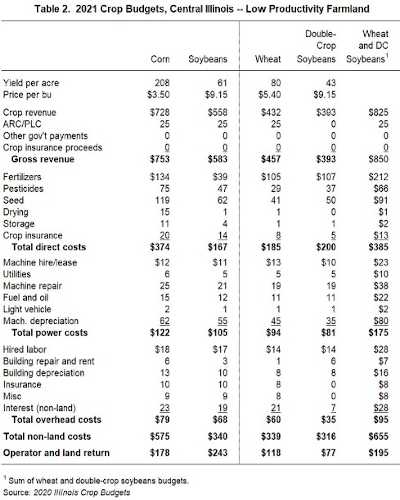

Table 2 shows budgets for low-productivity farmland in central Illinois. Yields are at trend-levels for corn (208 bushels per acre) and soybeans (61 bushels per acre). Stand-alone wheat with a yield of 80 bushels per acre has a $118 per acre returns, below both the returns for corn ($178 per acre) and soybeans ($243 per acre). For stand-alone wheat to have higher return than corn, wheat yield would have to exceed 91 bushels per acre. Stand-alone wheat would have to yield above 103 bushels per acres before stand-alone wheat is more profitable than soybeans.

The $195 per acre operator and land return for wheat-double-crop-soybeans is above the corn return ($178 per acre) but below the soybean return ($243 per acre). Unlike southern Illinois, soybeans are projected to be more profitable than wheat-double-crop-soybeans because of the higher relative soybean yields in central Illinois.

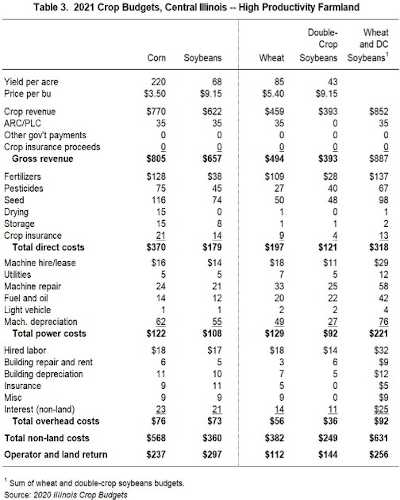

Table 3 shows for high-productivity farmland in central Illinois. Stand-alone wheat has a $112 per acre return, less than half the $237 per acre return for corn with a yield of 220 bushels per acre. Wheat yield would have to exceed 108 bushels per acre before wheat is more profitable than corn. The $297 per acre return for soybeans is $185 higher than stand-alone wheat. Wheat yield would have to be higher than 119 bushels per acre before wheat is more profitable than soybeans.

Wheat-double-crop-soybeans has an operator and land return of $256 per acre, above the $237 per acre corn return but lower than the $297 per acre soybean return. Ironically, wheat-double-crop-soybeans is competitive with corn in the heart of the corn-belt.

Why High Relative Wheat Prices?

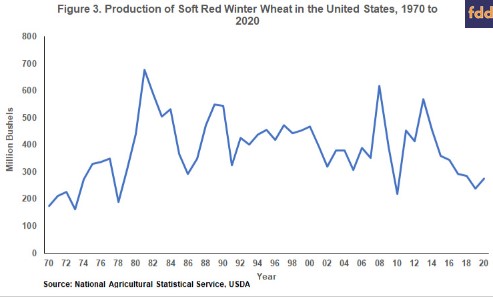

From a peak of 568 million bushels in 2013, soft red winter wheat production has declined most years (see Figure 3). The U.S. Department of Agriculture estimates 2020 U.S. production at 276 million bushels. This value is up from the 2019 value of 239 million bushels, but still below the 2015 through 2019 average of 304 million bushels. Milling demand for soft red winter wheat is offsetting reduced acreage and largely driving the relatively stable prices. As a result, any increases in production could quickly meet soft red winter wheat milling needs, leading to lower wheat prices relative to corn and soybean prices.

At the same time, COVID-19 social distancing measures have had less impact on wheat prices than on corn prices, with corn prices heavily impacted by a reduction in fuel and ethanol. Soybean prices have been supported recently on positive movement in export sales. As a result, soybeans are more profitable than corn across all regions using current prices for fall 2021 delivery. In the southern region, a combination of wheat and double-crop soybeans is expected to provide an additional layer of return above soybeans. In other regions, the wheat and soybean combination results in lower returns than stand-alone soybeans, although still above corn. Notably, a wheat and double-crop soybean combination may provide value to a farm in other ways, such as for agronomic benefits or if straw is needed for livestock. And farms may realize greater profits than stand-alone soybeans if a higher yield is achieved on the double-crop soybeans than 43 bushels per acre used in the budgets.

Commentary

Wheat-double-crop-soybeans is projected to be more profitable than either corn or stand-alone soybeans in southern Illinois, mainly because wheat prices have held relatively firm compared to corn prices. Wheat is projected to be less profitable than corn or stand-alone soybeans in central Illinois, but more profitable than corn when paired with double-crop soybeans.

If wheat is planted, pricing some of the expected 2021 production may be warranted. Wheat prices have been relatively stable so far in 2020, unlike those for corn. Any acreage increase in soft-red winter wheat acres could cause milling needs to be met, leaving excess wheat to compete with corn in the feed grain market and leading to declining wheat prices. At that point, the relative feed values would dictate the spreads between corn and wheat prices.

Source : illinois.edu