Wet and damp conditions increase fuel variable costs while warm and dry keep fuel costs in check.

‘Typically, Alberta crop producers will spend approximately $15 per acre for their fuel requirements over the duration of a crop year,’ says Ryan Furtas, market analyst with Alberta Agriculture and Forestry. ‘With just a few exceptions, the per acre fuel cost amounts to a per acre diesel cost, since nearly all farm machine engines burn diesel fuel. The $15 per acre fuel cost is somewhere between 5 or 10% of the crops total variable input cost.’

The per-acre cost of fuel is impacted by the price per litre of diesel as well as the amount or volume of fuel that is required on a per acre basis.

‘While the price of diesel depends a lot on crude oil values,’ he adds, ‘the amount of fuel depends a lot on the machine and also the environmental conditions - weather - that a producer encounters, especially during spring planting and fall harvest.’

Furtas notes that diesel prices in the spring of 2020 were as much as $0.25 per litre less compared to the spring 2019. Table 1. indicates that fall 2020 diesel prices remain lower compared to fall 2019 by 9 cents per litre.

Table 1. Diesel fuel, price of diesel marked farm fuel for fall months

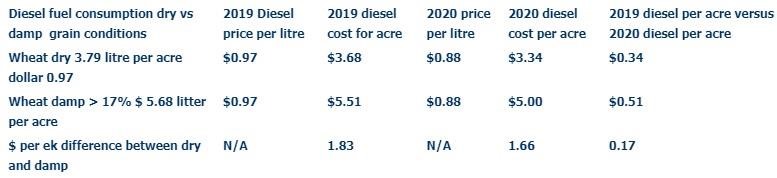

‘Table 2. shows the impact that $0.09 per litre drop in diesel price has at the per acre level,’ he explains. ‘Using a dry acre diesel consumption rate and the 2020 cost per litre amounts to a $3.34 per acre fuel cost, compared to the 2019 per dry acre diesel cost of $3.68 per acre. The cost difference between the 2 years amounts to a decrease of $0.34 per acre.’

Table 2. Fuel cost comparison of dry versus tough conditions with 2019 and 2020 diesel prices with 2019 and 2020 diesel prices

In addition to lower diesel prices, the 2020 harvest so far has had warm and dry field conditions. Threshing dry grain and oilseeds consumes much less fuel as machines work more efficiently than when grain and straw is damp or wet.

Furtas uses harvesting wheat as an example. ‘In standard dry conditions, and approximate fuel consumption rate is a simplified estimate of 3.79 litres per acre, or 1 U.S. gallon per acre. Compared to harvesting wheat in damp, over 17%, conditions where it can consume approximately 5.68 litres per acre, or 1.5 gallon per acre. Not using the extra 1.89 litres per acre, or 0.5 gallons per acre, results in keeping the fuel budget in check.’

‘Table 2. details the potential savings for a producer when harvesting in dry conditions,’ he adds. ‘Using the 2020 diesel cost of $0.88 per litre at the dry wheat acre rate of 3.79 litre per acre, puts the cost for 2020 at $3.34 per acre. Compared to a damp acre in 2020, that would cost $5.00 per acre based on the 2020 diesel price. The reduced volume of diesel required because of dry conditions amounts to $1.66 per acre savings.’

He notes that the savings from using less diesel due to dry conditions, $1.66 per acre, is considerably higher than the saving from a 9 cent per litre drop in price, or $0.34 per acre, not to mention, far fewer headaches.

‘The double whammy of lower prices and consumption rate results in an approximate $2.00 per acre reduction and keeps fuel costs within the predicted cost range,’ he explains.

‘More impactful is that it helps improves the per acre profit margin producers strive for, and goes to show that farmers can absorb an increase in the price of diesel much easier than an increase in consumption of diesel. Of course, a year where both are lower comes as significant benefit to a producer’s variable cost.’

Source : alberta.ca