Global fertilizer prices expected to finish 2025 about 20% higher than 2024

The global fertilizer market is still being driven by high input costs, energy price volatility (especially natural gas), and shifting supply dynamics heading into 2026. Farmers could expect sticky input expenses, affecting margins, crop budgets, and supply chain decisions throughout the year.

Current Trends

Fertilizer prices rose in 2025 compared to 2024, driven by strong demand and persistent supply constraints. According to the most recent Commodity Markets Outlook from the World Bank, global fertilizer prices could finish 2025 around 20% higher than the previous year, with urea, DAP (diammonium phosphate), and MOP (potassium chloride) all experiencing substantial gains due to tight exports and robust usage.

With fertilizer prices continuing to rise, this is reducing affordability for farmers and beginning to curb global demand; an effect Rabobank expects to intensify in 2026. While global fertilizer use is still increasing, high prices are set to slow that growth next year. In nitrogen markets, some analysts expect prices to ease as new production capacity becomes available, though the outlook remains uncertain.

Energy’s Role in Fertilizer Costs

Energy costs, especially natural gas, remain central to fertilizer costs. Natural gas is the primary feedstock for nitrogen fertilizers, meaning that gas price volatility directly affects production costs. In the United States and Europe, evolving Liquid Natural Gas (LNG) flows and storage conditions keep supply tight and prices elevated.

In contrast, broader energy markets show potential downward pressure on oil and gas prices into 2026, according to major financial institutions like Goldman Sachs and World Bank projections. They anticipate weaker energy price indices near year-end 2026 due to supply growth and slower demand.

A possible Ukraine–Russia peace deal in 2026 could ease sanctions on Russian oil and allow more crude back into global markets, putting downward pressure on prices (which has already been happening). If Russia’s exports rebound, they could add to an already large OPEC+-reported oversupply, and some analysts believe this extra volume could push oil prices below current 2026 forecasts.

Supply Chain & Geopolitical Factors

Trade dynamics continue to influence fertilizer markets. Export restrictions from major suppliers like China and sanctions affecting Belarusian potash shipments have tightened global fertilizer availability, contributing to price instability. But the U.S. has dropped sanctions on Belarus potash exports which is a small win, but it has a small impact on U.S. prices as it is only 5.7% of total exports to the U.S.

Capacity expansions in Middle Eastern and East Asian fertilizer production facilities are expected to moderate pressure on supply through 2026, but policy barriers such as the European Union’s Carbon Border Adjustment Mechanism, pose additional risks to cost structures and trade flows.

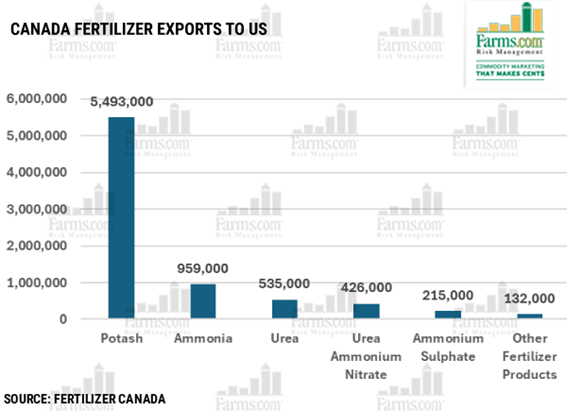

A major potential influence on the North American fertilizer market in 2026 is the possibility of U.S. tariffs on Canadian fertilizer imports, after President Donald Trump suggested imposing “very severe tariffs” to reduce dependence on foreign supply and boost domestic production. Because Canada is the dominant supplier of several key fertilizer nutrients like providing more than 80% of U.S. potash imports, any tariff-driven price increase could significantly raise input costs for American farmers and disrupt the tightly integrated North American fertilizer supply chain.

Implications for Farmers & Outlook

Lower energy (diesel fuel) costs may offset some of the higher fertilizer input costs. Experts suggest that farmers will need to adapt and adopt strategies to manage budgets carefully. U.S. government data suggests fertilizer can comprise up to 40% of some crop production costs, highlighting the severe budget pressure caused by increasing input costs.

Looking ahead, fertilizer markets may see some price moderation as new supplies come online. However, lingering affordability challenges and energy cost volatility suggest that 2026 will remain a cautious year for farm input planning.