Nick Paulson and Gary Schnitkey

Department of Agricultural and Consumer Economics

University of Illinois

Producers of program commodities will face program enrollment decisions for the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs in 2021. Farmers of eligible crops will also be able to utilize a new supplemental crop insurance program called the Enhanced Coverage Option (ECO) in 2021. This article summarizes the material covered in the Illinois Farm Economics Summit (IFES) webinar held on December 8th, 2020.

ARC and PLC

For the 2021 crop year, producers will once again be making an enrollment decision between the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs as part of the 2018 Farm Bill. In 2019, producers made enrollment decisions which covered the 2019 and 2020 crop years. The 2021 decision will be for the 2021 crop year only, with a deadline of March 15th 2021.

Enrollment decisions made in 2019 favored PLC for corn and wheat base acres, and ARC-CO for soybean base acres. PLC payments were triggered for both corn and wheat for the 2019 crop year. ARC-CO payments were triggered in some areas for all three crops for the 2019 crop year.

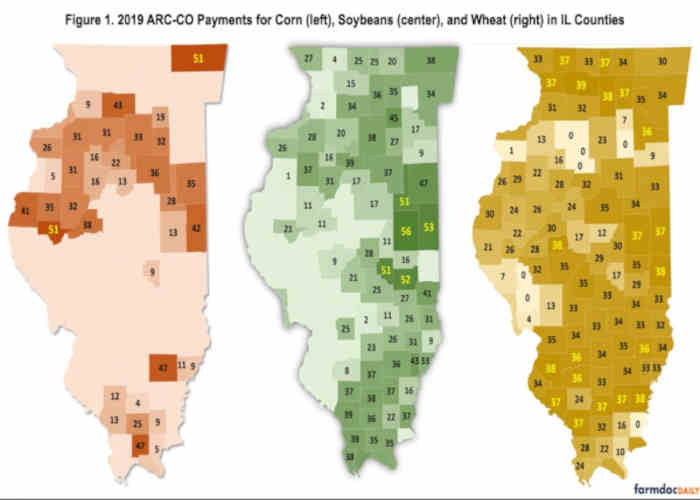

The 2019 PLC payment rate for corn was $0.14 per bushel, based on the 2019 marketing year average (MYA) price of $3.56 being below the $3.70 reference price. Payment levels vary based on PLC program yields of individual farms but were likely in the range of $18 to $22 per base acre range for most farms throughout Illinois. ARC-CO payments for corn were triggered in a band of counties across the northern half of Illinois, and in various counties in southern Illinois (see left panel in Figure 1). ARC-CO payments exceeded $50 per base acre in two counties but tended to be in the $30 to $40 range for most counties where they were triggered.

The 2019 MYA average price for soybeans was $8.57, above the $8.40 reference price thus not triggering PLC payments. ARC-CO payments on soybean base were triggered on the majority of Illinois counties, with many counties in the western portion of the state being the exception (see center panel of Figure 1). Payments exceeded $50 per base acre in some counties but tended to be in the $25 to $40 range throughout most of Illinois.

The 2019 MYA price for wheat was $4.58, resulting in a $0.92 per bushel PLC payment rate and large PLC support in the $40 to $45 range for most Illinois farms. ARC-CO payments on wheat were also triggered across most counties in Illinois, with payments usually in the mid- $30 range (see left panel of Figure 1).

Current price projections from the USDA do not suggest large payments from PLC or ARC-CO for the 2020 crop year for corn or soybeans. Similarly, longer-term forecasts based on futures do not suggest large program payments from either program in 2021. For wheat, large PLC payments are expected in 2020, and longer-term forecasts suggest PLC payments might also be triggered in 2021. Yields below trend would likely be required to trigger ARC-CO payments in 2021.

The farm-level ARC program – ARC-IC – played a major role in 2019 given the large number of prevent plant acres in 2019 and the late timing of enrollment decisions for 2019 and 2020. ARC-IC may still be considered on a farm-by-farm basis, but it is not expected to be the preferred program choice in as many cases for 2021.

The early advice for the 2021 farm program enrollment decision is that current price expectations suggest limited support from ARC and PLC to corn and soybeans, with a greater likelihood of PLC support for wheat for the 2021 crop year. More information will become available prior to the March 15th deadline, but producers should keep in mind that 2021 MYA price expectations will still very much be based on forecasts over the next few months.

Enhanced Coverage Option

Historical insurance use figures illustrate the strong preference of farm-level revenue products and high coverage levels among Illinois farmers (farmdoc daily, November 17, 2020; December 1, 2020). Uptake of area-based plans, including the Supplemental Coverage Option (SCO) which was introduced in the 2014 Farm Bill, has not been as large.

In 2021, a new supplemental area-based insurance program called the Enhanced Coverage Option (ECO) will become available. Similar to SCO, ECO will provide county-based coverage for a portion of the farmer’s deductible range. Specifically, farmers can choose coverage levels for ECO of either 95% or 90% with coverage extending down to 86%. An underlying individual plan of insurance, such as RP, will be required to be eligible for ECO. Unlike SCO, ECO eligibility is not tied to farm program choice – acres covered by ARC or PLC programs will both be eligible for ECO coverage.

Because of the high coverage level options for ECO, premiums will be relatively large even after accounting for premium assistance (44% subsidy if used with revenue coverage; 51% if used with yield coverage). Premiums reflect the fact that ECO will trigger payments often due to the high coverage level options. Producers will need to weigh the benefits of frequent and potentially large payments against the premium cost and area-based coverage aspect of ECO as they decide whether or not to utilize the new insurance program in 2021. More detailed analysis of the program has been covered in a series of recent farmdoc daily articles (November 24, 2020; December 8, 2020; December 10, 2020; December 15, 2020; December 22, 2020).

Source : illinois.edu