The 2021 U.S. and Canadian spring wheat crops have faced dryness issues since seeding.

‘Record temperatures the last week of June added more stress to struggling crops,’ says Neil Blue, provincial crops market analyst with Alberta Agriculture and Forestry. ‘Many areas on the Prairies and in the United States have experienced abnormally dry conditions, which in turn has affected wheat prices.’

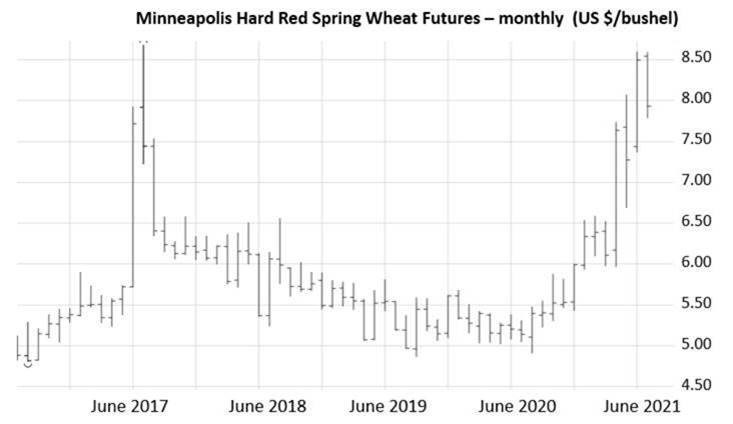

The Minneapolis hard red spring wheat futures rallied the week of June 28 to the highest level since dryness concerns in 2017. In Alberta, hard red spring wheat prices reached $360/tonne ($9.80/bushel) or higher.

‘Likely implications of lower hard red spring wheat supplies for next crop year are improving price spreads to lower quality wheats and higher protein premiums,’ explains Blue.

Image 1. Minneapolis hard red spring wheat futures – monthly (US$/bushel) Source: Barchart.com, MGEX

The USDA released crop condition ratings on July 6. United States spring wheat conditions dropped another 4% to just 16% good to excellent. Montana wheat crop conditions dropped sharply to only 7% in good to excellent condition. North Dakota wheat crop conditions dropped 2% to 18% good to excellent. Rain in the previous week helped spring wheat conditions improve in Minnesota to 35% good to excellent.

‘Following the U.S. Independence Day holiday, wheat futures were sharply lower on rain and forecast rains in the northern U.S. and southern Canadian Prairies. The U.S. and southern Prairie spring wheat crops are headed out, so maximum kernel count is set. Rain in the dry areas could still result in a good quality wheat crop, but yield is unlikely to be above average,’ says Blue.

Source : alberta