A shorter claim form and new renewal package have been developed to make it easier for customers to participate in AgriStability.

The Year-end Report and Claim Form has been developed to replace the Year-end Application. The form is now half the length, and the section on reporting of farm information has been significantly streamlined to make it easier to complete. As well, a tip sheet has been developed to help producers avoid common errors when filling out the form.

The Year-end Report and Claim Form is available online in a prepopulated format with built-in prompts that make it easier for customers to provide the right information. Producers are invited to visit agricorp.com/agristability-webinar and watch the segment titled New AgriStability Claim Form for a demonstration on how to complete the form. The June 30 deadline to submit the form has not changed.

The new renewal package includes a renewal notice detailing the customer's information on file at Agricorp. Receiving the information at the beginning of the program year allows customers to review and notify Agricorp of any necessary changes that may affect their coverage. The package is being mailed in advance of the April 30 deadline.

AgriStability protection

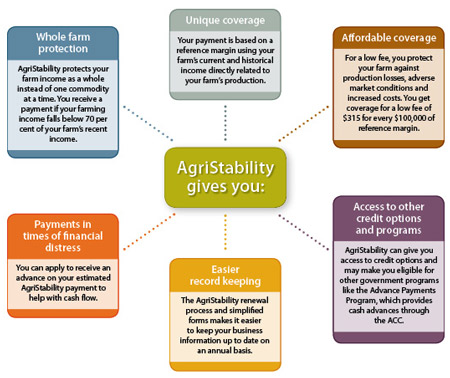

AgriStability is an important part of a comprehensive suite of business risk management programs. AgriStability protects producers from large declines in their farming income caused by production loss, increased costs or market conditions.

Source: Agricorp