By Gary Schnitkey, Krista Swanson, Ryan Batts

Department of Agricultural and Consumer Economics

University of Illinois

and

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

We stand at a point of extreme price and policy uncertainty. In the Midwest, corn planting is historically late and many acres are or soon will be eligible for prevented planting payments on corn crop insurance policies. On many farms, corn prices have not increased enough to cause net returns from planting corn to exceed net returns from prevented planting. However, the U.S. Department of Agriculture announced a 2019 Market Facilitation Program (MFP) and has currently indicated that payments will be tied to 2019 planted acres. The 2019 MFP could provide incentives to plant crops and not take prevented planting payments. Moreover, this program could bring a little used option into play this year: take 35% of the corn prevented planting payment and plant soybeans after the late planting period for corn. Adding confusion to this situation is a disaster assistance program working its way through Congress. We provide detail on the 2019 MFP program based upon what is known at this time, and the Congressional disaster assistance bill. Then, we evaluate farmer options at this point. Decisions are difficult. Corn prices have not risen enough to justify planting corn on many farms. Yet, corn prices could increase if a large number of prevent planting acres occur.

2019 Market Facilitation Program Payments

In a

May 23rd press release, the U.S. Department of Agriculture (USDA) outlined the 2019 Market Facilitation Program (MFP). This program is projected to provide $14.5 billion in direct payments to farmers of specific commodities, $4.9 billion more than the $9.6 billion spent on the 2018 MFP (

Schnepf, Monke, Stubbs, and Hopkinson). Important details of this program are:

- Payments will be based on 2019 planted acres to MFP-covered crops. USDA has initially stated that payments will not be received on prevented planting acres but the final details have yet to be released. By itself, this provision provides incentives to plant crops and not take prevented planting payments.

- MFP-covered crops in 2019 include corn, soybeans, wheat, alfalfa hay, barley, canola, crambe, dry peas, extra-long staple cotton, flaxseed, lentils, long grain and medium grain rice, mustard seed, dried beans, oats, peanuts, rapeseed, safflower, sesame seed, small and large chickpeas, sorghum, sunflower seed, temperate japonica rice, and upland cotton.

- There will be a single payment rate for a county. That per acre payment rate will be based on total plantings of the MFP-covered crops on the individual farm. Acres planted to an individual crop will not matter other than its contribution to total planted MFP crops on the farm. As an example, suppose that MFP rate for a county is $50 per acre. A farm with 60 acres in corn and 40 acres in soybeans will have 100 MFP acres and receive $5,000. The farm will also receive $5,000 if 40 acres are corn and 60 acres are soybeans.

- Payments acres in 2019 cannot exceed the payment acres on the farm for the 2018 MFP. This restriction is designed to prevent more acres moving into covered crops, particularly from grasslands or lands typically not farmed. It will most likely be made on a Farm Service Agency (FSA) farm basis. A farm that had 80 MFP-acres in 2018 cannot receive payments on more than 80 acres in 2019. (see, Perdue Provides More Clarity on Tariff Aid).

- Payments will be made in three tranches, the first in late July/early August after the July 15th planting reporting date with the Farm Service Agency (FSA), November, and early January. Whether or not the November and early January payments are made will depend on USDA determination on the need for these payments.

Many important questions remain to be answered regarding 2019 MFP payments; the answers to these questions could affect 2019 planting decisions. The most important question is: What are the 2019 per acre payment rates? The Farm Service Agency (FSA) likely will not release payment rates until after prevent planting decisions have been made. To aid in decision-making, we calculated 2018 MFP payments as if they were applied on a county basis for Illinois. In these calculations, we used the 2018 MFP rates ($1.65 per bushel for soybeans, $.01 per bushel for corn, and $.14 per bushel for wheat), and 2018 acres and yields from National Agricultural Statistical Service (NASS). Per county payment rates ranged from $30 per acre to $69 per acre, with an average of $53 per acre.

Obviously, $53 per acre will not be the average for Illinois in 2019. How it will vary from the $53 per acre is a good question. The $14.9 billion allocated for 2019 is about 50% higher the $9.6 billion spent in 2018 on MFP. An increase of 50% would raise the average to $80 per acre. Conversely, there are many more crops included in the MFP program in 2019. Those crops newly added to the 2019 MFP increases potential MFP payment acres by 11%. More crops could cause 2019 payments to be lower than 2018 payments.

For this analysis, we will use a 2019 MFP value of $25 per acre. Again there is little historical experience on which to base an estimate. It seems prudent to include some sort of conservative estimate. There are reasons to be conservative, including the fact that 2019 MFP payments will be made in three tranches with no guarantee of receiving the latter two payments. For farmers who believe that payments will be larger, we suggest the highest payment rate is not likely to be more than the previously discussed 50% increase over last year’s estimated average county rate for Illinois.

In addition, questions exist on payment limits. There was a $125,000 per person payment limit on 2018 program. In a radio interview, Secretary Purdue indicated that this limit would be structured differently in 2019 (see,

Perdue Provides More Clarity on Tariff Aid).

Ad hoc Disaster Assistance in the Supplemental Appropriations Bill

Disaster assistance provisions are contained in a supplemental appropriations bill currently working its way through Congress. This bill will provide assistance as a consequence of “Hurricanes Michael and Florence, other hurricanes, floods, typhoons, volcanic activities, snowstorms, and wildfires occurring in calendar years 2018 and 2019 under such terms and conditions as determined by the Secretary.” Among other things, the bill will:

- Increase the prevent payment factor on crop insurance up to 90% at the discretion of the Secretary. Currently, prevented payment factors are 55% for corn and 60% for soybeans.

- Use the higher of the projected and harvest price in determining prevented planting claims. Currently, only the projected price is used and, notably, only cotton had a higher harvest price in 2018.

Our reading of the bill suggests that, as currently written, it is not likely to be applicable to most counties in the Midwest. Passage of this bill has been blocked and will not likely be considered again by Congress until after June 3.

Prevented Planting and Planting Decisions

Final planting dates for corn in Midwest states are May 25, May 31, and June 5 Table 1 shows estimated acres left to be planted by final planting date for each state. Several states have multiple final planting dates. In Table 1, each state is categorized by final planting date according to the date containing the most counties (see map in farmdoc daily,

May 7, 2019 for more detail by county). Given planting progress at the end of May 26, about 36 million acres are yet to be planted in Midwest states, or 46% of intended acres have yet to be planted. Weather forecasts for this week suggest that many acres will still be unplanted by next week.

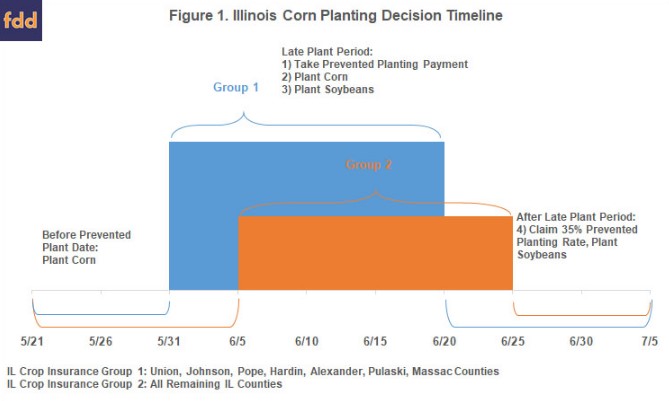

Figure 1 shows a timeline of options for making planting decisions for corn in Illinois. A similar timeline with different dates exists for soybeans (see Appendix Figure 1). The final planting date is June 5 for most Illinois counties. The exceptions are the seven southernmost counties, which have a final planting date of May 31.

The “prevent plant” decision process is illustrated for corn with a June 5 final planting date for corn. After June 5 (the final planting date), a farmer can determine whether or not to take a prevented planting payment on corn acres. This is a farmer-based decision. Field conditions after June 5 do not matter. A farmer can decide to take a prevent plant payment on corn anytime during the late planting period. For corn, the late planting period is 20 days long in Illinois, resulting in a decision between June 6 and June 25. Once a farmer has determined to take prevent planting payment, the crop insurance agent should be notified within 72 hours. As a result, the farmer can notify the crop insurance agent from June 5 to 72 hours after the end of the late planting period (June 26). We suggest notifying crop insurance agents sooner rather than later. Importantly, acres eligible for corn payments need to be determined. Farmers may also be asked to provide evidence that they intended to plant corn on acres on which prevented payments are taken (seed corn receipts, field maps, etc).

Anytime during the late planting period (June 5 to June 25 for corn in most of Illinois), corn can be planted. Note, however, that crop insurance guarantee will decrease one percent per day. Corn can be planted after the end of the late planting period (June 25), but the guarantee will be 60% of the original. On farmland intended for corn, soybeans could be planted as well. Farmers could take 35% of the corn prevented planting payment and then plant soybeans after the late planting period (June 25).

A similar set of decisions exist for acres intended for soybeans. Dates for the final planting date and late planting period differ from corn (see Appendix Figure 1).

In the following sections, we focus on decisions for corn after the final planting date has arrived for corn. All of these options only apply to acres eligible for corn prevented planting payments that have not been planted to corn (see farmdoc daily,

May 14, 2019, for a more in-depth discussion of these alternatives):

- Take a corn prevented planting payment and plant no crop (planting a cover crop is allowed and a full payment will be received if the cover crop is not hayed or grazed before November 1),

- Plant corn,

- Plant soybeans (or another crop for harvest),

- Take 35% of the corn prevent planting payments and plant soybeans (or another crop for harvest) after the late planting period for corn.

Each option is discussed in the following sections using the example shown in Figure 2. Figure 2 is a screen image from the Prevented Planting Comparison Tool, a sheet in the Planting Decision Model, a Microsoft Excel spreadsheet

available for download from the farmdoc website. This tool has been modified to allow for entry of 2019 MFP payments under the planting options. We suggest downloading the new version of the tool. Revisions of this tool will be implemented as more details of the programs become available.

The example in Figure 2 is for a farm with a 220 bushels per acre Actual Production History (APH) yield. This is a very productive farm. As productivity goes down, as measured by a lower APH, the profitability of planting corn will decrease from the results shown here.

Option 1: Take a Corn Prevented Planting Payment

The example has a 220 bushel APH yield and has Revenue Protection (RP) at an 85% coverage level. The projected price for 2018 is $4.00 per bushel. Given a prevented planting payment factor of 55%, the farm will have the option to receive a $411 prevented planting payment (.55 prevent planting payment factor x .85 coverage level x 220 APH yield x $4.00 projected price). The example has $25 of weed control costs and $18 of crop insurance premium, giving a net return of $368 per acre. Note that this $368 per acre is not net income. Overhead and land costs still must be subtracted, likely resulting in losses on many farms.

Again, prevented planting payments are available after the final planting date for the insured crop has arrived, given that prevented planting is widespread in the area, a condition likely to be met this year. Several items to note about this scenario:

- Prevent planting does not need to be taken on all acres in an insurable unit. The lowest limit for prevent planting is 20 acres or 20% of the total acres in the insurable unit.

- Prevent planting payments will be limited to acres eligible for prevent planting in that crop (generally the highest number of acres planted in the last four years, adjusted for size increases). If 400 acres are eligible for corn prevent planting payments and 300 acres are planted to corn, prevent planting can be taken on 100 acres.

- Farmers need to notify crop insurance agents about their intention to take prevent planting after the final planting date has arrived. Note that soybeans cannot be prevented from planting until the soybean final planting date arrives. Farmers should notify their agents as soon as practical. Importantly, acres eligible for corn prevented planting payments need to be determined.

- Prevented planting acres will not be eligible for 2019 MFP payments, according to current comments from USDA but the rules are not yet final.

- Farmers can plant a cover crop on prevented planting acres. This cover crop cannot be hayed or grazed until November 1.

Option 2: Plant Corn

Corn can still be planted after the final planting date. Figure 1 shows the option to plant corn with the following assumptions:

- Yield will be 190 bushels per acre. This is based on trial work done at the University of Illinois for planting in the first week of June.

- Cash price of corn is $4.10. Cash prices have been rising in recent days.

- A $25 per acre MFP payment is included. This is a guess. No information has been provided on 2019 MFP payment rates.

- $469 of costs are left to be incurred.

In this case, expected net returns are $335 per acre. Note that this $335 per acre is not net income. Overhead and land costs still must be subtracted, likely resulting in losses on many farms.

The $335 of net returns is lower than the $368 of net returns from taking the prevented planting payments. Planting corn would have the same return as taking a prevent plant payment if:

- The 2019 MFP payment is above $58 per acre and the full payment is paid out.

- The corn price is above $4.28 per bushel, $.18 higher than the $4.10 price used in the example

One of the assumptions built into this scenario is a yield of 190 bushels per acre based on planting soon after June 5. Later planting dates will likely result in lower yields and lower net returns. Net returns were calculated for different yields and later planting dates (impacts RP revenue guarantee):

- $326 per acre net return at a 173 harvest yield planted on June 10,

- $273 per ace net return with a 158 harvest yield planted on June 12,

- $220 per acre net return with a 142 harvest yield planted on June 19, and

- $85 net return with a 129 harvest yield planted on June 26 (guarantee is 60% of original guarantee, resulting in no crop insurance guarantee).

Several items to note about this scenario:

- The 2019 yield will enter into the APH yield calculation, likely resulting in lower APH yields in future years. In contrast, taking prevent plant has no impact on future APH yields.

- There is considerable yield and price risk given the large amount of unknowns this crop year.

- Costs could be much higher than shown in Figure 1. In particular, drying costs could be very large due to late harvest of late planted corn.

- Supply of corn likely will be low this year, leading to higher corn prices. If prevent planting occurs on many acres, much higher corn prices could occur to ration limited supplies (see farmdoc daily, May 23, 2019 and May 28, 2019).

Option 3: Plant Soybeans

Figure 1 shows the option to plant corn with the following assumptions:

- Soybean yield will be 50 bushels per acre.

- Soybean price is $8.40 per acre.

- $256 costs are yet be incurred for soybeans.

In this case, net return is $276 per acre, lower than the $335 per acre expected return for planting corn. At this point, switching acres from corn to soybeans does not seem advisable. Soybean would have the same net return as corn if:

Soybean yield is 69 bushels per acre, or

Soybean prices is $10.20 per bushel.

Option 4: Take 35% of the Prevented Planting Payment and Plant Soybeans After the Late Planting Period for Corn

The fourth option is planting soybeans (or another crop) after the late planting period for corn, which reduces the corn preventing planting payment to 35% of the total corn prevented planting payment. In this case, the farmer will only be charged 35% of the original premium but will be required to purchase a policy for the crop that is planted, such as soybeans, at the full premium rate. Our understanding is that FSA will treat the soybeans planted in this situation as eligible for MFP payments. There is uncertainty about this interpretation, however.

This option will require farmers to wait until after the late planting period for corn is over to plant soybeans. In Illinois, the late planting period for corn is 20 days, resulting in the end of the late planting period being June 25 for counties with a June 5 final planting date. Notably, this is past the final planting date for soybeans in Illinois. Soybeans planted under this option will already be subject to a reduced revenue guarantee at this point.

We estimated a return for these alternative assuming that soybeans are planted on July 1 for the farm depicted in Figure 1. Revenues are:

- $144 per acre in corn prevented planting payments (35% of $411 the corn prevented planting payment),

- $25 per acre in 2019 MFP payment,

- $324 per acre in soybean revenue (Cash price is $8.10 and yield is 40 bushels per acre), and

- $125 in crop insurance revenue from soybeans (This was calculated using a 40 actual yield and an $8.60 harvest price. An RP policy is used with an 85% coverage level and a 65 bushel per acre APH yield. Note that the crop insurance guarantee is going down because soybean planting is occurring after the final planting date of June 20).

Expenses are:

- $6 in corn insurance premium (35% of the corn insurance premium), and

- $273 per acre in soybean costs (including a full premium on soybean crop insurance).

The $279 per acre in costs is subtracted from the $618 per acre in revenue to arrive at net returns of $339 per acre. The $339 per acre is $29 per acre lower than the $368 projected return from prevented planting, but $4 per acre higher than planting corn.

Obviously, substantial risk exists for this alternative. Moreover, this alternative will lower the APH yield for corn (60% of the approved yield will be used in the APH history) and will likely lower future APH for soybeans due the likelihood of lower soybean yields in 2019.

This alternative does not need to be decided on now. A farmer could begin by taking a corn prevent planting payment, and then decide if this option seems like a beneficial alternative later in June.

Commentary

A great deal of uncertainty exists and the introduction of potential 2019 MFP payments has added to that uncertainty and the confusion. Given the large number of acres yet to plant, and the rainy weather forecast for the coming week, it seems certain that a record number of corn acres will be prevented from planting.

The above analysis was conducted with a very productive farm. Farms with lower APHs will find that break-even corn prices are higher than those shown in this article (see Figure 3). At lower APHs, the prevent plant decision will likely have higher expected returns than planting corn. Costs yet to be incurred and coverage level of crop insurance also impact those break-even levels (see farmdoc daily,

May 21, 2019).

At this point, higher corn prices are needed to bring acres into planting. On some farms, cash corn prices likely need to approach or exceed $5.00 per bushel before planting corn is economically attractive (see Figure 3). Whether or not prices rise to these levels is an open question.

In this environment, decisions will be difficult for farmers. Farmers can take prevented planting payments and accept a known return that will likely result in negative farm incomes, especially for high dollar rented land. Alternatively farmers can plant and hope for higher prices and higher returns, with considerably more downside income risks than taking prevented planting payments.

For many farms, a blended strategy may be in order. Planting corn on highly productive and fit farmland may be warranted while taking prevented planting payments on lower productivity farmland.

Summary

Planting decisions are difficult this year due to weather, the prevent plant option, and unprecedented policy uncertainty. These same factors make it difficult to pinpoint price dynamics. Moreover, widespread late planting has not occurred with the prevented planting provisions that exist today and there is no precedent for the introduction of a direct payment tied to planting decisions at this stage of the crop year, making farmer behavior difficult to predict. It is a difficult year to form expectations on which to base prevented planting decisions.