By Gary Schnitkey and Ryan Batts et.al

Department of Agricultural and Consumer Economics

University of Illinois

By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

The 2021 Crop Insurance Decision Tool has been released to aid in crop insurance decisions. It is a Microsoft Excel workbook that can be downloaded from farmdoc (here). One sheet in this workbook provides farmer-paid premiums for different federally-regulated policies administered through the Risk Management Agency. This Premium Calculator has been revised to include Enhanced Coverage Option (ECO), a new plan available for the first time this year (see farmdoc daily, November 24, 2020, December 8, 2020, December 10, 2020).

2021 Premium Calculator

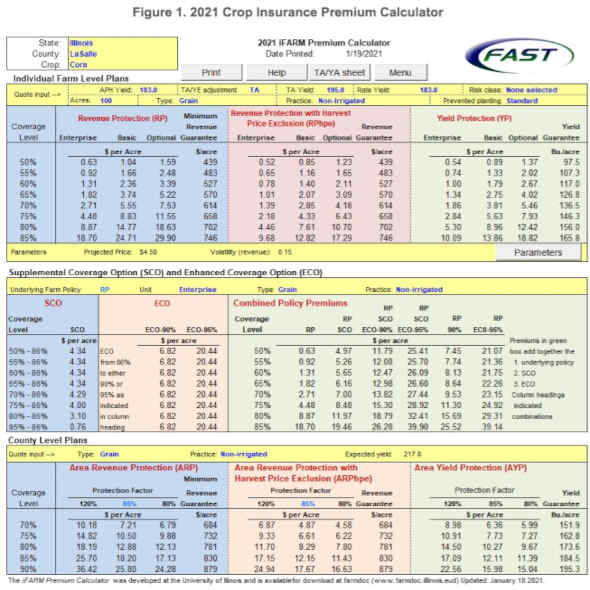

Figure 1 shows the 2021 Premium Calculator, which gives farmer-paid premiums for a user-specified county and crop, corn for LaSalle County in Illinois in this example (see top left corner of Figure 1). Once a state and crop is selected, default values are brought in for all parameter items, which have blue lettering on yellow background. Defaults represent a typical case for the county, and can be changed.

Once county and crop have been selected, three sets of premiums are given in three panels 1) Individual Farm Level Plans, 2) Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO), and 3) County Level Plans.

Individual Farm Level Plans

Farm-level plans insure yield or revenue using yields from the insured unit. There are three plans for farm coverage:

- Revenue Protection (RP). RP provides revenue insurance with the guarantee increase.

- Revenue Protection with the harvest price exclusion (RPhpe). RPhpe provides revenue insurance without a guarantee increase.

- Yield Protection (YP). YP provided yield insurance.

Premiums are given from the low coverage level of 50% up to the highest coverage level of 85%. For each plan, premiums are given for three different insurance units:

- Enterprise — all of one crop in a county.

- Basic — all of one crop in a county under the same ownership split. All owned and cash rent farmland will be in one basic unit, while each share rent farmland under differing ownership will form another unit.

- Optional — divides basic units into units based on township sections.

Premiums are given for each type of unit based on parameters specific to that insurance unit, given in yellow at the top of the panel:

- Actual Production History (APH) yield is based on the last ten years of yields with substitutions made for low yields. The APH yield for the example farm in Figure 1 is 183 bu/acre.

- TA/YE Adjustment indicates whether the Trend Adjustment and Yield Exclusion (YE) is used. In the example, the “TA” selection indicates that the trend adjustment is used.

- Trend Adjusted (TA) yield is the APH yield adjusted for trend. The TA yield for the example farm in Figure 1 is 195 bu/acre.

- Rate yield typically is the historic yield from the unit. If no yields are substituted, the rate and APH yields often are the same, which if often the case in northern and central Illinois. In the example, rate yield is 183 bu/acre, the same as the APH yield.

- Risk class indicates whether the farmland is in an area of high risk as denoted by the Risk Management Agency. In the example, “none selected” means that the unit does not contain high risk farmland.

- Acres are the total acres in the unit. The example unit in Figure 1 has 100 acres.

- Type of crop. The type of crop in the example, is “grain”, a standard type in Illinois.

- Practice in production. The type of crop in the example, is “non-irrigated”. Corn also has an “irrigated” practices.

The Tool will bring in default values that represents the average or prominent inputs for the particular county.

Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO)

When a farm-level plan is purchased, farmers also can purchase county-level products that provide coverage on top of the farm-level coverage:

- Supplemental Coverage Option (SCO) provides protection for 86% to the underlying farm level policy (farmdoc Daily, March 12, 2019, January 31, 2020).

- Enhanced Coverage Option (ECO) provides protection from either 90% or 95% down to 86% (see farmdoc Daily, November 24, 2020, December 8, 2020, December 10, 2020).

ECO is new this year and can be purchased with or without SCO. Use of either (or both) ECO and SCO requires the purchase of an underlying farm-level COMBO policy.

Users of the Tool can choose the underlying farm-level product: RP, RPhpe, or YP. Based on this choice, the Tool will bring in the appropriate SCO and ECO quotes. In the example shown in Figure 1, SCO and ECO are shown for RP. The highest SCO premium is $4.34 per acre when the underlying RP policy has a coverage level of less than 65%. The lowest SCO premium is $.76 per acre for the 85% RP policy.

There are two premium costs for ECO, one for each of the coverage band options. ECO has an $8.02 per acre farmer paid premium to cover the band from 90% to 86%. An ECO-95% policy provides coverage from 95% down to 86% for a farmer-paid premium of $24.04 per acre.

The SCO and ECO panel also shows total premium costs for combinations of the underling COMBO plan, SCO, and ECO. These are shown in green in the right-hand portion of the SCO and ECO panel. In Figure 1, RP is used as the underlying policy at the enterprise unit level, as indicated by user inputs. Seven combinations are given:

- RP (or the underlying COMBO product). These premiums are the same as in the “Individual Farm Level Plans” panel. An 85% RP policy has a farmer-paid premium of $18.70 per acre.

- RP plus SCO. Purchasing an 85% RP and SCO has a cost of $19.46 per acre, the sum of the $18.70 RP and $.76 SCO premiums.

- RP plus SCO plus ECO-90%. This combination has a $26.28 per acre farmer-paid premium ($18.70 RP + .76 SCO + $6.82 ECO-90%).

- RP plus SCO plus ECO-95%. This combination has a $39.90 per acre farmer-paid premium ($18.70 RP + .76 SCO + $20.44 ECO-95%).

- RP plus ECO-90%. SCO does not have to be purchased with ECO. This combination has a $25.52 per acre farmer-paid premium ($18.70 RP + $6.82 ECO-90%).

- RP plus ECO-95%. SCO does not have to be purchased with ECO. This combination has a $39.14 per acre farmer-paid premium ($18.70 RP + $20.44 ECO-90%).

County Level Plans

County products make payments based on county revenue or county yields. Plans include

- Area Revenue Protection (ARP). ARP provides revenue insurance with the guarantee increase.

- Area Revenue Protection with the harvest price exclusion (RPhpe). RPhpe provides revenue insurance without a guarantee increase

- Area Yield Protection (YP). YP provides yield insurance.

Premiums are given for coverage levels from 70% to 90% in 5% increments. Area plans also can be purchased at protection levels from 120% down to 80% in 1% increments. The Tool gives premiums for an 120% protection levels, a user-specified level, and an 80% coverage level.

The premiums for the example are based on an expected yield of 217 bu/acre for corn in Lasalle County Illinois. Premium levels for the county-level products will vary based on expected yields across counties.

Summary

Similar to the previous year, the 2021 Crop Insurance Decision Tool reports estimates of farmer-paid premiums. This year the Tool has been modified to include ECO, a new county-level product available for the first-time.

Source : illinois.edu