July exports of U.S. pork were slightly below last year but accounted for a larger share of production, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Market access obstacles continued to weigh heavily on exports of U.S. beef, with the vast majority of plants still ineligible to ship to China.

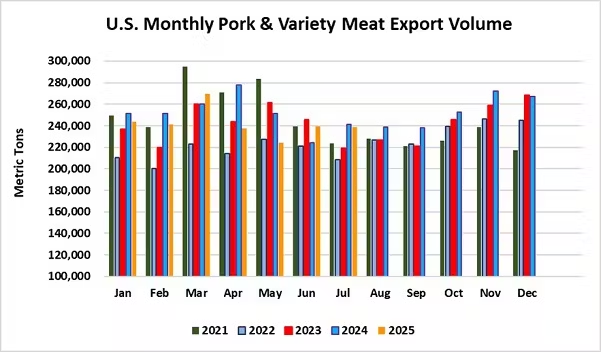

Pork exports totaled 238,922 metric tons (mt), down just 1% from a year ago, while value fell 4% to $680.9 million, largely reflecting the 10% decline in pork variety meat prices due to China’s tariffs. Through the first seven months of 2025, pork exports were 4% below last year’s record pace in both volume (1.69 million mt) and value ($4.8 billion).

“While July exports to Mexico didn’t match the monster totals from a year ago, demand for U.S. pork remains very robust in our top market,” said USMEF President and CEO Dan Halstrom. “July also saw great results in Central and South America, while volumes to the key Asian markets were largely steady with last year and pork variety meat volumes achieved broad-based growth.”

With shipments to China nearly halted due to a lack of eligible plants, July beef exports totaled 89,579 mt, down 19% from a year ago and the lowest in five years. Export value declined 17% to $752.5 million, the lowest since January 2023. From January through July, exports were 8% below last year in volume (691,800 mt) and down 7.5% in value ($5.67 billion).

The decline was largely due to China’s failure to renew registrations for the vast majority of U.S. beef plants and cold storage facilities, most of which expired in March. China has also suspended 11 U.S. beef facilities since June.

“The plant registration impasse with China unfortunately drags on, and it has left U.S. beef essentially shut out of the market after exporters worked through their eligible inventories,” Halstrom explained. “Demand elsewhere has remained fairly resilient, even in the face of higher pricing, but restoring access to China is clearly the urgent priority. Export value and share of production exported declined in July, reflecting the loss of competing bids from Chinese buyers.”

Momentum continues for U.S. pork in Western Hemisphere markets

July was another strong month for pork exports to leading destination Mexico, even though shipments were below the massive year-ago totals. Exports totaled 92,524 mt, down 8% year-over-year, while value reached $228.4 million – down 7% from a year ago but still the second highest this year (after the near-record in June) and the sixth highest on record. Mexico accounted for 10.9% of U.S. pork muscle cut production in July and from January through July, up from 10.6% in the same period last year.

Through July, exports to Mexico were 2% above last year’s record pace at 678,815 mt, while value increased 6% to $1.53 billion.

Fueled by surging demand in Honduras, Guatemala, Costa Rica, Nicaragua, El Salvador and Panama, pork exports to Central America are also on a record pace in 2025. July shipments to the region climbed 35% from a year ago to 14,563 mt, while value increased 36% to $47.4 million. July shipments were the third highest on record to both Costa Rica and El Salvador. Through July, exports to Central America jumped 22% in volume (103,823 mt) and 24% in value ($329.4 million).

Demand for U.S. pork continues to expand in Colombia, where July exports reached 9,839 mt – up 15% from a year ago – while value increased 8% to $26.9 million. January-July shipments to Colombia were 16% above last year’s record pace at 76,289 mt, with value climbing 19% to $217.4 million.

Other January-July results for U.S. pork exports include:

Despite a total tariff rate of 57%, U.S. pork shipments to China – which are mostly variety meat – were steady with last year at 36,461 mt. The heightened tariff rate (which was 37% at this time last year) weighed on export value, which was down 13% to $77.6 million. For January through July, exports to China were 16% below last year in volume (218,005 mt) and 17% lower in value ($513.3 million), but this was mainly due a sharp drop in exports in April and May, when U.S. pork was subject to prohibitively high tariff rates.

July pork exports to Japan were slightly above last year at 26,629 mt, though export value slipped 3% to $105.9 million, as the U.S. supplies more frozen and less chilled pork to Japan. January-July shipments to Japan were 9% below last year in volume (188.944 mt) and 11% lower in value ($752.2 million).

Led by year-over-year growth in the Dominican Republic and Cuba, July pork exports to the Caribbean increased 8% to 9,963 mt, while value was up 3% to $30.3 million. Through July, exports to the region were steady with last year’s record pace at 73,268 mt, as growth to other markets offset a 7% decrease to the Dominican Republic, while value climbed 5% to $223 million.

Larger shipments to the Philippines and Vietnam drove July pork exports to the ASEAN region to just under 10,000 mt, up 8% from a year ago, while value increased 13% to $20 million. July exports to the Philippines topped 7,300 mt, the highest in more than two years, while the monthly total of nearly 2,000 mt to Vietnam was the highest since 2020. July volume included more than 4,100 mt of pork variety meat to the Philippines and more than 700 mt to Vietnam for the second consecutive month. January-July exports to the ASEAN totaled 42,971 mt, down 9% from a year ago, while value was down just 1% to $101.2 million. The Philippines is this year’s third largest export destination for U.S. pork variety meat and Vietnam is 11th largest.

Pork exports to Canada have trended lower in 2025, with January-July shipments down 17% in volume (98,192 mt) and 15% in value ($404.2 million). But U.S.-Canada trade received a potential boost earlier this week when Canada confirmed removal of a 25% retaliatory tariff on U.S. sausages. The tariff, in place since early March, had a significant negative impact on sausage exports.

In addition to China, July exports of pork variety meat also trended higher year-over-year to Mexico, the ASEAN, Central America, Colombia and Japan. July exports were up 9% to 50,609 mt, the second largest volume this year. For January through July, pork variety meat exports were still down 10% in volume (312,623 mt) and 11% in value ($677.3 million).

Pork export value equated to $66.31 per head slaughtered, down only slightly from last July’s strong average. Through July, per-head value equated to $65.25, down 2% from the same period last year. Exports accounted for 30.7% of total July pork production, up one full percentage point from a year ago, and 26.1% of muscle cuts (up from 25.9%). For January through July, exports accounted for 29.8% of total production and 26.2% of muscle cuts (down from 30.4% and 26.1%, respectively).

Click here to see more...